Chris Gilmour takes a closer look at StatsSA retail sales figures and the numbers put forward by listed grocery retails that indicate the size of the market.

It’s important to monitor the retail sales figures from Statistics SA (StatsSA).

Firstly, the trends in the overall and component parts of the time series give valuable clues as to the direction of spending in the economy. It’s certainly not perfect and the various categories that StatsSA employs in compiling these stats don’t necessarily align with what the JSE-listed retailers are seeing, but it’s a reasonable proxy.

Secondly, it can help in having a stab at estimating which companies are gaining and which companies are losing market share in the various categories of spending. It is possible to buy market share and other information from market research organisations such as AC Nielsen with their Retailer Liaison Committee stats, but these are expensive and not really for the general public.

The informal sector cannot be ignored

The other big factor that must also be borne in mind when using these stats is the fact that not all data is captured in the formal retailing market. As a rough guess, it has been estimated over the years that the informal retail sector probably accounts for around 40% of total retail grocery sales in SA, but nobody really knows how accurate that figure is. Informal traders, such as spaza shops, service the great majority of South Africa’s population and although they are not always the cheapest option, they are certainly the most convenient from a township perspective. In the rest of Africa, that figure is substantially higher, as formal retailing is still in its infancy on the rest of the continent.

Additionally, not all formal retailing is carried out by JSE-listed retailers. There are many cash and carry / wholesalers in South Africa, especially in the rural areas, many of which offer exceptionally keen pricing for their customers.

So, market share among the large JSE-listed companies has to be seen in the context of being only a proportion of total retail sales. Over time, under “normal” economic conditions, one would expect to see the formal JSE-listed retail component growing. However, in a languid economy characterised by low growth and high interest rates, we should expect the informal sector to do relatively better.

Lack of clarity in the numbers

Up until about 15 years ago, when grocery market shares were more openly discussed in the industry, it was generally acknowledged that Shoprite enjoyed a market share of around 35% of the formal market, with Pick n Pay on about 28%, Spar on 23% and Woolies Food in mid to high single digits. But then it was discovered that Shoprite’s market share figure didn’t include VAT, whilst Pick n Pay and Spar’s did, resulting in a massive distortion of the figures. At that point, Pick n Pay stopped supplying market share information and the figures have been treated with a deal of circumspection ever since.

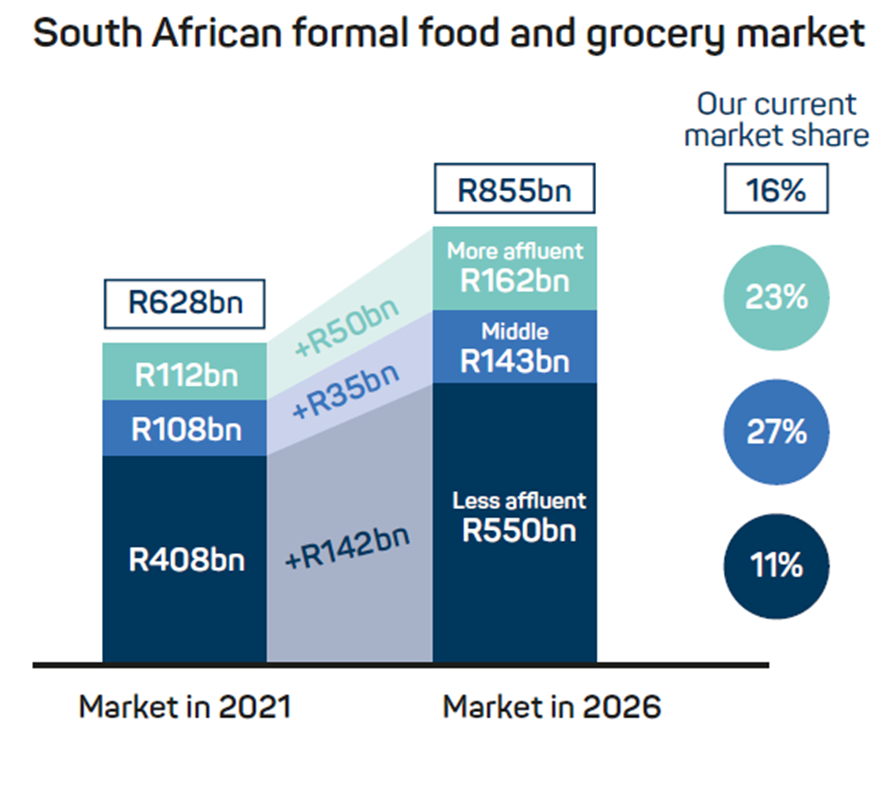

However, in the past couple of years, Pick n Pay has provided a remarkably good segmentation of its sales, as shown in the graphic below:

For 2021, Pick n Pay estimated the size of the formal grocery market to be R628 billion, of which it had a 16% share. That was split into 23% of the more affluent market, 27% of the middle market and only 11% of the less affluent market. Using the same methodology would result in Shoprite having a 26% market share.

Woolies Foods estimates its grocery universe to be between R350 million and R400 million, of which it has a 10% share. If the Pick n Pay universe was used instead, Woolies’ market share would be closer to 6%.

In the latest Stats SA retail sales figures to June 2022, total retail sales in SA for 2021 were estimated at R1.166 trillion. Of course, this includes all categories of retailing, not just grocery, but if the Pick n Pay estimate of total grocery sales is correct, then grocery accounted for 628/1 166*100 = 54%, which sounds about right.

Retail growth trends by category

In the June StatsSA figures, overall retail sales declined by 2.5%, which was something of a shock, as most analysts were looking for a positive print. The main culprit was the continuing reduction in Hardware, Paint & Glass category, which continued its dismal decline. But the other big surprise was a decline in sales at General Dealers, which went backwards by 5.7%. This is highly unusual, as General Dealers is predominantly food, which is non-discretionary. This decline may be explained by the sharp rise in clothing, footwear, textile & leather (CFTL) sales, which rose by 5.3% in June, following a sharp reduction of 4.3% in May. The rise in CFTL sales is perhaps explained by the continuing drift back from home to office work and the need to replenish wardrobes. It is just possible that consumers decided to forego some food shopping in June in preference to CFTL shopping. We may get a clearer picture of this phenomenon as the year progresses and the drift back to the office has fully run its course.

The so-called “homebody economy” phenomenon, whereby huge numbers of people worked from home during the coronavirus pandemic and spent a lot of money making their homes comfortable and efficient, appears to be well and truly over. A good proxy for that economy is the Hardware, Paint & Glass category of retail sales, which recorded a -8.6% contraction in June. This category has recorded six successive negative prints since January 2022.

Recent trading updates

Woolies, Truworths and Shoprite have all published trading updates in recent days, as they all have June year ends. Woolies Foods and their Clothing divisions both appear to have lost market share, while Shoprite appears to have gained significant market share. After a pretty dreadful first half, Truworths has bounced back and although it seems to have lost market share overall, its second half performance appears to be much better than the first half. Truworths will no doubt claim that they have gained share of the credit apparel market market, a market that most other participants are actively leaving in favour of cash retailing.