Ghost Mail reader Greg Salter has written this opinion piece on what may have been the unsung hero of the South African economy during the pandemic.

Like with 9/11, the release of Nelson Mandela and the outbreak of the Gulf War, I remember where I was when I heard the news that half of South Africa’s economy had been destroyed by the Covid pandemic.

Convention struggles with catastrophe

It was just over two years ago, on 8 September 2020, when Stats SA released second quarter GDP figures1. Within minutes, my Twitter timeline lit up with news reports that South Africa’s economy had contracted by 51%.

That’s half the economy gone. Decimated.

A closer examination (who even does that?) would reveal that the damage was actually 16% in the quarter and the remainder of the pain was the result of the normal process of annualising the quarterly change to get an annual estimate. Convention does not handle catastrophe very easily.

Nonetheless, 16% was a tremendous blow. With our economy growing around 2% in recent times, it represented 8 years of economic growth wiped out in a single quarter.

The full extent of the impact would be revealed a month later when Finance Minister Mboweni presented his budget update2 in October 2020. South Africa’s debt-to-GDP ratio, a crucial measure of our ongoing financial viability as a nation, was expected to blowout to 95% within 5 years. This is a level which is generally regarded as wholly unmanageable for an emerging market country, and which would almost certainly have forced us to seek assistance from the International Monetary Fund (“IMF”).

Reserve Bank Governor Kganyago was warning that we were heading into an economic abyss and were dangerously close to becoming like Argentina3, where sovereign defaults, hyperinflation and currency devaluation have become the norm.

Still standing

Yet, two years on, we have not been knocked out. Instead, recent headlines are rather encouraging:

- Moodys has upgraded our sovereign ratings outlook from negative to stable4;

- The IMF has just raised its estimate of South Africa’s economic growth5;

- The latest estimate from National Treasury is that debt-to-GDP will stabilise at 75% in 2025, an incredible 20% lower than was originally feared6.

How did this happen? What was the cause? Has our daily news diet of power cuts, potholes, petrol prices, pilfery, pillage, politics and pain blinded us to the possibility of good news?

What of the existence of a rose among the thorns? A miracle in our midst?

This is not a South African phenomenon but it is exacerbated in the South African context. Morgan Housel captures the essence of the issue in his incredible blogpost “Lots of Overnight Tragedies, No Overnight Miracles”7. It’s worth reading.

In summary:

“Good news always takes time, often too much to even notice it happened. But bad news? Bad news is not shy or subtle. It comes instantly, so fast that it overwhelms your attention and you can’t look away.”

Morgan Housel

The media has rightly attributed our change in fortune to a robust trade performance and higher than anticipated corporate tax receipts, both of which primarily trace back to our mineral resource companies in general (and platinum companies in particular). Yet, when we drill into the performance of these platinum companies, a big surprise awaits.

It’s not because of platinum!

Take a look at the revenue split at Amplats, SA’s largest PGM miner:8

Rhodium is the 45th element on the Periodic table. It derives its name from the Greek word “rhodon” meaning rose.

With platinum and palladium, it is one of six Platinum Group Metals. The others are osmium, iridium and somethingelseium!

It is a by-product of the platinum mining process and, like platinum and palladium, is mostly used in catalytic converters for motor vehicles9. These are devices which are incorporated in the exhaust system of the vehicle and change (or catalyse) harmful emissions into their unharmful constituent parts.

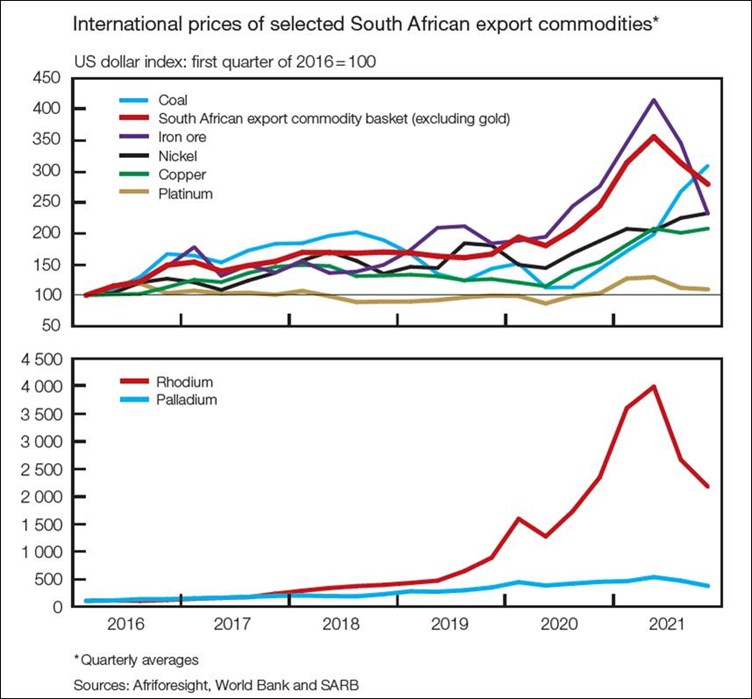

The table above reveals that at Amplats, rhodium was attributable for almost three times more revenue than platinum in 2021. Rhodium revenue has grown by 2,100% over 5 years (vs 20% for platinum)! This extraordinary result is corroborated by our export data. Allan Gray presents this excellently10 in the chart below:

Rhodium has risen from nowhere to be South Africa’s largest mineral export in 2021. It is by far the biggest contributor to the surge in export revenue.

The driver of this result has been the rhodium price which has positively exploded in recent years. When last did you see a commodity price grow by 4,000% in a short period of time?

These charts appear in the Quarterly Bulletin from the Reserve Bank11. The performance of the rhodium price is so extraordinary that it necessitated the creation of its own chart (with a vertical axis that is 10 times larger than the ordinary chart used for most other metals).

Amplats to be renamed Amrhodes?

The platinum belt in the North West Province has arguably become the rhodium belt.

Financial media, who focus daily updates on the gold and platinum prices, aren’t telling you the most important story. (Editor’s note: I’ll assume present company excluded.)

Names stick. Habits endure. But the world changes.

Of course, this all leads to the question of what caused the rhodium price to take off. Here, things get both murky and intriguing. Let’s start though with important context.

Rhodium is effective against harmful nitrogen oxide emissions

Nitrogen oxides (NOx) are a collection of harmful gases including nitric oxide (NO), nitrogen dioxide (NO2) and nitrous oxide (N20). They are emitted from the exhausts of combustion engine motor vehicles and contribute to smog, acid rain and global warming12.

Rhodium is a catalyst that is effective at separating the nitrogen and oxygen elements, which then enter the atmosphere harmlessly.

Rhodium has unique properties and is not easily substitutable

Bottom line, if a motor vehicle manufacturer wants to remove nitrogen oxides from its emissions, it needs rhodium. Nothing else is as efficient. Unlike platinum and palladium, rhodium is not easily substitutable.13

Rhodium is found mostly in South Africa

Amplats report that over 80% of primary rhodium supply came from South Africa in 2021. Not quite a monopoly, but not far from it.

The regulation of nitrogen oxide emissions is not new, but likely escalating

China in particular is reported to have tightened emission standards in recent times14.

Where the story becomes speculative is in relation to emission standards in Europe. It’s hard to discern whether there were changes to the emission standards which contributed to the rhodium price change. But something big did happen around the same time.

In September 2015, Volkswagen were caught cheating on their compliance with emission standards15. They had built sophisticated software to dupe regulators into believing their emissions were far lower than they actually were. When correctly measured, their emissions of nitrogen oxides were found to be as much as 40 times higher than they pretended them to be. This led to the adoption, in September 2017, of Real Driving Emissions tests.16

Was rhodium needed by motor vehicle manufacturers to actually reduce their nitrogen oxide emissions because they could no longer cheat? It’s a sensational possibility.

Where do the benefits go?

The benefits of rhodium’s rally will obviously have accrued most directly to employees of platinum companies and shareholders of these businesses. Millions of South Africans have pension funds or unit trusts with ownership interests in the platinum sector. Most sobering though is the realisation that the R350 monthly Covid relief grant, which supported 10 million unemployed fellow citizens through the pandemic, was fiscally unaffordable absent the commodity price cycle (i.e. mostly rhodium as we’ve seen).

Finance Minister Godongwana did not mince his words on this in his first budget update17 in November 2021, declaring: “Madam Speaker, the additional revenue due to the commodity price rally, created space for government to provide additional support for poverty and employment programmes this year, without negatively impacting the fiscal position.”

The rhodium price has come off somewhat in 2022. And the long-term outlook for rhodium is not positive as electric vehicles do not need catalytic converters. At the same time, emission standards are only heading in one direction in the interim. Even the United States is now passing climate legislation, albeit under the guise of inflation protection.

Could the good times roll on for a while?

Whatever happens next, nothing can take back rhodium’s recent run or the buffering which rhodium provided in South Africa against the savage economic damage of the Covid pandemic. It accounted for around R300bn and counting of unexpected export revenues and a decent chunk of that helpfully flowed into the coffers of the National Treasury.

Rhodium. South Africa’s rose by another name?

Twitter: @gregsalterjhb

Sources:

1 – e.g. Daily Maverick here, Reuters here, eNCA here

2 – 2020 Medium Term Budget Policy Statement here

3 – Public Lecture by Lesetja Kganyago, Governor of the South African Reserve Bank, at the Wits School of Governance, 18 June 2020 here

4 – e.g. SA News here

5 – IMF sees light in darkness for SA as it raises GDP forecast, Business Day, 26 July 2022, here

6 – Budget speech 2022, here

7 – Collaborative Fund, “Lots of Overnight Tragedies, No Overnight Miracles”, by Morgan Housel, here

8 – Amplats Integrated reports, 2017 -2021, available here

9 – Catalytic converters explained here

10 – Allan Gray Quarterly Commentary, “On the commodity boom and other South African fables (and foibles)”, Thalia Petousis, 28 July 2022, here

11 – South African Reserve Bank quarterly bulletin, No 303, March 2022, Quarterly Economic Review, pg. 46, here

12 – Wikipedia on NOx here

13 – “Clean-air legislation fuels breathtaking rally in rhodium”, Financial Times, 6 Jan 2021, here

14 – “While platinum loses luster, byproduct rhodium shines bright”, NikkeiAsia, 1 Feb 2022, here

15 – Wikipedia on VW emissions scandal here

16 – European regulation of nitrogen oxides discussed here

17 – Minister Enoch Godongwana: 2021 Medium-Term Budget Policy Statement here

Super informative. Thanks!

Brilliant, why has this only come out now! It’s a true miracle story and one that deserves more CG more attention.