The team from TreasuryONE looks ahead to the important rates decision this week, with an expectation of a 50 basis points hike by the MPC.

It would be an understatement to say that markets have been volatile in the past month. One of the most significant factors of the recent bout of market volatility has been the growth and inflation conundrum currently in the market. We have seen record inflation numbers globally, with Central Banks scrambling to fight inflation, which will invariably affect growth worldwide – so much so that there is a significant threat of a recession on the cards.

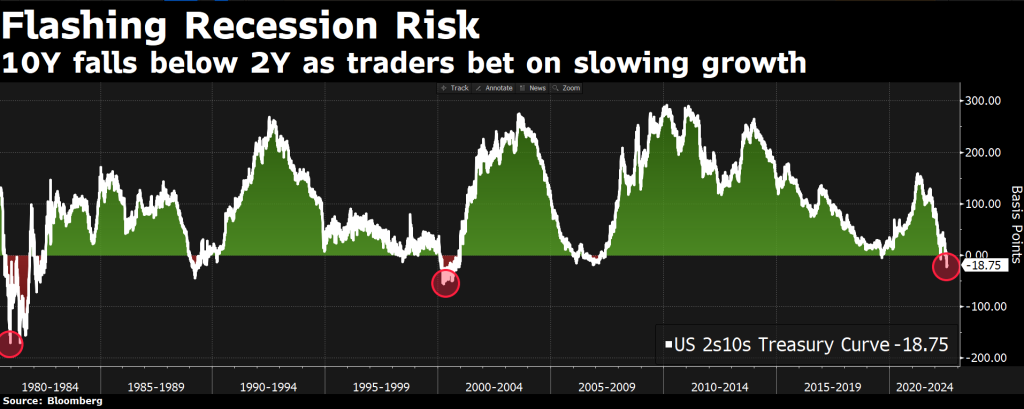

A significant indicator of an impending recession is the 10-2 year treasury yield spread that inverted further after the US CPI number printed its highest result in 40 years. Markets ran to the US dollar following the US CPI release, and the EUR/USD traded below parity for the first time in 20 years as the market priced in a full percentage point interest rate hike at the next FOMC meeting later this month.

Markets, however, cooled as Fed officials played down such a hike over the weekend, with a report from the University of Michigan showing long-term inflation expectations are falling.

In rand terms, we have seen the local unit still on the back foot, trading at a high of R17.30 after the release of US CPI. Still, with the US dollar slipping since the market opened yesterday, we have not seen the relief rally in the rand that other emerging market currencies enjoyed against the US dollar. The rand has failed to break below the R17.00 level after testing it numerous times, and we await the MPC decision on Thursday for any meaningful direction in the rand.

Speaking of the MPC, we expect a hike in interest rates of 50 basis points on Thursday, but that might change higher if the inflation number on Wednesday shows a significant increase from the previous month’s number. The MPC is caught between a rock and a hard place: with anaemic growth in South Africa, hiking too quickly will cause a recession. Still, with their overall mandate to curb inflation, they could be forced to hike aggressively in a low-growth environment.

On the international front, the ECB will announce their interest rate decision on Thursday, and the markets expect a 25 basis point hike. With inflation rampant in the Eurozone, we expect the rhetoric from the ECB to be relatively hawkish. However, with low growth, sustaining the hiking cycle in the Eurozone could be challenging, which could mean that the ECB will be well behind the curve in tackling inflation.

With all these market events towards the latter part of the week, the rand might be in for a volatile time with the MPC decision and the ECB decision happening almost simultaneously. We might see moves to both extremes depending on how the market perceives risky assets in the wake of the Central Bank rhetoric and forward guidance.