Andre Botha, Senior Dealer at TreasuryONE, updates us on the rand and market sentiment in a critical week of FOMC minutes and a public holiday in South Africa.

Last week, we saw two distinct tales of the rand and risk sentiment in general.

The rand started off the week on the front foot, with the local unit breaking below the R15.20 level as expectations were that US inflation was plateauing and that by any metric, the US Fed’s hiking cycle was set in stone.

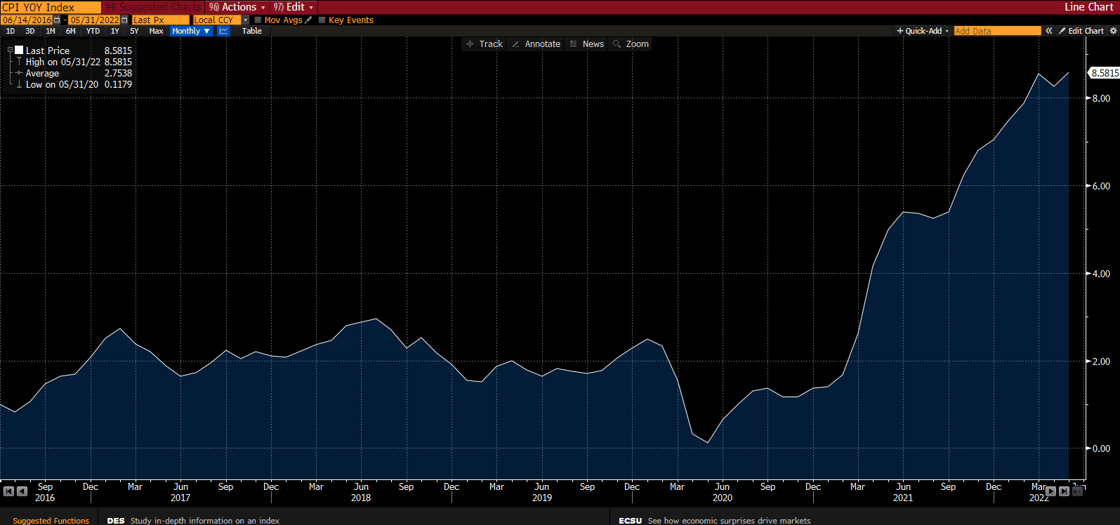

That was the case until Thursday last week, until the market found out that the US inflation number printed higher than the previous month at 8.6% YoY. That has sent markets spiraling with the US Fed meeting this week shining like a beacon in the data calendar.

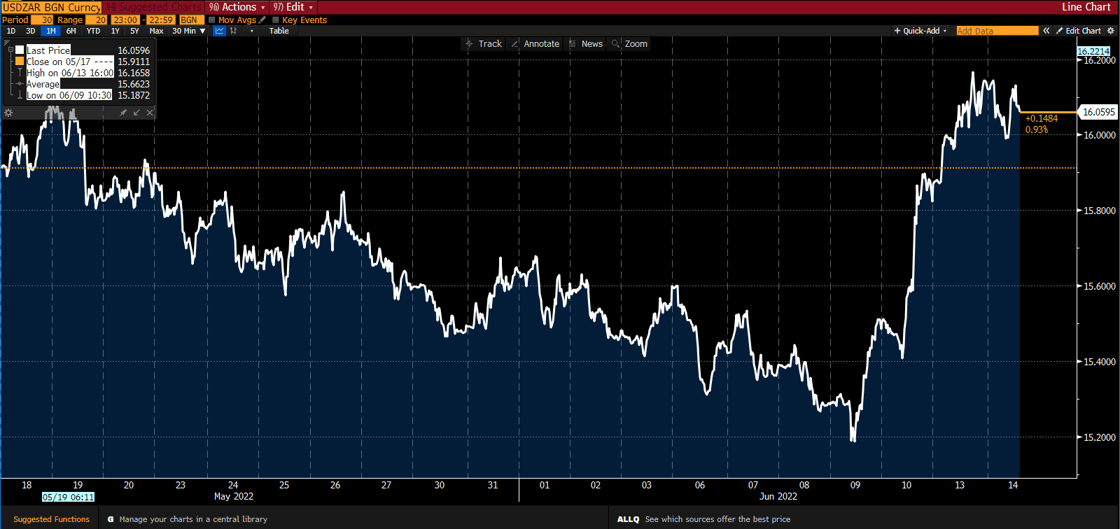

Since then, we have seen the rand breaking above R16.00 against the US dollar and losing over R1.00 in three trading days.

This chart highlights the US Inflation story:

The question then is, what happened to markets after the release of the US CPI number?

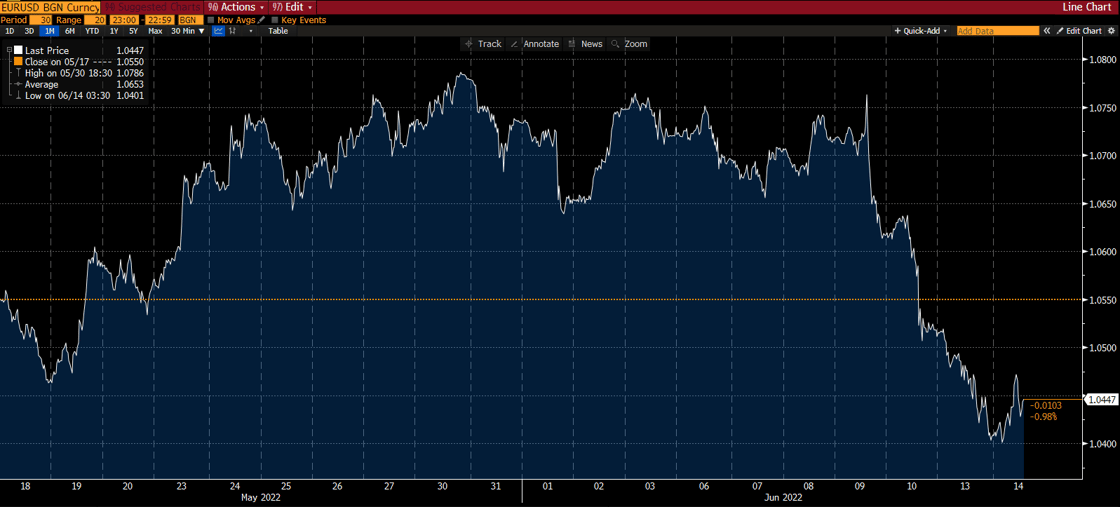

Well, for lack of a better term, it has been panic stations, with US equity markets losing ground, emerging markets currencies coming under pressure as the US dollar has gone from 1.07 against the euro to 1.04 and commodity markets taking a beating on the prospect of lower demand due to economic downturns and slower demand.

The reality is that the world economy is most likely heading for a recession, and the fear of stagflation is circling above that fear of recession.

Here’s a chart of the EUR/USD:

The common saying is that the cure for high prices is high prices, and with the current Central Bank policies we can expect the fight against inflation to boil down to curbing demand. The destruction of demand will force prices lower.

One way to curb demand is by hiking interest rates. This leads us to the Fed announcement due today.

The expectations in the market are that the Fed will raise rates by 75 basis points. Still, the real crux of the matter will be the press conference after the announcement, where Fed Governor Jerome Powell will get to explain the Fed’s vision for reducing inflation and their interest rate outlook going forward.

We can expect some volatility in the market in the evening of the announcement.

As for the rand, we expect the local unit to be under pressure as there has been a fundamental sentiment shift against emerging markets in the short term. We would not be surprised if the rand tested the highs of a few weeks ago around the R16.30 level. One problem the rand has is the public holiday on 16 June, which could see the rand moving wildly due to the lack of liquidity.

Emerging markets currencies and risky assets could come under severe pressure in the short term.

To finish, here is a chart of USD/ZAR:

For more information on TreasuryONE’s market risk and other offerings, visit the website.

IS EK DOM OF WAT, MOET DIT NIE WEES RAND/DOLLARS EN DOLLARS/EURO NIE

Hi Pietman – the way the currencies are quoted in the article is correct. If you Googled e.g. USD/ZAR you would find it quoted in the same way. Hope that helps!