The total value of local M&A deals captured for H1 2022 (excluding South Africa) was US$12,28 billion, almost double that recorded over the same period in 2021. This number only includes those transactions where at least one of the parties is headquartered in Africa, or where the target is African based. Where the parties are foreign, or the target has subsidiaries in an African country, the transaction is classified by DealMakers AFRICA as foreign, and these deals totalled US$50 billion in H1 (US$9,6 billion in H1 2021).

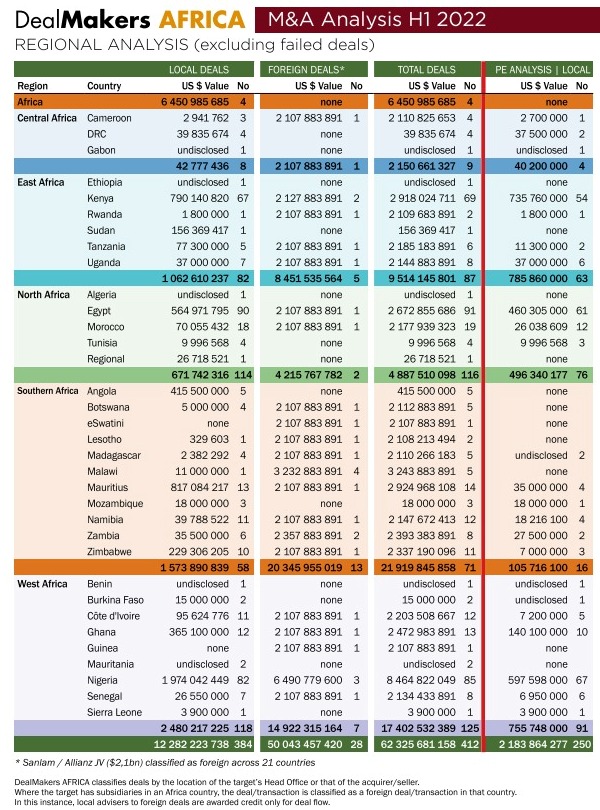

West Africa was the most active region with 118 deals valued at US$2,48 billion, 77% of which involved private equity; followed by Southern Africa (US$1,57 billion) and East Africa (US$1,06 billion). By country, Egypt led the pack with 90 deals (US$565 million), followed by Nigeria with 82 deals valued at US$1,97 billion and Kenya with 67 deals valued at US$790 million.

The trend that emerged during the pandemic continues with private equity the main driver of investment on the continent, representing 65% of all local deals. Much of this investment found its way into start-ups and, in particular, those in the fintech space – increasing access to banking and energy to the underserved population, providing strong traction in terms of revenue. The two largest private equity deals for H1 2022 (where deal values were disclosed) were the US$260 million investment into Sun King (previously Greenlight Plant) – a distributor, installer and financier of solar home energy products for people currently living without reliable energy access, and the investment in Nigerian Flutterwave’s series D capital raise of US$250 million.

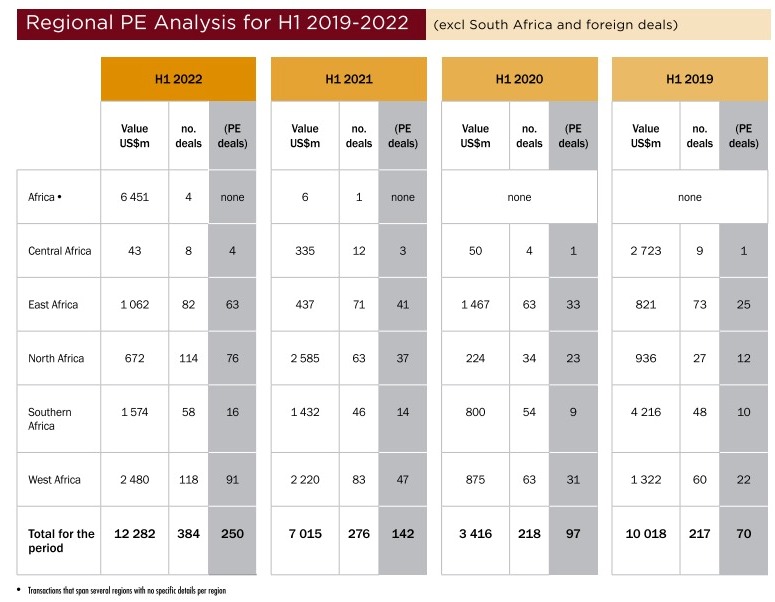

According to The Big Deal, an Africa-focused database, Africa bucked the trend in declining venture capital investment as the only region in Q2 2022 to record three-digit growth, raising US$1,3 billion against US$600 million in Q2 2021; this against a 29% decline year-on-year globally. Yet despite this growth, the numbers represent c.1% of global venture funding. Analysis by DealMakers AFRICA supports this trend, as seen in the growth of deal activity by private equity in the table below.

Data sourced from DealMakers AFRICA

Included in this issue for the first time is the feature, Women of Africa’s M&A and Financial Markets Industry, the first of its kind to be published by DealMakers AFRICA. It carries unique and inspiring stories, and it is hoped that these journeys will offer inspiration to young women, giving them courage where needed and the realisation that they are not alone.

The latest magazine can be accessed as a free-to-read publication at www.dealmakersdigital.co.za

DealMakers AFRICA is Africa’s corporate finance magazine

www.dealmakersafrica.com