Mergers and acquisitions (M&A) activity in South Africa was subdued during the first six months of 2024, influenced by a combination of domestic economic and political challenges, and global market trends. This impacted deal valuations and financing conditions, making M&A more complex to execute.

While certain sectors have showed resilience and strategic focus, there was a noticeable recovery in announced M&A during Q3, on the back of optimism ignited by the emergence of favourable domestic and international trends.

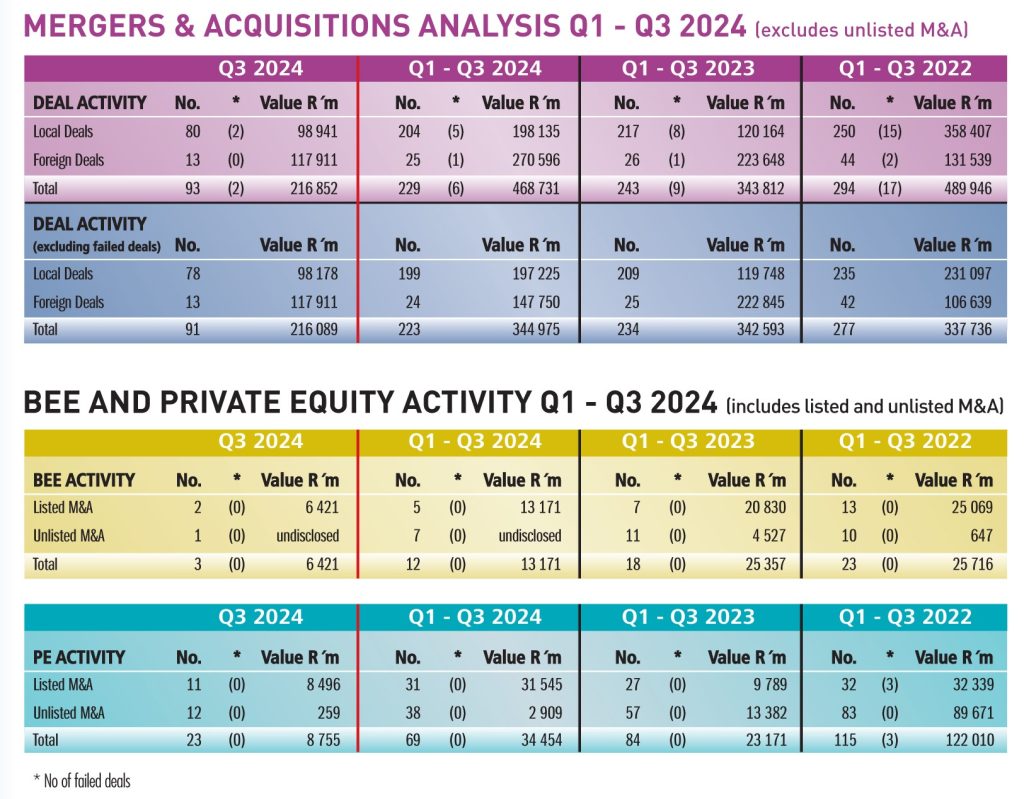

During Q3, 93 deals – executed by primary and secondary SA exchange-listed companies – were recorded by DealMakers (valued at R216,85 billion), of which 80 deals (with a value of R98,9 billion) were executed by companies with a primary listing. For the period Q1 – Q3 2024, a total of 204 deals were recorded – valued at R198,1 billion – against 217 deals valued at R120 billion during the same period in 2023.

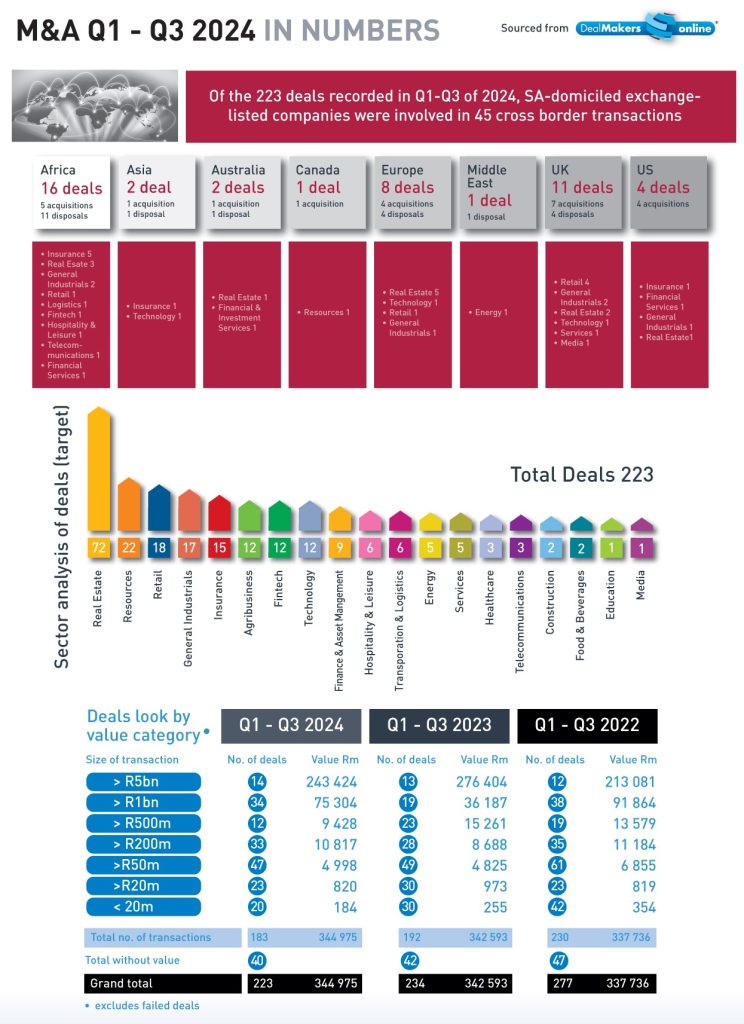

Analysis of the deals’ target sectors shows that M&A activity in the real estate sector remains buoyant, accounting for 32% of deal activity, followed by resources (10%) and retail and general industrials, both at 8%.

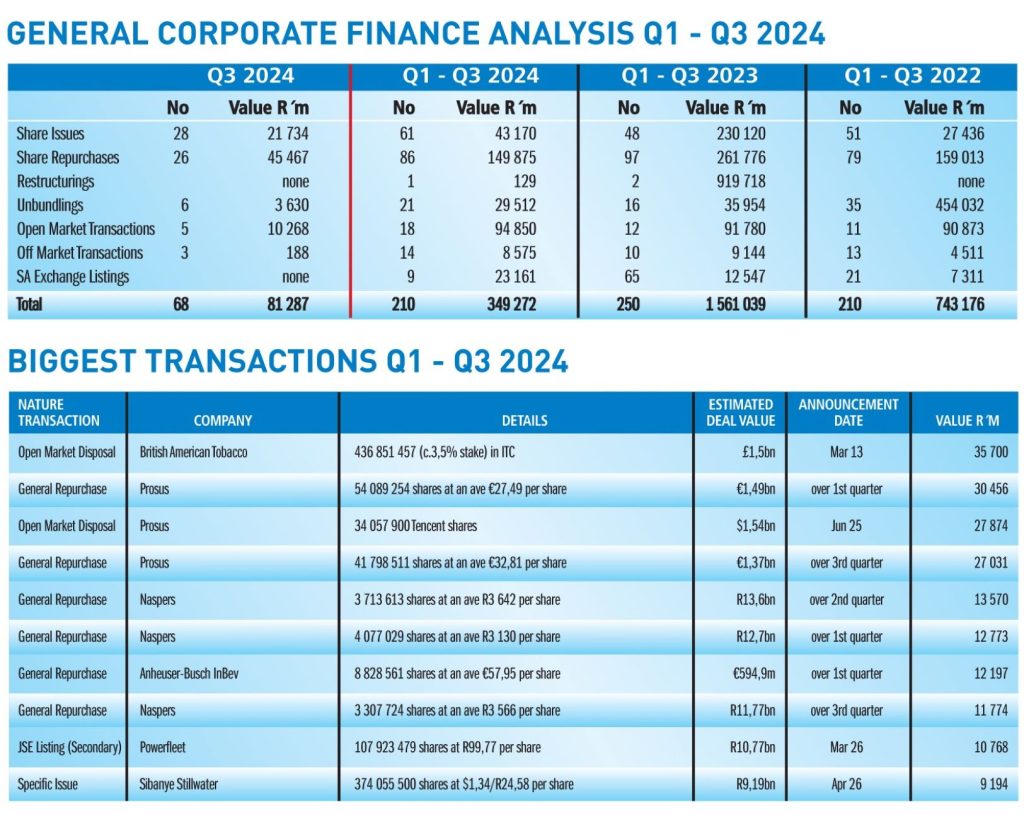

South Africa has continued to attract cross-border M&A, with investors from Europe, the Middle East and Asia showing interest. These deals have often targeted companies that can provide access to broader African markets, benefiting from South Africa’s established infrastructure and financial systems.

Of the top 10 deals by value for the year to end September 2024, the Canal+ buyout of MultiChoice minority shareholders remains the largest, with a price tag of R35 billion. South Africa has well-established regulations for M&A, but the uncertainty surrounding government policy and business reforms has sometimes deterred investment.

Private equity (PE) firms have remained active, although their strategies have shifted toward more selective investments and value-creation opportunities. The challenging economic environment has encouraged PE players to focus on portfolio optimisation and exits, while scouting for opportunities in resilient sectors like fintech, healthcare and logistics.

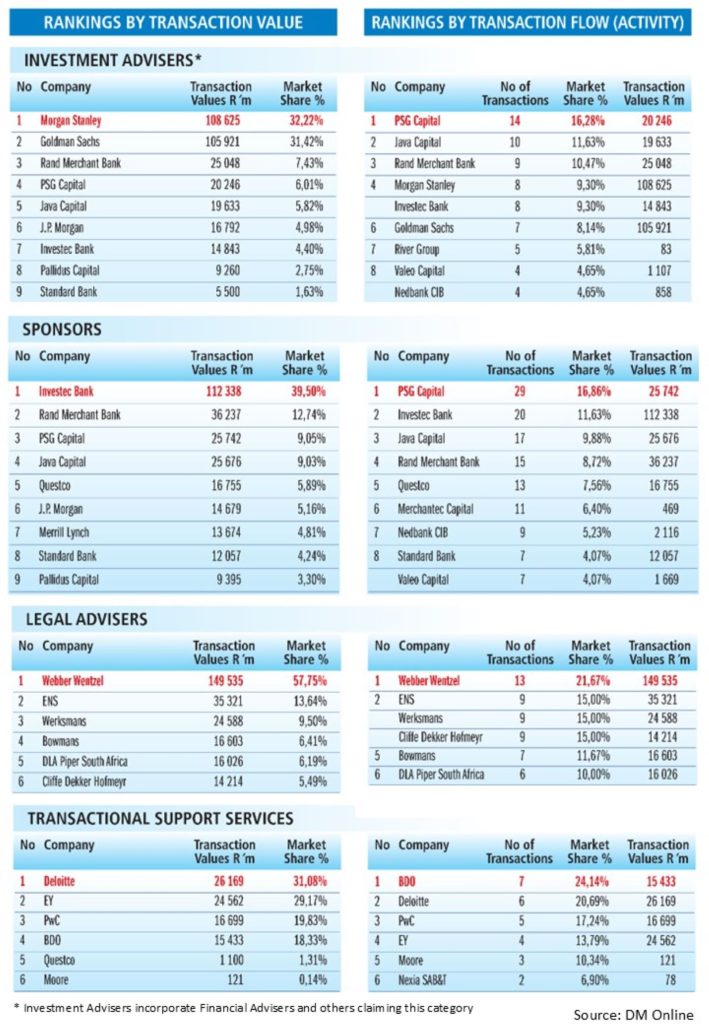

DealMakers Q1 – Q3 2024 League Table – M&A activity by the top South African advisory firms (in relation to exchange-listed companies).

DealMakers Q1 – Q3 2024 League Table – General Corporate Finance activity by the top South African advisory firms (in relation to exchange-listed companies).

The latest magazine can be accessed as a free-to-read publication at www.dealmakersdigital.co.za or on the DealMakers’ website

DealMakers is SA’s M&A publication.

www.dealmakerssouthafrica.com