Although we had a short week last week, some significant events happened. This included a rate hike by the Fed and an emergency meeting called by the ECB. Andre Botha, Senior Dealer at TreasuryONE brings us these insights.

The Fed showed its hand and hiked by 75 basis points to get rates back to neutral at a faster pace while also fighting the current inflation “monster” prevalent in the market.

We also saw an emergency meeting called by the ECB, at which a new tool was discussed to reduce bond market volatility as the Bank raises interest rates.

The Fed was always going to hike interest rates, so the question was whether they would do so by 50 or 75 basis points. With inflation picking up in the previous month, the smart money was on a 75 basis point hike, which Fed Chair Powell delivered.

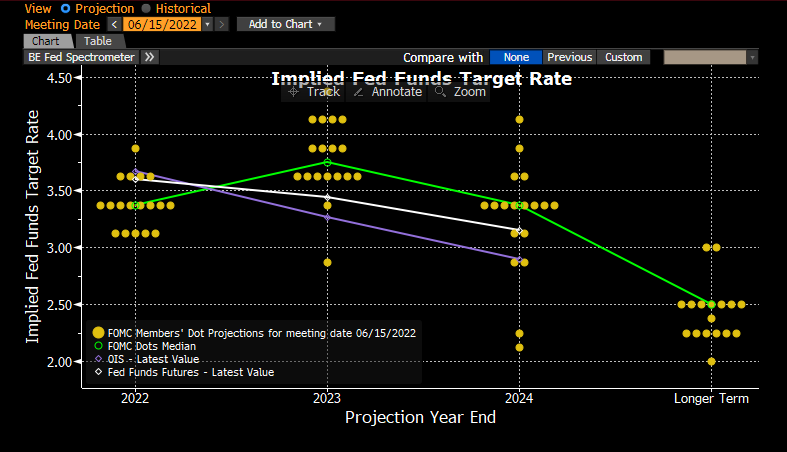

The dot plots below demonstrate that the Fed expects the rate to be 3.5 per cent by December, implying that even if this occurs, there will be some significant increases in the coming months.

However, the market has begun to worry about the Fed raising interest rates causing a recession, and we have seen multiple signals that the market is concerned about this possibility. Oil prices dipped on Friday, especially in the Northern Hemisphere summer, where demand for oil increases. Stock markets are losing some ground as flows have started to move away from risky assets like stock markets back into safe havens like the US dollar.

To address unwarranted moves in the bond market, the ECB called an emergency meeting, with many speculating that the Governing Council would reveal the tool mentioned above. Instead, the Governing Council agreed to direct APP reinvestments to the markets that require the most attention.

A portion of the statement reads as follows:

“The Governing Council decided that it will apply flexibility in reinvesting redemptions coming due in the PEPP portfolio, to preserve the functioning of the monetary policy transmission mechanism, a precondition for the ECB to be able to deliver on its price stability mandate.”

With that said, the US dollar was on the front foot immediately after the interest rate decision, but it lingered around the 1.05 level against the euro during the latter half of last week and the start of this week.

We must remember that the US was out of the market on Monday, which would have impacted the US dollar’s lack of momentum.

The rand had a rollercoaster week, fluctuating wildly between the R15.75 and R16.15 levels – appearing to want to break above the R16.15 level a couple of times but unable to sustain the break each time:

In the short term, we believe that the rand could come under some pressure as risky assets have come under pressure, and the rand could bear the brunt of it as it usually acts as a proxy currency for all emerging markets currencies.

On Wednesday, Fed Chair Powell will give his semi-annual testimony to Senate Lawmakers on monetary policy. We expect the market to watch the testimony closely as the testimony is the main highlight of a very bare data and event cupboard and could cause some volatility in the market.

Should the Fed reinforce its hawkish stance, we could see emerging markets currencies under pressure, and this could be the catalyst for the rand to move above the R16.15 level that it has been tested so frequently.

To find out more and to discuss your market risk needs (like forex) with the team at TreasuryONE, visit their website here.