What Difference Did the Extra Day Make?

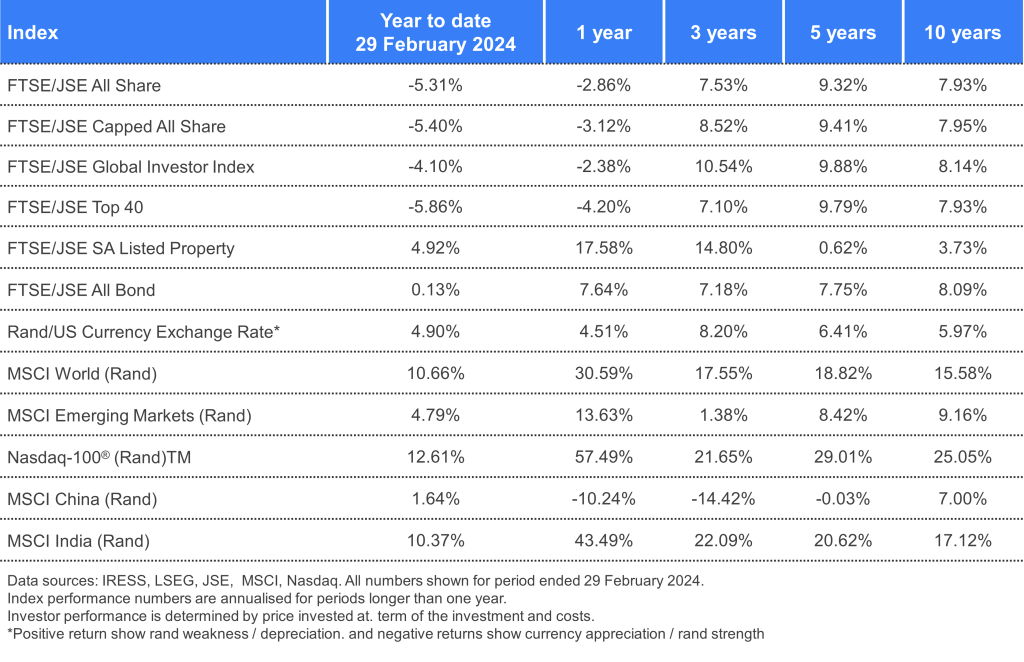

The South African rand weakened to the US dollar by 3.1% in February , despite the strong start shown on 1 February. The Budget Speech delivered on 21 February also didn’t seem to arrest the slide, with the rand weakening sharply a day after the annual Budget. Domestic markets followed this trend, with the FTSE/JSE All Share Index (ALSI) ending the month down -2.44% after a sharp increase immediately after the Budget Speech, followed by an even sharper decline two trading days later.

Following back-to-back ALSI monthly declines of more than 2% each in 2024, local equity losses were almost entirely concentrated to Resource companies in February, with the Resource index declining 7.17% for the month. The Property index was up 0.8%, with Financials and Industrials indices marginally down -0.84 and -0.69% respectively. Local investors with offshore exposure saw some reprieve, with the MSCI World Index up 7,5% in rand terms (buoyed by its high exposure to US companies), and the S&P 500 Index returning 8.65% in rand terms.

This points to a deeper principle that seasoned investors abide by: having exposure to different assets, industries, and geographies. International funds solve this through country-specific exposure or by achieving an assortment of countries in one basket, ensuring that even if the rand slides, the investor stands to gain.

Growth in Leaps and Bounds

All international indices tracked by Satrix realised positive growth in dollar terms last month, including the MSCI China Index (up 11.8%% in rands), which we highlighted as an underperformer in our last two newsletters. The MSCI India Index returned 5.9% in rands, while the broader MSCI Emerging Markets Index, of which China makes up a quarter, climbed 8.05% in rand terms.

The newly listed Satrix MSCI ACWI ETF, which includes both developed and emerging market indices and is one of the most diversified indices, also achieved positive growth in February 2024, climbing 0.98% since listing on 22 February.

International investors will be hoping that 2024 bucks the historical trend of the US market contracting by 2% during leap years. According to CNN, leap years have returned 10.8% on the S&P versus non-leap year returns of 12.8%, on average. Locally, the ALSI has returned, on average, 18.8% annually since 1996 during non-leap years, while returning a pedestrian 3.5% average return during leap years (granted, 2008 was a leap year too). But before we leap to any conclusions, perhaps this year will be different.

A New Tax-Free Season

March 1 marked the beginning of the new tax season, which means a new opportunity to make the most of your investments by harnessing the benefits of the tax-free savings account (TFSA). Your TFSA allows you to invest in funds without having to pay income, interest, or capital gains tax to SARS on any returns you may earn (provided you stay within the legislated contribution limits across all of your tax-free savings accounts.

For more information about how the TFSA works and its opportunities, click here.