Offshore Equity Market Rally

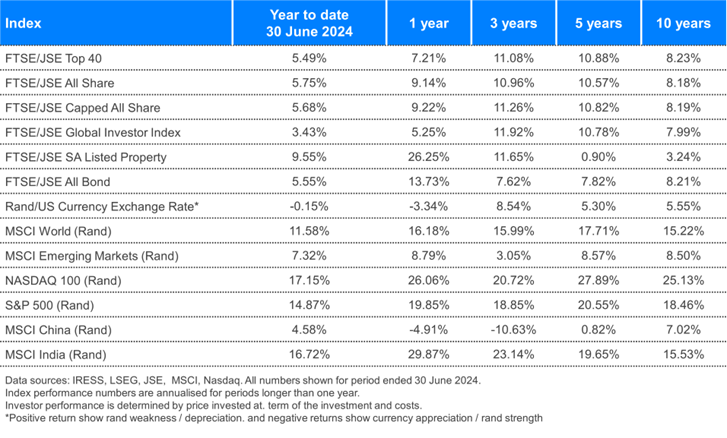

The MSCI World Index climbed 11.6% since the beginning of 2024. This was largely pushed by the continued demand for companies linked to Artificial Intelligence (AI), improved corporate earnings in the US market, and other developing economies. Inflation continued to cool in some parts of the world, including the US which published a 3.3% in its last inflation print.

Nvidia became the world’s largest-valued company after its share price hit another all-time high, doubling its gains since the beginning of the year. This helped the NASDAQ Index reach its all-time high, returning 17.2% for the first half of the year. The MSCI US and S&P 500 indices were up 14.5% and 14.9% respectively during the same period. In Emerging Markets, India posted strong returns – closing the first half of the year up 16.7%, while China was up 4.6%. Overall, Emerging Markets were up for the first half of the year, but not as strong as the developed Markets, as the MSCI Emerging Markets Index closed the first half of the year up 7.3%. All returns are in rands.

Was Local as Lekker?

The FTSE/JSE All Share Index was up 5.8% for the first half of the year, trailing global stocks. However, during the first two months of the year, the index was down 5.3% while offshore indices like the Nasdaq were up 12% during that period. Year to date, local markets were led by SA-listed stocks, with the SAPY up 9.6%, while Financials were up 8.9%, followed by Industrials up 5.6%, and Resources up 4.1%. The currency has held up since the end of December 2023 and has ended the first half of the year 0.15% stronger than it began the year. After much anticipation, President Cyril Ramaphosa was voted in for his second term as president. Several political parties agreed to form a Government of National Unity (GNU) with the ANC, which drove a massive recovery in SA Inc. stocks in June.

Fixed Income

The South Africa 10-year Government Bond Yield was back at its March 2024 levels as it closed June at a yield of 10.2%, after peaking at 11.2% in April. The South African Reserve Bank reiterated that interest rates may remain elevated for an extended period as the committee was sticking to its mandate of achieving its inflation targets. The FTSE/JSE All Bond Index closed the half-year period up 5.6% while the STeFI cash index returned 4.2% for the same period.

The US 10-year Treasury Bond Note Yield was up 4.41% at the end of June. It started the year at 3.86% as investment-grade floating notes and high-yield corporates were some of the best-performing fixed income investments. However, US Treasuries and Long-term US aggregated bonds fell behind. The Bloomberg Aggregate Bond Index was one of the worst performers for the first half of the year when compared to other assets, returning 3.3% in rands.

Commodities

The first half of 2024 has been positive for Gold, as geopolitical tensions and hopes for rate cuts this year were some of the factors driving the price, closing the period up 12.8% in US dollars – reaching an all-time high in May. Investors also continued to keep track of Silver and its demand from top consumer, China. The metal was up 22.6% year to date, out-pacing Gold.

A rise in demand for oil and production cuts from OPEC+ drove inventories during the first half of 2024. Some geopolitical tensions in the Middle East also continued to influence the oil price. Brent crude oil futures rose during this period. They rose 10.2% and closed the period at US$85.0 at the end of June.

Europe

After nine months of stable interest rates, the European Central Bank (ECB) lowered rates by 25bps as inflation rates were stable at around 2.6% in May. In the equity markets, the MSCI Europe Index was up 5.6% in rands, with the President of the ECB stating that they were not planning to introduce more rate cuts as they wanted to assess inflation and trends in the economy.

The Bank of England has held interest rates at the same level since August 2023, as the population was gearing up to go to the polls. The MSCI UK Index held up during the first half of 2024. It rose 6.8% in rands while the United Kingdom 10-year Gilt bond yields rose from 3.5% at the beginning of the year to 4.2% at the end of June 2024.

With so many options out there, the only free lunch in investing is diversification. Listen to Kingsley Williams, CIO at Satrix, discuss this with me in a recent podcast:

SatrixNOW is a no-minimum online investing platform from Satrix that allows you to buy and sell ETFs directly.