In a market that is ultimately a hybrid of emerging and developed characteristics, South African retailers continue to demonstrate resilience in the face of huge challenges. Chris Gilmour explains.

January has started off well for the JSE All Share Index (ALSI), reaching an all-time high last week, mainly on the back of higher commodity prices.

This underlines the view that the South African equity market is still predominantly driven by commodities, even though the mining industry itself is a relatively small contributor to GDP. The rest of the market outside of mining stocks hasn’t really moved much, though this is to be expected, given that household consumption expenditure (HCE) is in the doldrums and that is by far the biggest GDP contributor at over 60%.

And with HCE and GDP generally not forecast to do very much this year, there seems little reason to get excited about consumer stocks generally and retail stocks in particular. But as with everything in life, the devil is in the detail and there may be some surprises from the strangest of places as 2023 unfolds.

Much of the rationale behind South African retailing’s place on the global retailing map redounds to South Africa’s perceived position as somewhere between an emerging and a developed economy. In 1990, as Nelson Mandela was released, the ANC and other liberation movements were unbanned and the first tentative moves toward democracy were made, there was understandable impatience among local investors. Many were firmly of the opinion that foreign money would come flowing in almost immediately to the JSE and when that didn’t happen, they were crestfallen.

It took quite a few years post-1990 before foreigners starting eyeing up SA as an emerging market destination and even then, it was only pocket money that came our way. The big money was going into countries in eastern Europe, South America and Turkey and of course emerging Asia.

Are we really an emerging market?

I had the privilege of taking a veteran US emerging markets specialist called Joe Williams of Batterymarch (Now Legg Mason) around Cape Town in the mid-90s, meeting the CEOs of companies such as Rembrandt Group (now Remgro), Pepkor and Pick n Pay. He and his sidekick Cam Huey were suitably impressed with these companies and at the end of the trip as I was driving Joe back to the airport to catch a plane back to the US, I innocently asked how he thought SA stacked up in comparison with other emerging markets.

He let out a huge belly-laugh and said “Chris, South Africa is NOT an emerging market; it’s a developed economy with high unemployment!”

I was a bit non-plussed by that remark, but it has stayed with me all these years. And on reflection he was absolutely correct. SA rarely if ever managed to squeeze any decent growth out of its economy, even before Eskom went into terminal decline. And South African institutions – be they banks or accounting bodies, or the JSE, or industrial companies or retailers-are world class and have been for decades. They are not emerging, they are right up there with the world’s best.

A year of so later at an investment seminar I asked Mark Mobius of Templeton the same question. He phrased his response differently, saying that SA was a hybrid between developed and emerging. Very diplomatic and in its own way, equally true.

What does this have to do with retailers?

So, what does this have to do with the outlook for retail stocks in the current years and beyond? Well, South African retailers have first world management but the ambient economy mimics emerging market conditions because of the chronically high rate of unemployment. Self-service checkouts, a feature of many British, American and European supermarkets, are not used in South Africa because of the fear of union resistance, not because of technological incapability. South African food retailers are among the most efficient in the world and that is reflected in their paper-thin operating margins.

It’s difficult to see how the retailing industry can get much more efficient in 2023 and beyond.

In food and drug retailing, the emphasis is going to be on price. And this is where the unlisted retailers may do better than the listed ones. Unlisted banner groups such as EST Africa support a broad range of independent FMCG and hardware retailers all round the country and their hefty buying power allows them to compete head-on with the listed giants. But they have a much lower overhead structure, which allows them to be able to sell their products at keener prices than the listed FMCG players.

And in discretionary retailing, too, the emphasis will be on price. But it will be increasingly difficult to increase volumes in a high interest rate environment. Those discretionary retailers that have elected to adopt an aggressive expansionary through-the-cycle approach, such as Mr Price and TFG, will show growth, but it will be largely acquisition-driven.

Another feature that may aid discretionary sales is enhanced use of credit. This is a very sensitive subject and banks and retailers are keen to ensure that their credit books stay in good health and don’t deteriorate while at the same time looking for ways to increase turnover. Already a number of clothing and furniture retailers have exhibited enhanced cash:credit sales ratios in their recent trading updates, a marked divergence from trend.

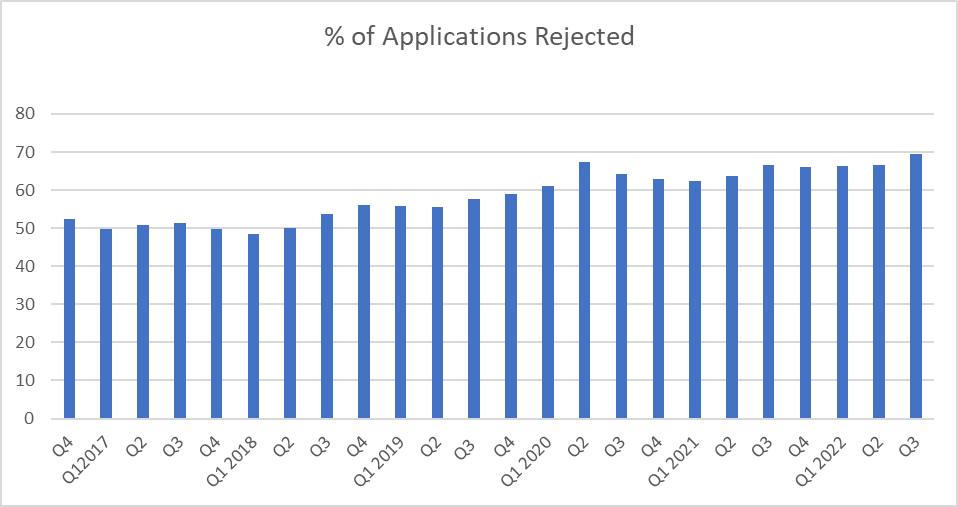

This is happening at a time when rejection rates for credit applications are rising:

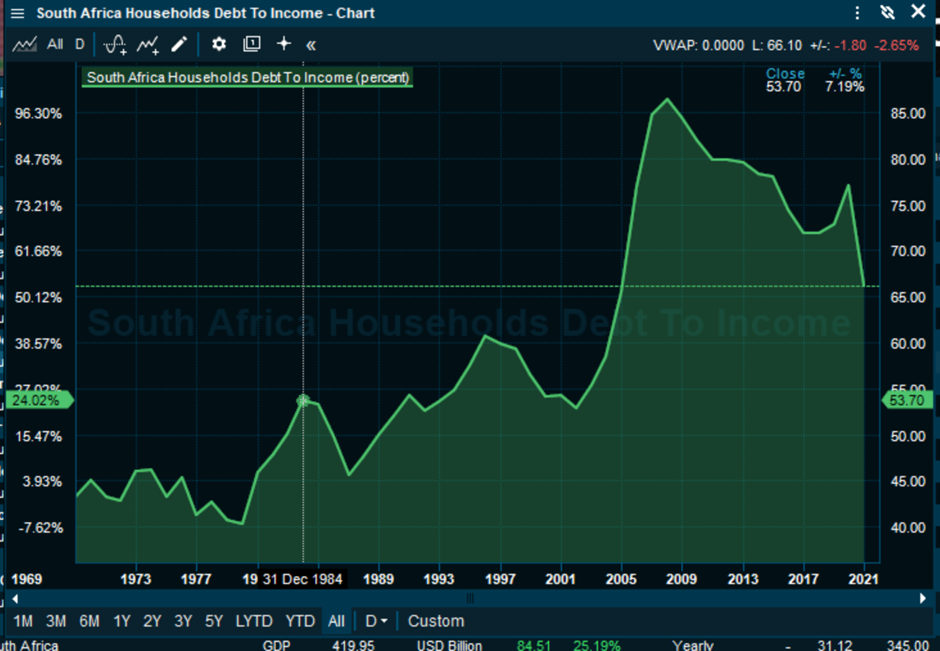

As the next graph illustrates, household debt/household income has been declining for a number of years. Recent surveys by FNB/BER suggest that consumer confidence is improving and that consumers are more inclined to spend again. If this is the case and higher degrees of credit can be advanced in a responsible manner, discretionary consumer spending may be aided to an extent:

The unknown factor is the extent to which rotational power cuts (load shedding in Eskom-speak) will impede retail sales this year and next. The really scary aspect of all of this is that there is no plan to reduce load shedding from government. It appears to be impotent, as the utility lurches from one crisis to another.

At the time of writing, Eskom had applied a continuous stage 6 and there were rumours that stage 8 was being contemplated. Some of the discretionary retailers such as Mr Price and TFG have installed some serious battery backup capability and by financial year end will have 70% of their stores “immune” to the impact of load shedding. But food retailers require far greater power input for refrigerators for example and only a few of them are adequately prepared for a prolonged escalation in power cuts.

So, one can add another string to the bow of SA retailers: world’s most resilient. One can only imagine how brilliantly these retailers would perform under more “normal” economic conditions with a stable power supply.

But that’s another story for another time.