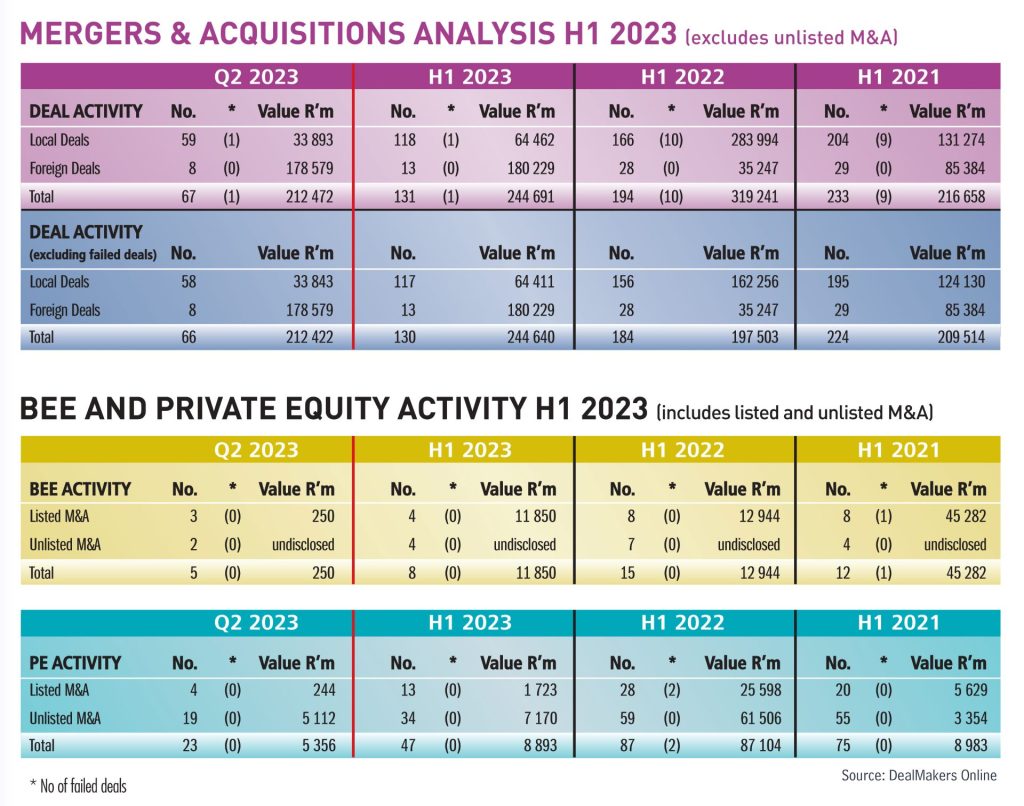

If a picture paints a thousand words, then so too do the M&A analysis tables below. The decline in merger and acquisition activity in South Africa began as far back as 2008, when the effect of the financial crisis hit home and the economy entered recession. In its hay day (2007), the industry reported 883 deals (listed and unlisted deals combined); an aggregate of some 405 for the half year. At the end of June 2023, the number was a meagre 242.

Since the release of a damaging report on state capture by the outgoing Public Protector Thuli Madonsela in 2016, and particularly in the last two years since emerging from the COVID-19 pandemic, the extent and reach of the malaise throughout the organs of government have become all too clear. This, together with uncertainties created by the war in Ukraine, inflation rates, looming recession, a weakening domestic exchange rate, foreign policy blunders, and the recent ‘greylisting’ of South Africa have forced investors to place more scrutiny on their investment domiciling decisions.

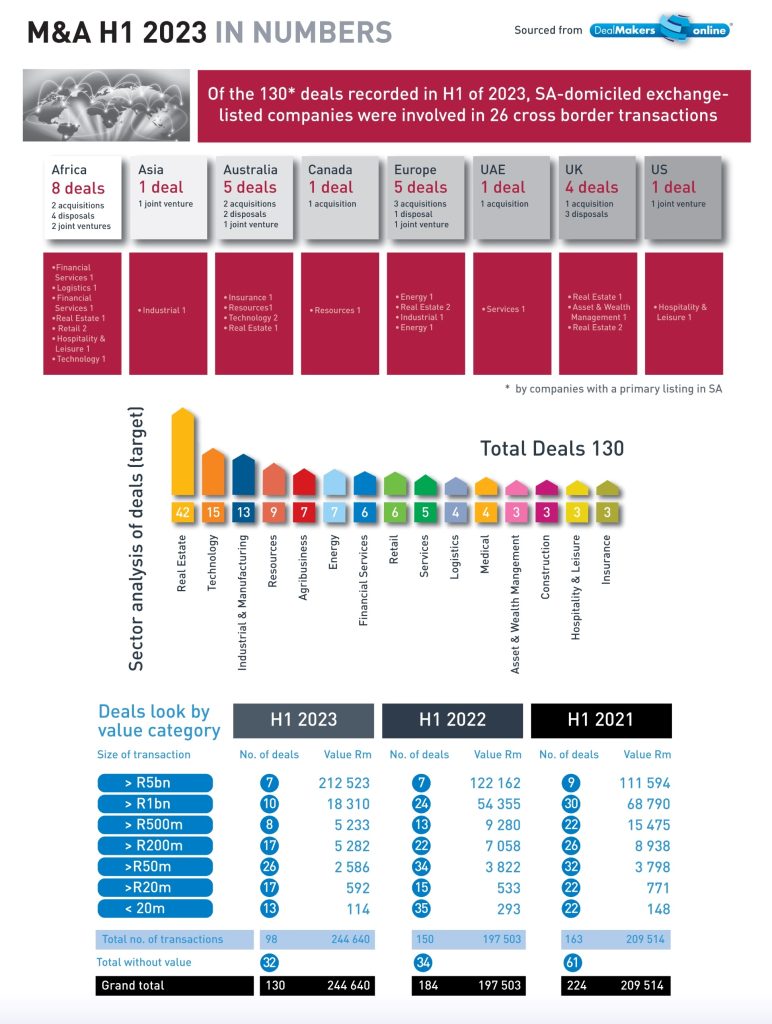

The most active sectors during H1 were Real Estate (32% of the quarter’s deals) followed by the tech sector. Deal size fell typically in the R50m to R200m bracket reflecting a third of deals recorded for the period. SA-domiciled companies were involved in 26 cross border transactions, notably within Africa (8), Australia (5) and Europe (5).

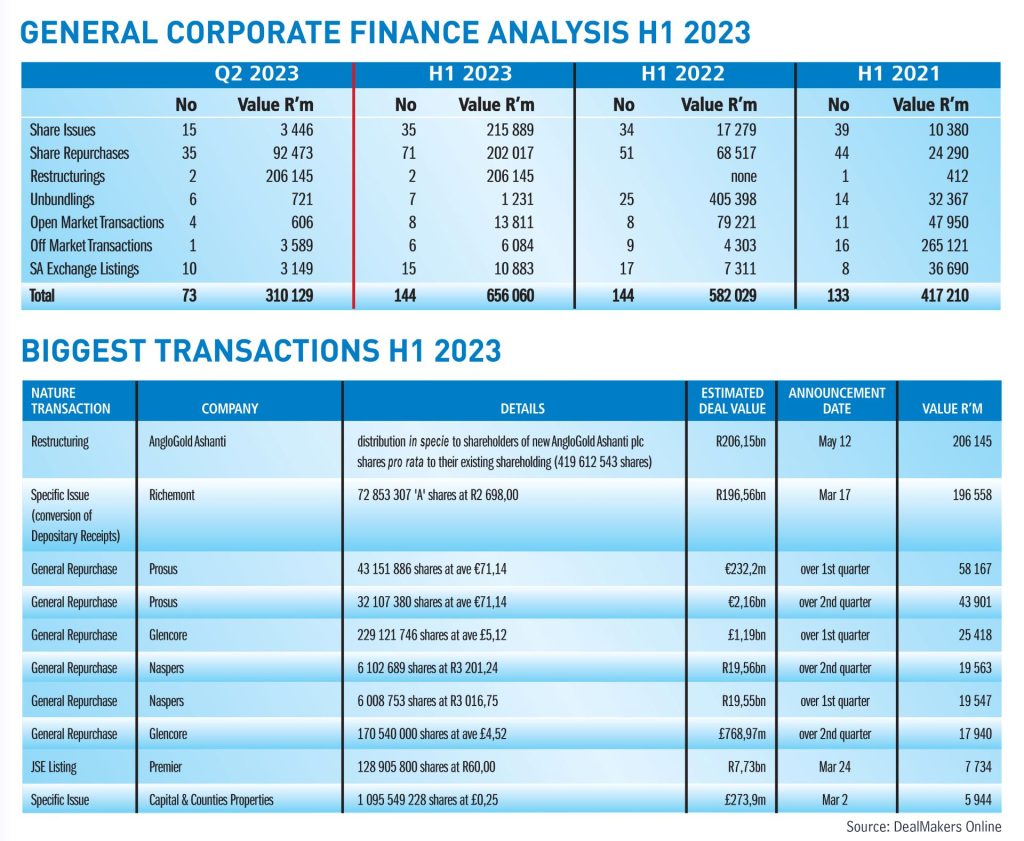

Share issues and repurchases characterised the general corporate finance activity for the first six months of 2023, with R215,89 billion raised from the issue of shares and R202 billion the value of shares repurchased. The repurchase programmes of Prosus, Naspers and Glencore account for most of this value, while the aggregate value of Richemont’s issue of A shares (conversion of depositary receipts) was R196,56 billion.

Although ratings agency, Fitch recently held SA’s credit rating at BB- (three steps below investment grade), it warned that further big increases in government’s debt-to-GDP ratio could lead to a further downgrade. The IMF is forecasting GDP growth of 0.3% in 2023, against 1.9% in 2022, due to severe power shortages – lagging far behind the 4% average at which the IMF sees emerging markets and developing economies growing in 2023. The Reserve Bank estimates that power cuts trimmed between 0.7% and 3.2% off the GDP growth rate in 2022, and that supply disruptions will cut 2% off output growth in 2023.

Looking ahead, the local equities and the SA bond markets offer value to potential investors relative to their international counterparts – but investors will continue to be circumspect, with much depending on SA’s ability to extract itself from the quagmire in the months ahead.

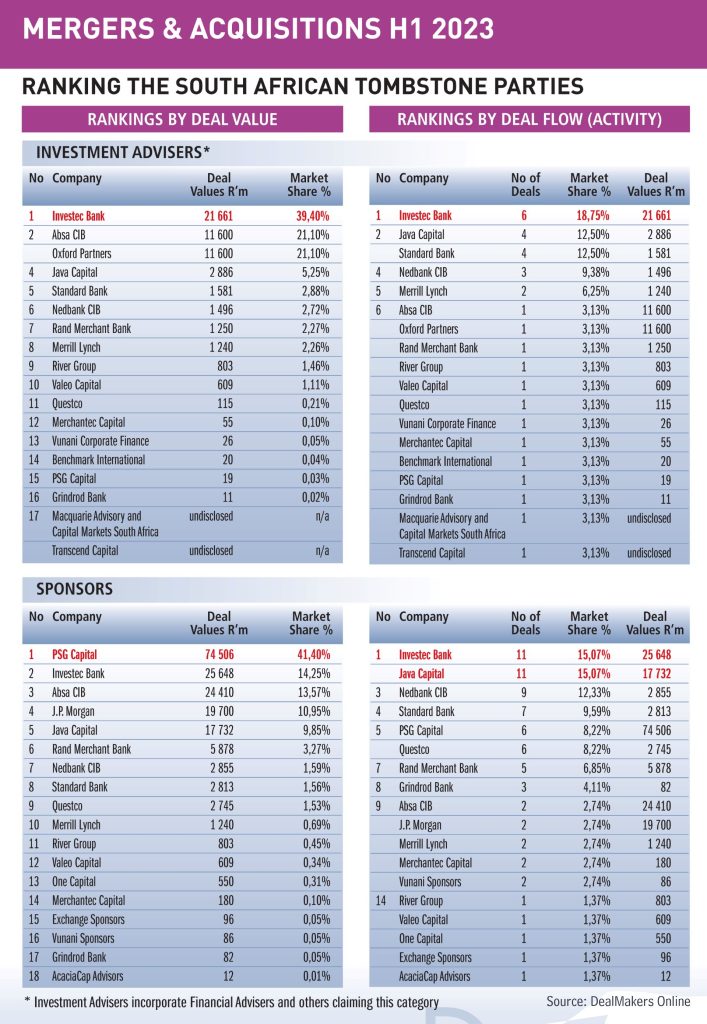

DealMakers H1 League Table – M&A activity by the top South African advisory firms (in relation to exchange-listed companies).

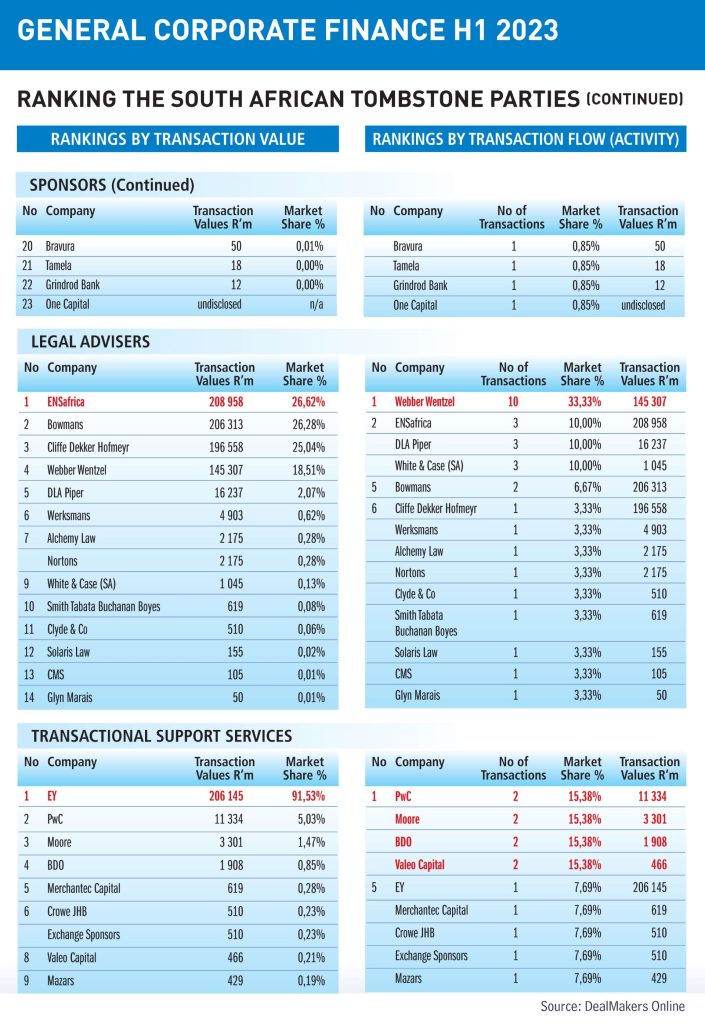

DealMakers H1 League Table – General Corporate Finance activity by the top South African advisory firms (in relation to exchange-listed companies).

The latest magazine can be accessed as a free-to-read publication at www.dealmakersdigital.co.za

DealMakers is SA’s M&A publication.

www.dealmakerssouthafrica.com