As interest rate hikes bite and high fuel and food inflation persists, South African retail spending is at risk of slowing down significantly. Chris Gilmour explores this issue.

The recent global trend of rising interest rates and higher inflation is being felt in South Africa, where the repo rate was increased in July by 75 basis points and now stands at 5.5%, with the prime rate at 9%. South Africa may still be regarded by many people as a commodity-based economy but in reality it is very much a consumer-based economy, with over 60% of its GDP coming from consumer spending. Within this broad category of consumer spending, it is estimated that around 20% of GDP comes specifically from retail sales.

Stagflation is an ugly word

The combined impact of substantially higher inflation and interest rates is probably going to result in “stagflation”– low to negative economic growth coupled with higher inflation. And there are other factors that are causing consumer spending to slow down or decrease, notably the chronically high rate of unemployment. South Africa’s unemployment rate is the highest in the world and there are no signs of it abating.

Anecdotal evidence also suggests that conditions among the very poorly-paid domestic workers have deteriorated in the past couple of years since the coronavirus pandemic. It appears that many South Africans have decided to dispense with the services of their domestic workers as they have a) got used to working from home and have become more adept at cleaning themselves and/or b) they have discovered that jettisoning a domestic worker is one of the easiest ways of saving money. Whatever the reason, it appears that around a quarter of SA’s domestic workers may have lost their jobs since the pandemic started, according to a recent survey by domestic worker labour broking organisation Sweep South. This organisation estimates that approximately 125 000 domestic workers (mostly female) lost their jobs in the past year. Main reasons given were unaffordability and employers “semigrating” or emigrating.

Another factor contributing to cost-push inflation in SA is the gradual return to the office for a great many workers who have largely enjoyed the benefits of working from home until now. Resuming a daily commute, even if it is for substantially less than the traditional five-day working week, will undoubtedly result in an extra cost burden for many people. Higher fuel costs compound the misery.

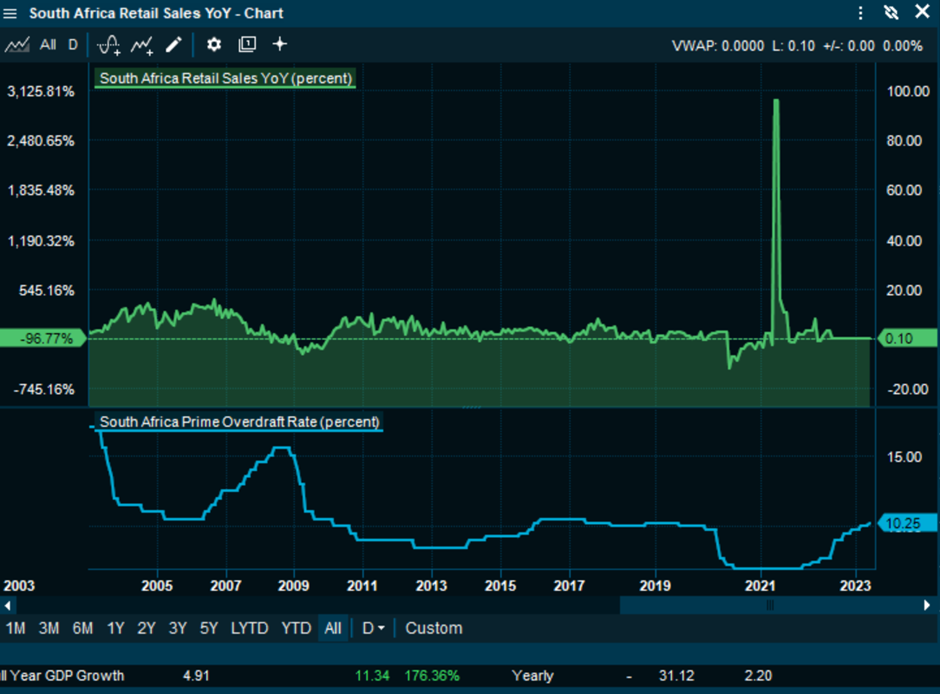

Although the huge spike in March 2021 masks the exercise to an extent, there is a good visual inverse correlation between retail sales growth and the prime rate, as shown in the graphic below. As interest rates fall, retail sales growth improves and vice-versa:

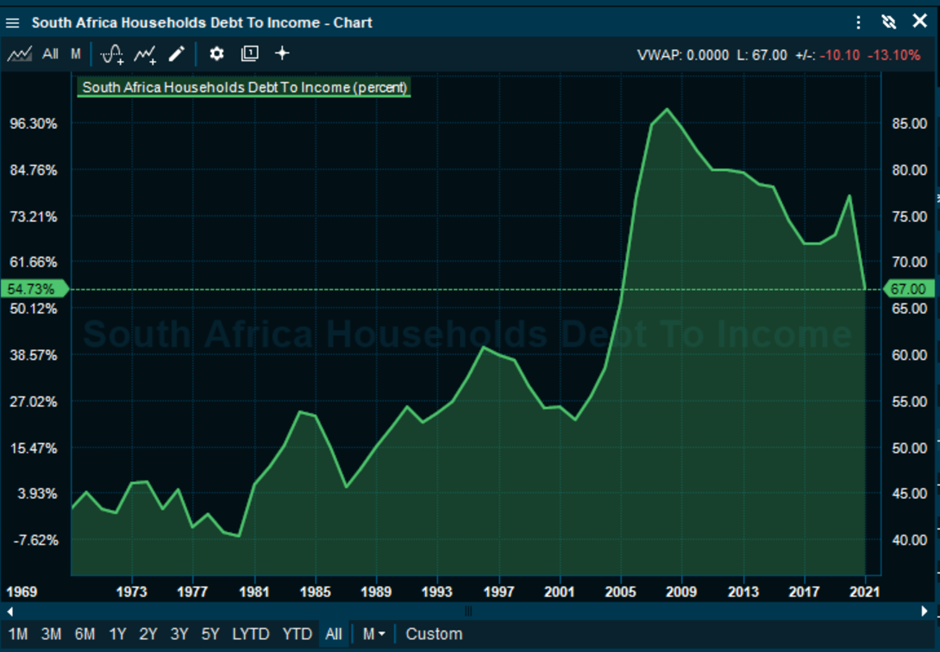

The one factor that could have conceivably offered a degree of relief to cash-strapped consumers is increased use of credit. Household debt to disposable income has been declining for some time now as consumers became very debt-averse over the past few years and as affordability criteria by banks and retailers were tightened.

But in an increasing interest rate environment coupled with a moribund economy, the credit taps are highly unlikely to be turned on again, for fear of a massive bad debt situation materialising.

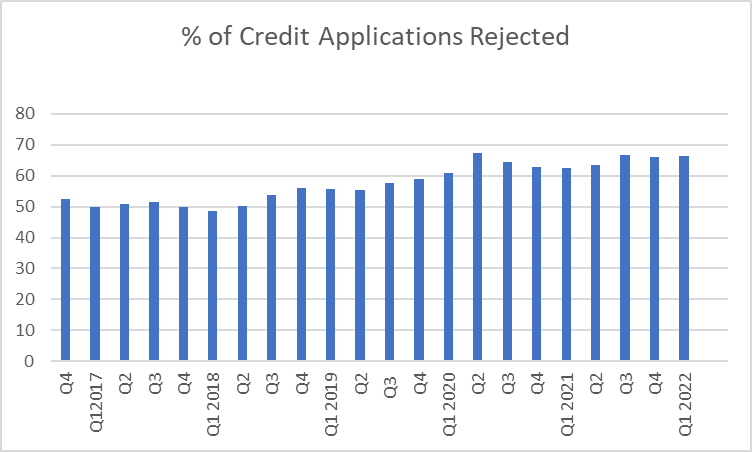

In fact, as the following graph from the National Credit Regulator (NCR) illustrates, the percentage of rejected credit applications has been steadily increasing over the past five years. And this graph is only up until the end of the first quarter this year, before the full impact of the last two SARB/MPC rate hikes came about:

So the bottom line is that the retail market generally is likely to remain under considerable strain for the foreseeable future. Non-discretionary retailers such as the food and drug retailers (Pick n Pay, Shoprite, Spar, Clicks and Dischem) should fare better than discretionary retailers such as Truworths, Mr Price, TFG, Woolworths, Massmart and Lewis.

However, this assumes a level playing field. In reality, certain retailers are going to do much better than others. In the non-discretionary space, Shoprite and Pick n Pay are showing signs via positive recent trading updates that they are coping well with the flagging SA economy. Woolies Food, conversely, is making heavy weather of it and is struggling to maintain market share.

In the clothing space, too, there are two players in the form of Mr Price and TFG that are likely to take market share away from the likes of Truworths and Woolworths.

Enjoyed the article