The recent World Cup win by the boys in green and gold brought much needed relief, albeit for a fraction of time, from the daily bombardment of negative news that has become a way of life for South Africans. But like all good things, this hype has faded, and our attention is once again focused on making the best of, let’s face it, a very difficult setting.

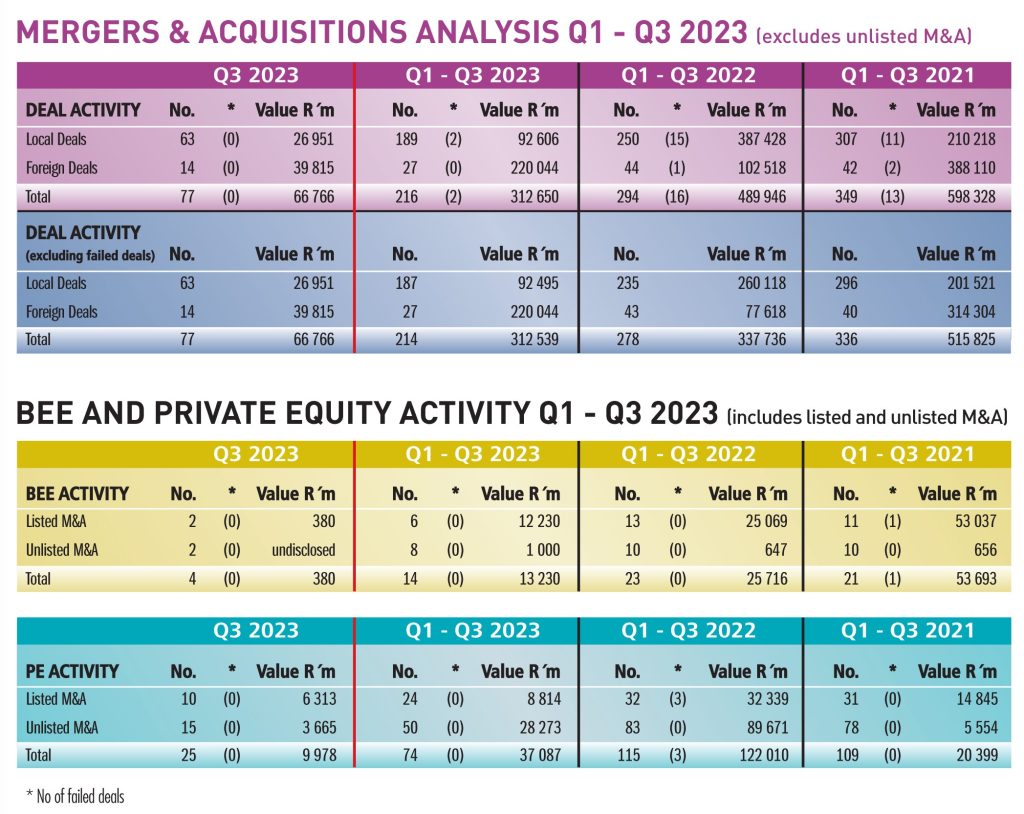

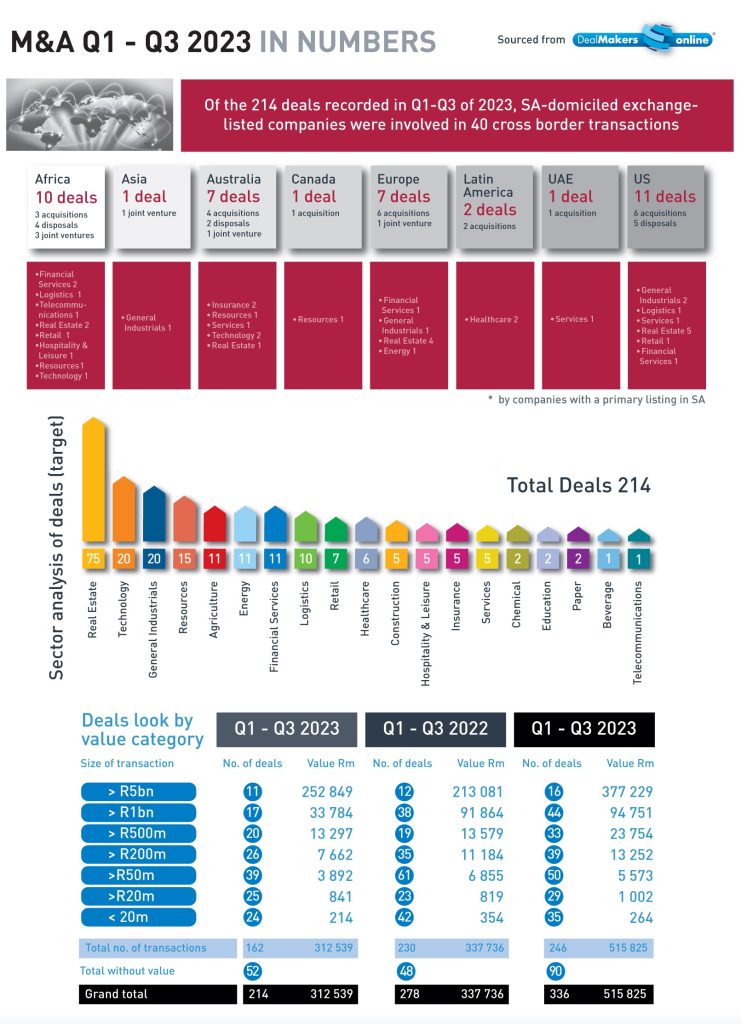

M&A activity is, by its very nature, resilient in tough times – rather, it is the type of deals completed that changes. Nevertheless, the industry has come under pressure. For the period from January to end-September 2023, deal activity declined 26% year-on-year, and almost 40% when compared with deal activity in 2021. Private Equity, an important driver in the dealmaking space, also declined – down 36% on the previous year.

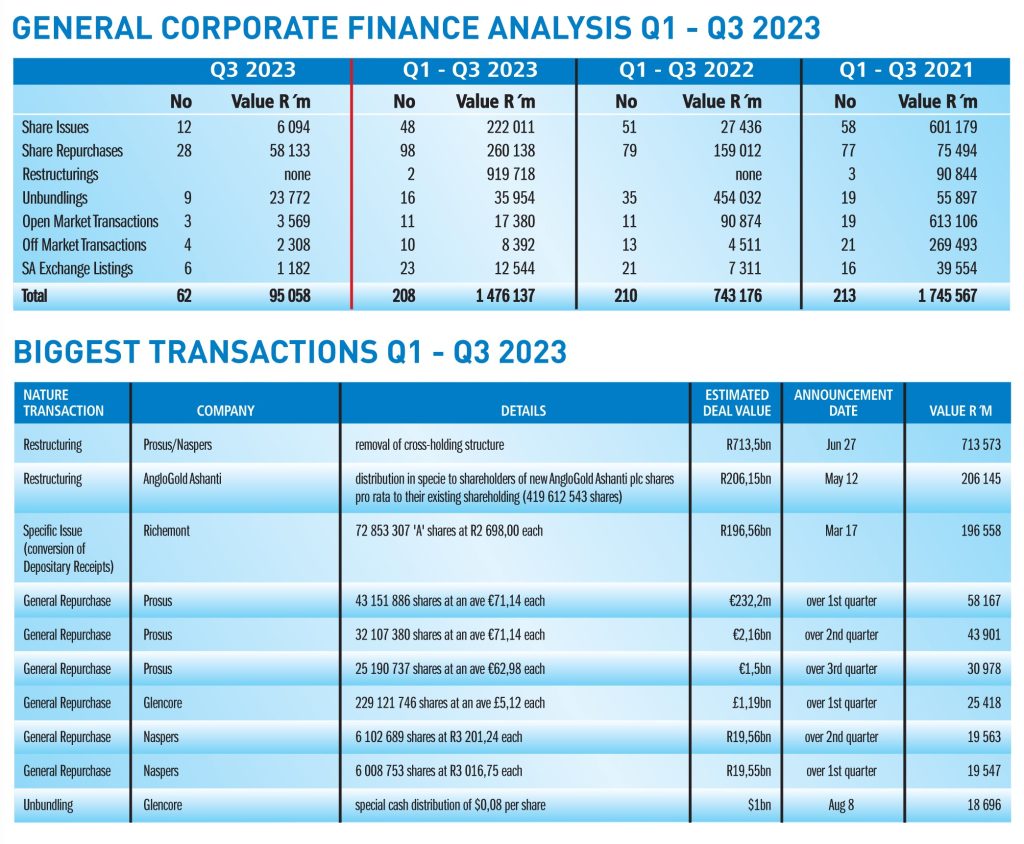

Share issues and repurchases continue to characterise the general corporate finance activity in 2023, with R222 billion raised from the issue of shares and R260 billion the value of shares repurchased. The repurchase programmes of Prosus, Naspers and Glencore account for most of this value, while the aggregate value of Richemont’s issue of A shares (conversion of depositary receipts) reported in Q1 was R196,56 billion.

A worrying trend is the exit of companies from Africa’s largest stock exchange, the JSE. Over the past six years (excluding 2023), an average of 25 companies have delisted each year. For the year to end-September, 19 companies have delisted, with a further five set to do so within the coming months. New listings have all but dried up. Private equity has been identified as one reason for the loss of listings, providing financing in softly regulated private markets. In 2017, the JSE welcomed 21 new listings; in the year to September 2023, this figure had dropped to three. Secondary listings on A2X continue to increase, with 18 recorded for the period under review.

It is becoming increasingly clear that South Africa’s approach to foreign affairs will play an important role in determining investment and growth outcomes for the country. While investor interest is present, with a good supply of deals in the pipeline, the challenge is getting them across the line. Investor sentiment – weighted down by the macroeconomic environment, geo-political influences, and the impending local elections – is adopting a wait and see attitude.

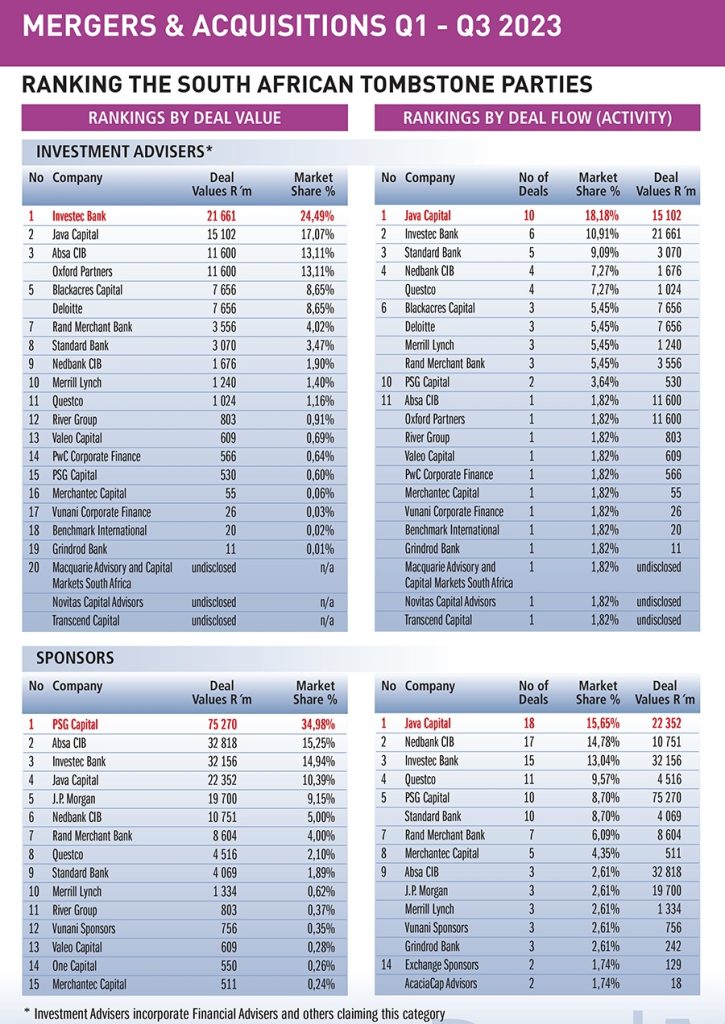

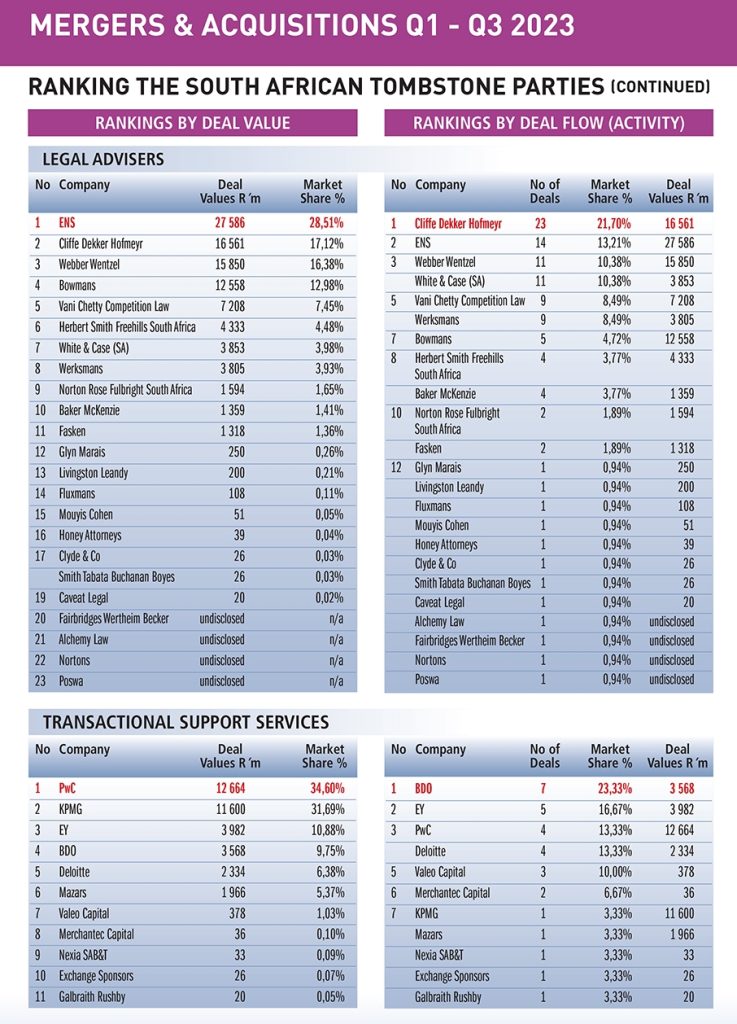

DealMakers Q1-Q3 League Table – M&A activity by the top South African advisory firms (in relation to exchange-listed companies).

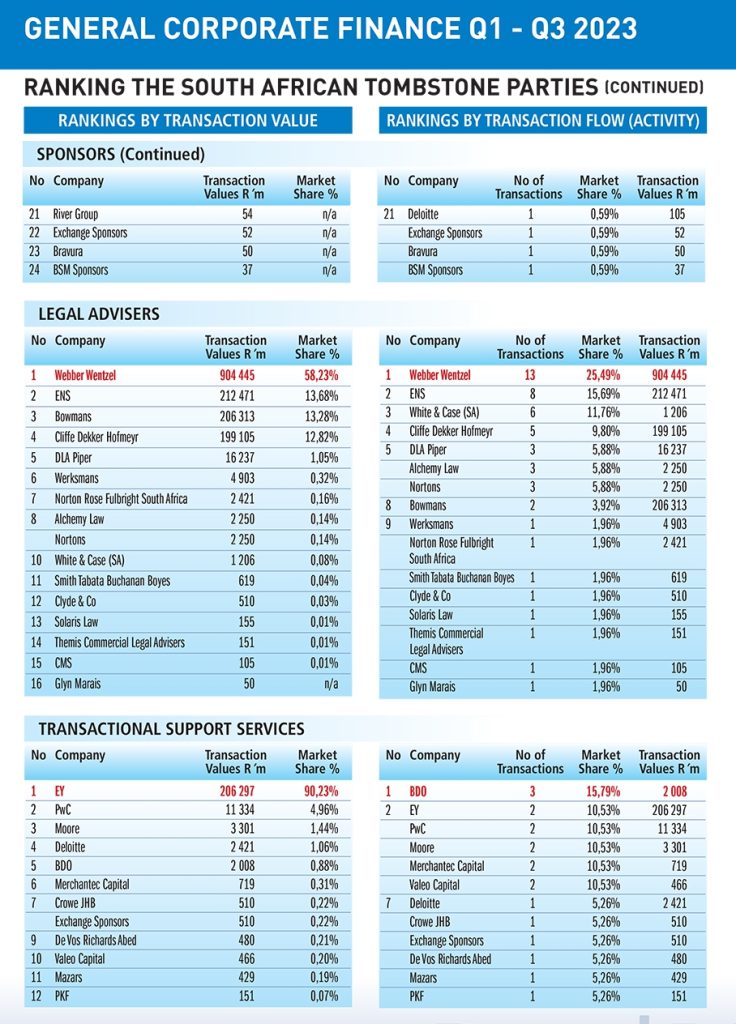

DealMakers Q1-Q3 League Table – General Corporate Finance activity by the top South African advisory firms (in relation to exchange-listed companies).

The latest magazine can be accessed as a free-to-read publication at www.dealmakersdigital.co.za

DealMakers is SA’s M&A publication.

www.dealmakerssouthafrica.com