Spar’s slogan these days is “Under the Tree” – I had to Google it to check. Gone are the days of “Good for You”, which may be apt considering recent share price performance.

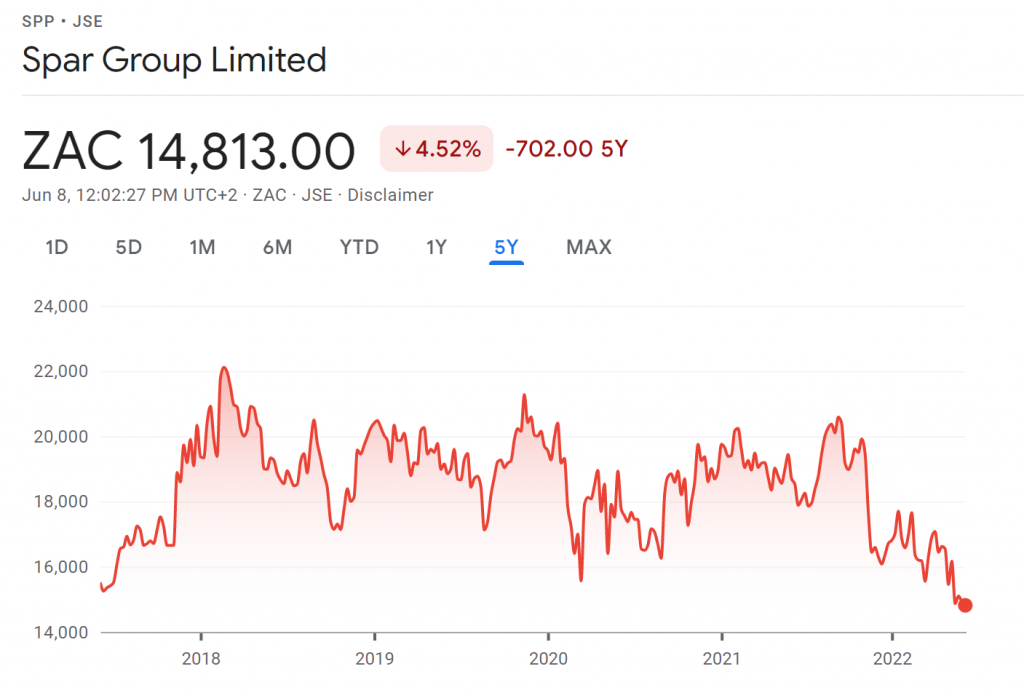

Spar has traded in a channel for years. Check out this chart and take note of how the stock has swung up and down in a clearly visible range:

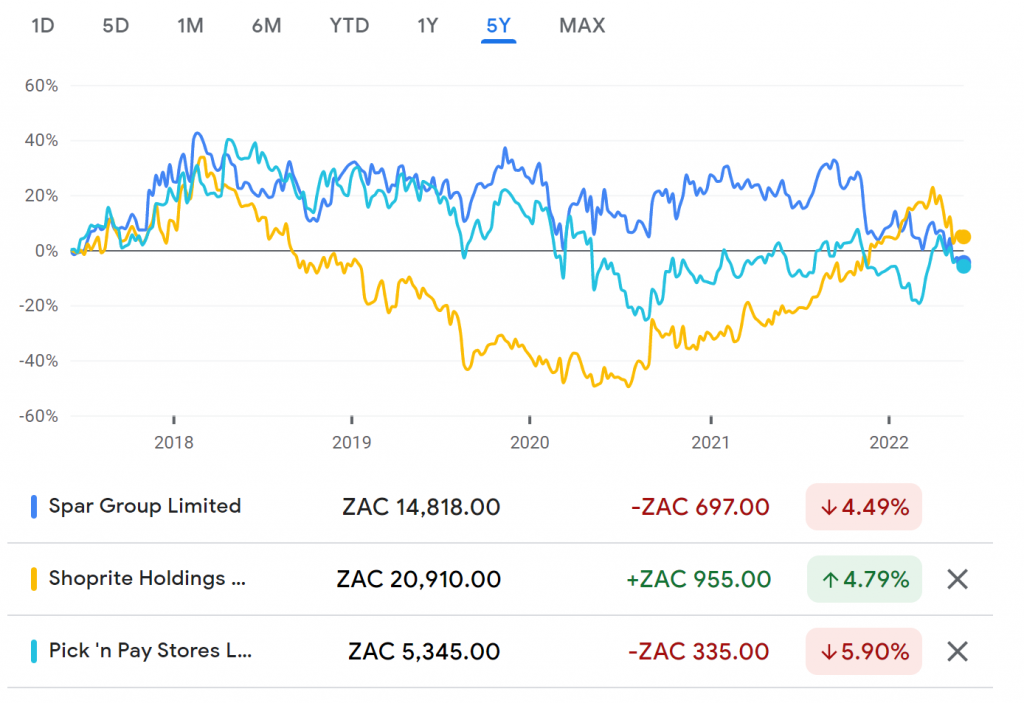

This means that Spar has been a poor choice in a buy and hold strategy. Before you get carried away in thinking Shoprite and Pick n Pay were any different, here’s a 5-year relative performance chart of all three of them:

Clearly, this isn’t a sector where you can buy and forget. For fans of swing trading and pairs trading (long one and short the other), the grocery retail sector does offer plenty of fun. I think part of the reason is that this sector is hyper-competitive, so success at one retailer is often at the expense of another.

I took a punt on Spar ahead of the latest earnings. The stock sold off sharply at the end of 2021 based on issues in integrating the acquired business in Poland and the guidance given to the market that the dividend would be significantly lower for the next couple of years. This is to give the balance sheet breathing room for a large SAP implementation project.

To be fair to Spar, substantial investment in IT infrastructure is part of what drove Shoprite’s recent run of form. The process is painful but it should be worth it.

I bought after the big sell-off and my long thesis was based on the following expectations for this result:

- Poland to be doing better, not least of all with so many Ukrainians to feed (sad but true)

- The food service businesses in Ireland and England to perform well as restaurants have recovered

- Local grocery retail to lose further ground to Shoprite and Pick n Pay but nothing major

- TOPS to put in a huge recovery performance as people were allowed to buy alcohol and have braais

- Build it to experience slightly negative turnover growth in line with the broader pressures in DIY and building materials vs. a really strong base year

- I didn’t have a firm view on Switzerland but didn’t expect it to cause fireworks in either direction (sigh)

So, what happened?

I’ll start with Poland, where turnover was +6.5% in local currency (a good result). Retailer loyalty (the percentage of goods that franchisees acquire from Spar group as the wholesaler) only increased marginally to 31%, which isn’t great. The issue seems to be in the south of the country. Expenses were -3.3% which is really good as corporate stores were closed and the footprint rationalised. There’s still a loss of R187.5 million but it’s a lot better than it used to be. So, expectations partially met.

Moving on to Ireland and Southwest England, turnover +8.3% in local currency so that ties in with what I hoped to see. Here’s the bad news: operating expenses jumped by +16.9%, driven by labour shortages and distribution costs. This caused a nasty impact on margins that I didn’t see coming.

I’ll deal with Switzerland before bringing it home. Turnover was -1.6% in local currency and operating expenses increased by 10% in local currency, so this business’ margins also got hammered as operating profit fell by 13.7%. Ouch.

The improvements in Poland were effectively offset by the pressures in the other businesses. This is a major disappointment.

Within South Africa, TOPS shot the lights out with turnover +41.6%. TOPS revenue of R5.5 billion in this period is much higher than R4 billion in the six months to March 2019 before the world became a less enjoyable place.

Build it did well I think to achieve turnover growth of +1.4%. Inflation was +5.8% so volume growth was approximately -4.4% (assuming no major change to the footprint).

Core grocery turnover was +4.6%. Price inflation for the SA business as a whole was 5%, so it is likely that volumes dropped slightly in grocery. As a wholesaler, Spar runs at much tighter margins than Shoprite and Pick n Pay, so the impact of fuel cost increases etc. have to be passed on to franchisees. It’s worth noting that whilst employee costs only increased by 3%, fuel jumped by 40% and the period ended March only includes a few weeks of the petrol price jumps we have suffered with. Watch out for this in the next period.

Spar’s private label turnover was only +4.1%, with riots severely impacting major suppliers and thus Spar’s range of house brands. This is an important source of gross margin uplift and I would hope to see this tracking ahead of revenue growth in future.

My idea hasn’t worked out

By the time you roll this up to group level, turnover was +5.2% and operating profit was +7.1%. An unfavourable tax contributed to profit after tax +4.1% and headline earnings per share (HEPS) +3.5%.

It’s also very important to note that HEPS of 642.6 cents is much higher than the interim dividend of 175 cents per share. Spar is retaining cash for the R1.8 billion SAP implementation. The interim dividend is 37.5% lower than the prior year.

If we simply double the interim dividend for the purposes of working out a forward yield, we have a yield of around 2.4% at the current share price. The risk for investors is the share price dropping to around R125, which is where support is found at a share price level going back to 2015!

The worry for me is that there’s also a fundamental argument that the share price could get to R125. Investors in a rising yield environment may not have the patience required to sit on the stock at this dividend yield and the share price may drift lower as a result.

I bought Spar with a swing trading outlook and swings don’t always go in the direction you want them to. If they did, everyone would be a stock market millionaire!

The share price jumped in the opening auction and then traded down rather quickly, eventually closing 0.8% lower for the day.

Having considered the reasons why I bought the stock and what the outlook is from here, including critical macroeconomic considerations like inflation, I’m now looking to exit my position.

I’ve long wondered why Spar trades at such a significant p/e discount to it’s competitors; thank you for the insight 🙂

Chris Gilmour recently recommended Ghost Mail to me and I have to thank both him and yourself for sharing, much appreciated.

Glad to hear you are enjoying it! 🙂