Access to deeper pools of capital is one of the key reasons for being listed, as the increased liquidity, profile, disclosure and regulatory protection resulting from a listing raises the potential to attract a wider audience of investors.

While the JSE has, over recent years, seen a reduction in new listings – as well as a surge of companies exiting the bourse – it remains, by far, Africa’s largest and most liquid stock exchange, with a long history as a reliable platform for companies to attract investment within a highly sophisticated financial market.

In this article, we will touch on certain key aspects for raising equity on the JSE, and strategic decisions companies must navigate to do so successfully.

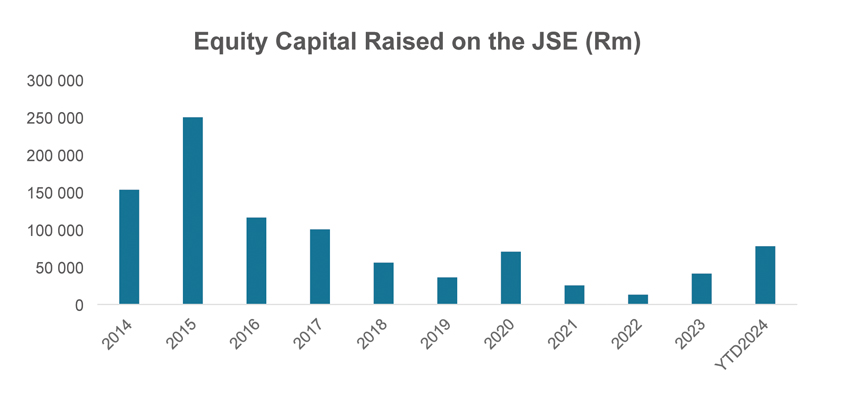

The above graph shows the relative decline in equity raised on the JSE in recent years, caused mainly by a higher cost of capital in volatile financial markets and a low growth operating environment. Such downturns are cyclical, and the current improved inflation and interest rate outlook – as well as initial positivity around South Africa’s new government of national unity and its potential economic impact – could signal that an improvement in equity raise volumes may be on the horizon.

While many businesses find themselves in circumstances where high inflation and interest rates put pressure on both top-level growth and profit margins, investors are also expecting higher returns to compensate for the same challenging macroeconomic and geopolitical conditions affecting the operations of these companies. The result is that the cost of equity has, in some instances, become unaffordable or unsustainable (or both), as many companies arguably trade at a discount to their intrinsic value where risk is overstated. For acquisitive parties with access to cash, this presents an opportunity; but for others, it means that their business model is not feasible (unless they are able to address this with careful capital management), and that they may be the target of a take-over.

Businesses must navigate such financing challenges to ensure that they remain optimally and adequately capitalised to deliver appropriate returns during market cycles, and thereby continue to attract capital and remain competitive.

Most companies are susceptible to cyclicality and/or the surrounding economic and political environments in which they operate. Capital budgeting is, therefore, a critical requirement as companies plan for various scenarios, and to ensure ongoing stability, downside protection and maximum growth potential.

Companies that have developed a reputation for raising well-priced capital on the JSE in the past, and have established a track record of successfully deploying it, are better placed to raise capital again in future. Successful deployment of capital into acquisitions can be highly accretive and transformative, due to the potential step growth that can be achieved. However, for other companies, a more attractive alternative could be to raise equity to strengthen their balance sheet at an opportune time by deleveraging or investing into their existing operations to support organic growth. Dividend reinvestment programmes or scrip dividends may, in certain circumstances, also be attractive capital management approaches – issuing shares in lieu of dividends, thereby retaining cash.

In the context of the South African market – where high interest rates, challenging economic conditions and policy uncertainty currently prevail – some companies are able to acquire weaker competitors at a discount sufficient to offset their own high cost of capital, thereby indirectly benefiting from a weaker operating environment. These targets are either acquired at deep discounts in the belief that, with the backing of a stronger balance sheet, they can survive what is perceived to be a temporary downturn, or immediately gain an advantage from being part of a larger enterprise that benefits from lower marginal costs and higher economies of scale.

JSE companies should pursue and communicate a clear capital management strategy and execute on it, thereby showing a consistent track record and building investor confidence for potential future equity raises. Equity raises on the JSE often succeed when a company presents a robust acquisition pipeline and a proven track record of executing accretive acquisitions effectively.

In addition to the longer-term planning alluded to above, the exact approach and mechanism for raising capital or returning capital to shareholders is specific to each company. A company looking to raise capital on the JSE, or other exchange, should engage a corporate finance advisor to assist in positioning itself for such a raise, and to navigate the various financial, market, regulatory and practical requirements to ensure the best outcome and achieve its strategic objectives.

Henning de Kock is CEO, Terence Kretzmann a Director: Head of Listed Capital Markets, Calvin Craig a Corporate Financier, and Bhargav Desai a Junior Corporate Financier | PSG Capital.

This article first appeared in DealMakers, SA’s quarterly M&A publication.

DealMakers is SA’s M&A publication.

www.dealmakerssouthafrica.com