With no real data out of the market last week, the main event of last week was the testimony by Fed Chair Jerome Powell to Congress. TreasuryONE expected the market to be very cautious around the testimony and with no other significant events last week, the market traded relatively flat for most of the week.

Much of the Fed Chair’s testimony has been available for some time. With little to no new information, it’s easy to see why the market didn’t react much to the testimony.

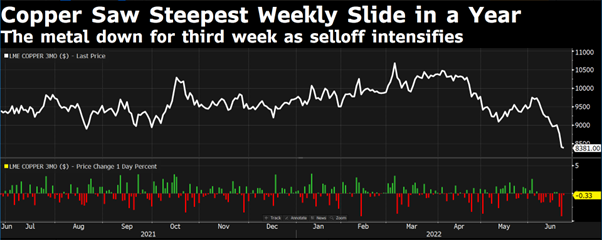

One of the highlights of the meeting was Fed Chair Powell’s statement that whilst raising interest rates aggressively will fight inflation, there is a real risk of rising unemployment rates as the economy slows. There have been forecasts for a recession and the copper price, one of the leading signs of a recession, entered a bear market last week.

The chart below shows that copper is presently trading at a 16-month low:

The IMF has reduced the US growth rate from 3.7% to 2.9% for 2022, so the US should still avoid a recession. The report also highlighted that there is a high degree of uncertainty in the outlook of the US economy. It’s very uncommon for the market to run on second- or third-level data during times of uncertainty, especially now with inflation and interest rates.

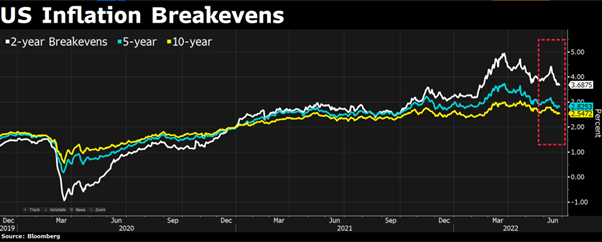

That was the case on Friday when the University of Michigan 12-month CPI number dropped slightly from 3.3% in the previous month to 3.1%. This caused some of the markets to run as the US dollar lost some ground and risky assets like the rand and stock indices had a decent Friday afternoon.

As shown in the chart below, inflation breakeven rates in the 2-year, 5-year and 10-year space have started to turn down once again:

With this in mind, the more aggressive rate hikes that the US market is pricing may also self-correct. The question is, at what interest rate will the US economy collapse?

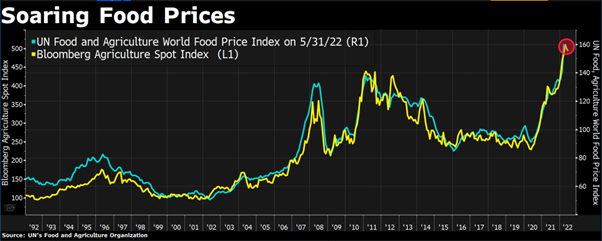

Food price inflation will be a major source of concern around the world. Food prices skyrocketed following Russia’s invasion of Ukraine, as the fear of shortages had a significant impact. This could also be a turning point for several other countries, as crop estimates from throughout the world are higher than expected. Brazil and Australia, in particular, are having bumper crop years.

This will help to reduce inflation significantly.

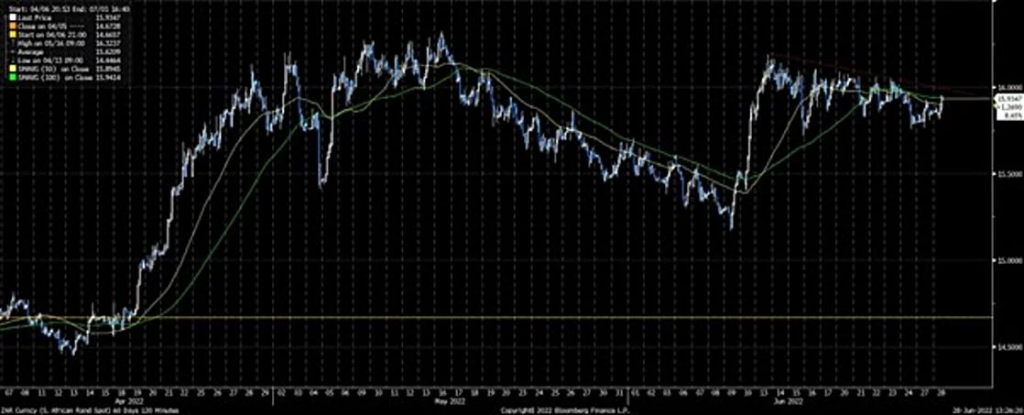

The rand closed last week at R15.80 after spending the majority of the week around the R16.00 level. The US dollar also slipped to 1.055 against the euro after threatening to break below 1.04 earlier in the month. For now, the USD/ZAR seems to be stuck within a short-term range of R15.70 to R16.10:

Looking ahead to this week, most of the risk is concentrated on Wednesday with speeches by both Fed Chair Jerome Powell and ECB Chief Christine Lagarde. Much of the focus will be on interest rates and inflation, with German CPI due on Wednesday and the EU inflation figure due on Friday.

We expect the rand to stay within tight ranges for the early part of the week, with Wednesday being the big day for emerging markets movements as any hawkish/dovish talk by both Central Banks leads to movement in the currency market.

A keen eye will also be given to the commodity space, with a commodity sell-off also a good indicator of expected recessions, which could be negative for the rand should that happen.

For assistance with managing market risk and many other services ranging from treasury solutions through to robotic process automation, visit the TreasuryONE website.