The Trader’s Handbook is brought to you by IG Markets South Africa in collaboration with The Finance Ghost. This podcast series is designed to help you take your first step from investing into trading. Open a demo account at this link to start learning how the IG platform works.

Listen to the podcast using the podcast player below, or read the full transcript:

Note: examples used in this podcast should not be interpreted as advice. They are for informational purposes only.

Intro: Welcome to The Trader’s Handbook, a limited podcast series brought to you by IG in partnership with your host, the Finance Ghost. Over the course of our upcoming episodes, we are delving deep into the world of trading, helping both novice and seasoned traders alike navigate this exciting field. Join us as we unravel the intricate strategies and insights that define this dynamic landscape and the beautiful puzzle that is the markets. IG Markets South Africa is an authorized financial services and over the counter derivatives product provider CFD. Losses can exceed your deposits.

The Finance Ghost: Welcome to Episode five of The Trader’s Handbook and what an awesome podcast series this is turning out to be. Really, really enjoying it, and so are you, it seems. We’re happy with the numbers. It looks like people are opening demo accounts and making their first trades in accounts where it’s not monopoly money anymore. So, well done to you if you’re one of those people! And if you aren’t, go and check out the demo accounts and start putting some of the stuff into practice, because of course that is what makes it so fun. And we are recording this week amidst an environment of all-time highs on the JSE. We’ve had a strong rebound for stocks in general. We’ve had the rand below R18 to the dollar. Things are good in South Africa right now. Sentiment is strong. Most local stocks are rallying. The sun is kind of starting to shine. Not so much in Cape Town. More on that to come.

But let me first welcome Shaun Murison from IG Markets South Africa, our regular source of knowledge on the world of CFD trading. Shaun, thanks so much as always for doing this with me.

Shaun Murison: Great to be here again. Exciting times in the market. Like you correctly said, rand at its best levels in more than a year, we’ve had the JSE Top 40 Index trading to new all-time highs. We’re on the cusp of this easing cycle in interest rates. So, things are cautiously optimistic. Well, actually not so cautiously – more like aggressively optimistic at this stage, but markets don’t move in a straight line. So exciting times ahead, expecting a little bit of volatility.

The Finance Ghost: They are quite aggressively optimistic. You see these South African mid-caps now trading at like low- to mid-teen P/Es, where they were languishing previously at like sevens and eights. It’s quite interesting.

I’m sitting with quite a lot of listed property exposure in my investment portfolio, hoping for these rates to come down and for all of this good stuff to flow into these property owners, ultimately, especially on the retail side. It’s going to be pretty interesting to see how the next year pans out.

But of course, as I’ve learned in some cases the hard way, trading and investing are quite different animals. Now, listeners who have been following the shows thus far will know that one of the positions that I tried out in my demo account was to be short Mr Price.

Now this was very much based on my view that, well, I don’t think Mr Price is as strong as some of its competitors in that space. I think the valuation had gotten a little bit overcooked, and we’re going to reflect on that trade today and what I’ve learned from it, as well as perhaps a smarter way to actually go about things. But I think before we do that, for those who have perhaps made this their first podcast in the series, or still aren’t quite familiar with these terms, I think it’s always worth just spending literally a minute recapping the difference between long and short positions on a stock. The beauty of CFD trading is that you can go short. You can’t do that in your traditional brokerage account. You can only go long. So, Shaan, I’ll let you do the honours on a brief relook of long versus short.

Shaun Murison: Okay, so long, very simply, it’s the same as what you do if you’re investing. You want to buy low and sell high, obviously simplifying things. There’s a use of leverage in trading, and so we talked about the profits and losses being magnified. But when you talk about the short side of things, it’s taking a trade with a view that you expect that market to fall. When you’re going long, you want to buy low and sell high to make money. When you’re going short, you want to sell high and buy low, if that makes any sense. So essentially, in both scenarios, you need to pay less to buy something than you sell it for to make money. It’s just when you’re going short, you can do it the other way. If you think that market’s expensive, you can take a short position, you can sell it, basically borrowing shares if you’re looking at shares, you’re selling it and you’re hoping if it does come down, you can buy it back cheaper.

The Finance Ghost: So, back to the Mr Price trade. Now, I had what would best be described as a naked short – in some ways I lost my shorts, but we’ll talk about that now! And in other words, this is basically an unprotected position of being short Mr Price. I’m not long any other clothing retailers or South African general mid- to large-caps in case there’s a big rally in local stocks. I’m just sitting there short Mr Price, because I believe so strongly in that trade.

Easy with monopoly money, and that’s why I did it.

Now, it looked promising initially. Actually, I was in the green. I think we spoke about that on probably episode two, I can’t recall exactly. And at that point I should have said, thank you very much, I’ll take the profits and run. However, I didn’t. And on a naked short, I think you need to be in it pretty much for a good time rather than a long time. You can’t be too greedy because you are betting against a whole lot of things, like inflation, for example. I mean, this is such an important concept in long versus short, right? Shares are generally expected to go up over a long enough time horizon, so there’s actually no limit to how much you can lose on a short.

Whereas on a long position and if it goes wrong initially, you can kind of wait it out. But this is monopoly money in my demo account and I wanted to see how this trade would play out. Instead, as that share price moved higher and my short lost money, I added to the short and hoped that, okay, you know, I’ll get the right level, the thing will fall over and the trades will be in the money. That turned out to be a really bad call.

If you are naked short and it starts moving against you, I think you need to be very careful of fighting that momentum. The long positions, as I said, they sort themselves out over time, provided the stock is at least going up over the long term. But an ugly short that is going wrong has no limit to how much it can hurt you. So eventually I got out of the way of it. I locked in a loss in the process. So, a nice lesson learned there. I think the lessons I took from it were if you’re going to be contrarian, as I was, and as you pointed out at the time, one, you have to be nimble, which is exactly what you said. And two, don’t be stubborn and turn a small loss into a bigger loss. If you’re going to do something like that and it goes against you, then rather get out of the way. And I would definitely refer our listeners to the episode we did just before this. That would have been episode four in which we talked about what it means to have these different trading strategies to let your winners run, cut your losses, or not, as the case may be.

There may well be a smarter way to actually play these valuation dislocations. Because instead of a naked short, I could have done a pairs trade, which is quite an interesting way to play the market. And in one of your very recent newsletters, Shaun, you put out an idea for Mr Price vs. Truworths as a pairs trade. And I think before we get into the details of that exact trade, can you just explain for us what a pairs trade is? And then I think, yeah, maybe go into how that trade would actually work.

Shaun Murison: Just on the short side of what you were saying earlier on before going to the pairs stuff. You’re right. If you are short, there is no ceiling as to, you know, how far share can go up. So we have a saying, here we go: it’s better to be long and wrong than short and caught. And I think in your trade, you’re short and caught.

The Finance Ghost: Definitely short and caught. Definitely. That is precisely what happened.

Shaun Murison: Because, I mean, on the long side, a share can go to zero, but that means that if you’re on the wrong side of that, if you were long, your loss would be capped. But a way of protecting yourself in the market is basically a hedging strategy.

When we talk about pairs trading, we’re looking at taking two positions instead of one. We’re looking at taking a long position and a short position. And generally, we’ll do it with shares that are quite highly correlated. Shares within the same sector, like gold shares or platinum shares, banking counters etc. And looking at one that’s underperformed a little bit, and one that’s outperformed. The one that’s underperformed, you might look at a long position and then the one that’s outperformed, you look at a short position and you view the profit and loss from both those positions together. You’re trading one share against the other, rather than just the general macro market environment.

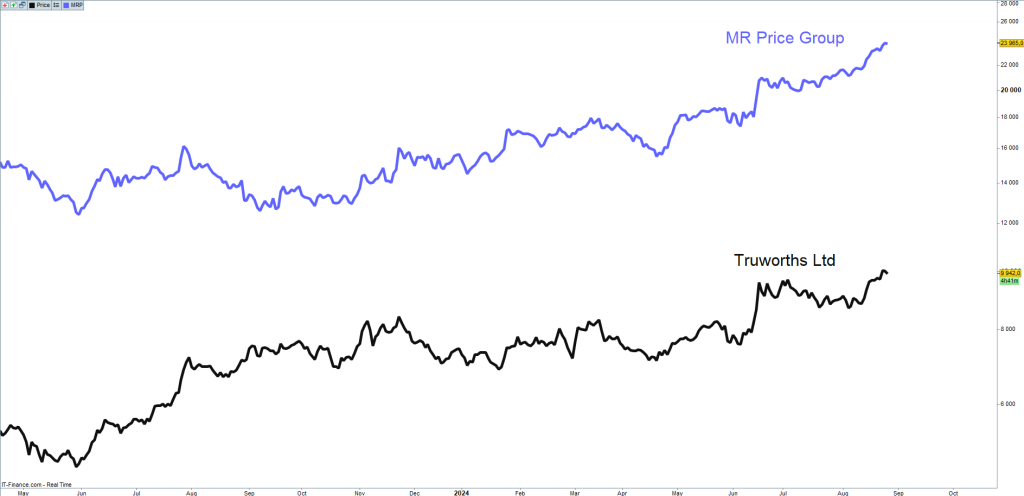

In my opinion, it’s a bit of a safer way to trade. You are essentially hedged in the market, and where the markets are going up or down, there’s an opportunity to make money in that pair. So, when we refer to that Mr Price trade, something that I was looking at in a Technical Tuesday newsletter which put out every Tuesday, and it is free for your subscribers if anyone is interested in that. The basic analysis there was saying that it looks like since the election time, we’ve seen quite an outperformance of Mr Price relative to Truworths. Now, they’ve both been positive, there’s been positive sentiment around both companies, both have rallied.

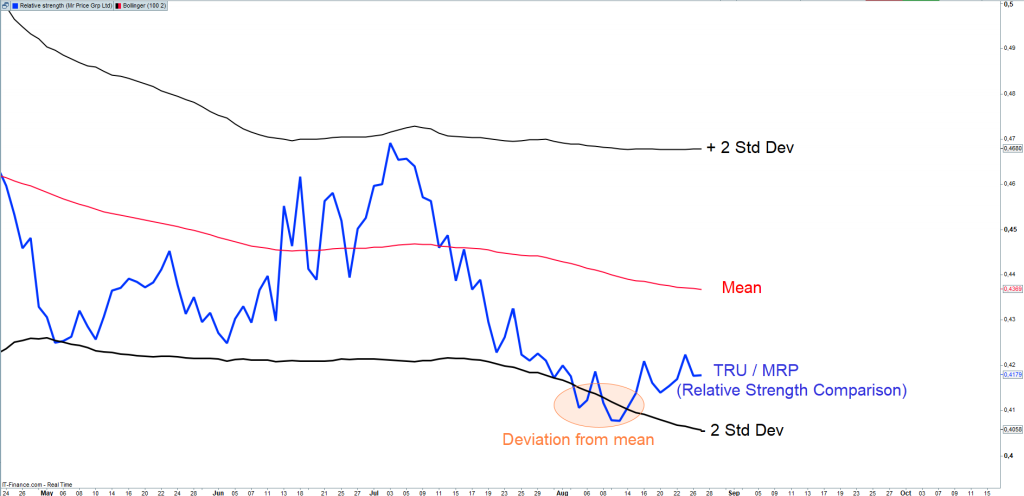

But perhaps, you know, the gains on Mr Price have gone a little bit too far relative to the gains in Truworths. We use a little technical indicator – yes, I’m using a technical analysis version for approach to the pairs trade – called the relative strength comparison. And all it is, is a ratio. It takes the share price of Truworths and it divides it by the share price of Mr Price.

And what that was telling me is that, well, Truworths has underperformed Mr Price a little bit too much over the short term. And maybe going forward, we can see now Truworths start to outperform Mr Price. It’s not saying that I think Mr Price has to come down and Truworths has to go up. It’s just saying their relationship needs to normalize, and if it does, then you’ll be making money. At the moment, that suggestion was maybe there was an underperformance of about 8% there. So, looking to make about 8% on that trade and it has started moving in the right direction, hasn’t hit the target just yet. That’s the basic premise of it.

The Finance Ghost: Yeah. And that’s very different to sitting naked short, right? Because if I think that there’s a company in the sector that is expensive, well, if the whole sector goes up, then that short can still lose money. Expensive things can get more expensive. But one of the ways to protect against that would be to go long one of the low valuation stocks in the same sector. So that if the sector gets the upswing, you would hope that the low valuation stock would get more of an upswing than the one that you’re sitting short and net net, you come out with a profit.

Would you say it’s also quite contrarian then, because you’re actually going short the winner and long the relative loser in the sector? It’s actually quite contrarian, which must be why I like it, right?

Shaun Murison: Maybe it is, it’s a bit of a mean reversion type strategy in technical analysis, there’s a lot of talk about trend following, and this is actually just deviating away from the trend following approach in trading. A mean reversion type strategy expects relationships to normalise over time. But yes, if we say there is a contrarian aspect to the type of trade, but we are still market neutral, we’re not worried about whether the shares are both going up or down. We’re trading the relationship between the two companies.

The Finance Ghost: For someone like me, who believes quite strongly in stuff like mean reversion in multiples and how important valuations are, I think pairs trading becomes really, really interesting and is a superior strategy, I think, to sitting naked short. The other mistake, of course, with that short was to just be naked short into immense South African sentiment.

And that was a good lesson learned as well: when you’re investing, which is my background and it’s long only and it’s longer term stuff, you are often rewarded by being against what the typical sentiment is. You’re buying the beaten down thing because you believe there are catalysts for it to improve at some point in the future. And then you look three, four years down the line and you’ve achieved a compound annual growth rate of 20% and you’ve beaten the market because you bought something at the right time when no one else wanted the thing.

Trading is just so different to that and it’s a lesson that you’ve got to learn by doing, which is why I’m so in favour of these demo accounts, because you’ve got to rather go and make these mistakes in a demo account than making them with real money. And a pairs trade would be a different outcome potentially for me.

I think, Shaun, let’s go into the costs of a pairs trade because this is obviously really, really important, right? You’ve got to look at your net return after costs because otherwise you might not be making any money at all. So, what are the costs of a pairs trade? There are actually two legs to this trade. Presumably it costs roughly double what it would cost you to just go with one leg of the trade. I think let’s run through that.

Shaun Murison: Yeah, so the costs don’t change in terms of how IG prices things. Entry level cost, commission on a position, you’re looking at 0.2% or R50 on a trade, and that’s each leg. Like you correctly said, when you start looking at a pair trade, you are essentially insuring yourself a little bit in the market and you’re doubling up on your position. Your cost does increase, which is, I suppose, the premium for, I would say, reducing your risk within the market, but so you’d pay that 0.2% on both legs. Let’s go back to that Truworths – Mr Price position. You’d be paying 0.2%, so on a R50,000 position you’d be paying R100 for the trade. But if you’ve got two of those, so now you’ve got two R50,000 positions, that’s another 0.2% and that would be another R100. And obviously you pay that when you enter the trade, and you’re going to pay that when you exit the trade. That’s your barrier to making a profit.

The Finance Ghost: Look, we definitely shouldn’t create the impression that a pairs trade is guaranteed to work, because of course, this is a trade with two legs. And that means technically, if you get both wrong, you can lose money twice as quickly if your short goes against you and your long goes against you.

In other words, if you believe that one share is expensive and one share is cheap, and that gap should close, but instead it opens – the winner keeps winning and the loser keeps losing – and you’ve now gotten the wrong way around, that gap can just keep widening. A great example on the international market would be something like Costco versus Walmart. I can imagine there were many times where someone looked at this and said, sure, Costco is crazy expensive, Walmart is looking cheap in relative terms, let me go long Walmart, short Costco. If you had been sitting short Costco at any point in that journey, you have been absolutely killed. That gap has just opened and opened and opened between the two. It’s actually now the biggest I think it’s ever really been in terms of the gap in valuation multiples.

That’s a very tempting one to say, okay, great, do the pairs trade, but it can just keep going. You just don’t know. So that’s obviously a challenge.

One of the ways to mitigate risk that we’ve talked about a lot in these podcasts is the use of stop losses. They’re probably a little bit more complicated in a pairs trade than they are in a normal trade. I think let’s just work through how stop losses work in the context of a pairs trade. Do they work? And is it something that you have to think about differently?

Shaun Murison: Okay, so when you’re trading, you’ve got to manage your downside risk. We’ve talked about that at length. And when we talk about a stop loss, it’s really about admitting when you’re wrong. We’re not going to get it right every time, especially when you’re trying to tell the future. That’s essentially what we’re doing with trading, aren’t we? We’re trying to tell the future. In a conventional trade, what you’re going to do is you’re going to have a look at what I want to buy here if it hopefully it moves in my favour and I’ll look to take profit there. But you know, if it goes against me, where am I prepared to accept that I’m wrong and take my loss? And that’s obviously what we refer to as a stop loss. Now when you’re trading on the IG platform, essentially you have the feature of being able to put in a stop loss into the system to automate that process. You don’t have to be in front of your computer the whole time. And if the market, you know, you’re at work and the market moves against you, it would pre-determine your loss and would kick you out of the trade. Now when you do look at something like a pairs trade, that does change a little bit. It does become a little bit more complicated because you don’t know how things are going to correlate. If you are taking two positions, you’ve got a long and a short in the market, in a perfect world, you want your long to go up and your short to come down. So you’re making money on the long and you’re making money on the short is what we call double alpha positive.

But quite often that’s not the case. It’s quite often you’ll find that both shares, because they are correlated and you know what’s happening in the macro environment, you might find that they both go up. And in that situation you want the position that you are long to go up quicker than the position that you’re short so that you make more money from the long than you’re losing from the short. And remember, we net those two positions off. Or alternatively you could have both share prices falling. In that situation to make money, you want the short to fall quicker than your long. So you make money on the short, you’d be losing money on the long, but when you net those positions together, hopefully you’d be profitable.

Now when we talk about a stop loss, we don’t know in pairs trading how that market’s going to correlate. For the example of Truworths vs. Mr Price, now that has started to work and has started to move in the right direction, but both of those shares have gone up. So, you’re losing a little bit on the Mr Price short, but you’re making on the Truworths long because you don’t know how that’s going to correlate. It’s hard to just put a stop loss in the system to try protect your risk.

You should still manage your risk, but I think in a pairs trade, you manually exit the trade. You might say to yourself, well, I’m prepared to lose, let’s say 3% in that trade, and then you just need to monitor that position and then say, okay, well, it’s breached my levels. And then you’d exit both trades at the same time. So still need to manage your risk, still need to manage that downside risk. And because if they do revert back to the mean, we don’t know how that’s going to happen. So, yeah, it’s a manual exercise of stop loss in that situation.

The Finance Ghost: And of course, position size is the other great risk management tool, right? It’s one thing to have stop losses, but if you go and put in this big position relative to not just your portfolio, but also your own ability to potentially lose money, and I think that’s maybe a concept that we don’t talk about enough. It’s not just relative to the size of your portfolio, it’s your value at risk. And you talked on the previous podcast about looking at stuff like the volatility in each stock, the average moves that it can make. It’s a very nice way to go and assess the risk. Look at those two charts and say to yourself, okay, how much do they typically each move? What is my risk in this trade? And then get the sizing right. I mean, that’s got to be another important risk mitigation tool here?

Shaun Murison: Yeah, so exactly what you’re saying. Position size is a function of stop loss. So, you always look at how much we’re going to risk per share, but you also need to determine the total risk of your account that you prepare to risk in any one trade. General guidelines, you know, between 1% and 5% of your account size in any one trade, but it really is up to you. You have to predetermine that, obviously, if you’re going too big into the market, your position sizes are too big, then you don’t give yourself that much breathing room. Now, when you’re looking at peer trades, you look at more or less equal position size. You’ve got a 100,000 position on the long, 100,000 position on the short. And I think if you are getting started out there, I always suggest taking smaller positions and having maybe slightly wider stops just so that we can actually give those trades a little bit of breathing room. Because quite often they don’t move immediately in the right direction. Sometimes they go against you before they move in the right direction, if they do move in the right direction, which is obviously the goal.

The Finance Ghost: Speaking of the sort of mistakes that can be made, and me getting it wrong in my Mr Price short, here’s another fun mistake. Always good to learn. So, I wanted to do a pairs trade in the last week of short Italtile, long Cashbuild, going and picking the downtrodden one. Italtile and Cashbuild, there are a lot of good reasons why they should move together as South African consumer discretionary spending improves, etc. I’m actually long Cashbuild in my vanilla equities account for what it’s worth. But obviously to do pairs you need CFDs, but also you need both of those instruments to be available. So instead of checking that they are both there, I just assumed they both would be. I put on the short for Italtile and then I was rather horrified to find that Cashbuild was not available on the system. This left me, guess what, naked short Italtile! Yay, me! The joy of a demo account and practicing.

So why is that the case sometimes, where you actually just don’t have a stock on the system? Obviously a pairs trade kind of requires two, as the name suggests. The lesson here being to check both legs of a trade before pulling the trigger. But I think it’s good to understand why sometimes there just isn’t availability on the platform.

Shaun Murison: Okay, so when you start trading leverage instruments, you want shares to have high levels of liquidity. And so generally shares that have lower level of liquidity, we won’t offer, just because they become a lot more volatile when you’re crossing the spread. You can see sharp sudden movements and it’s just a higher risk to the client and obviously higher risk to our books.

We offer the most liquid stocks. I don’t have the exact figure here, but it’s at least 200 of the more liquid stocks on the JSE, if you’re looking at the local market, ones that we think are suitable for short-term trading, and it’s gauged by risk and liquidity. There are some securities that won’t be available and they would be those smaller cap shares.

The Finance Ghost: Yeah, that does make sense. The lesson in this is always check, especially if you’re going to do a pairs trade. Don’t go and do one instrument and then potentially not the other.

I think, Shaun, this brings us to the end of episode five. I think it’s been another goodie in what is really a great series. I think pairs trading is just a great way to go and express your views on relative valuations and to actually look for the opportunities out there. And you can’t do it without being able to go short. And that, of course, means CFDs. So, the only way to see this for yourself, honestly, is to get that demo account open. You might think, oh, you know, I don’t want to try it or I’m going to go straight into the real deal. Just look at some of the silly mistakes I’ve made in my demo account. I can almost guarantee you’ll make other silly mistakes or different ones. You know, maybe you won’t, in which case you’re lucky. But why take the risk? Go and try it out. Go and get used to the system. Go and make those mistakes without real money. And then you’ll know for sure if this is something you want to dabble in, and then you can do it with the stuff that actually counts.

I would also put out there that if you are listening to this series and you’ve got questions that come up or you wish we covered something, send it through to us. You can contact me on X, which used to be Twitter, or you can contact me through Ghost Mail. You can reach out to Shaun on the various social platforms or the team at IG. Let us know what you’d love us to cover. There are still several podcasts in this series, and we would love to be responsive to your questions and sort of build them into what we’re going to cover.

Thank you for listening. We look forward to having you here on the next one, Shaun. And to the listeners, we look forward to welcoming you back for episode six when that launches. This has been episode five. Go check out the others that we have. Thank you.

Shaun Murison: Awesome. Thanks.

Outro: CFD losses can exceed your deposits. In our gorgeously diverse country, there really is a new reason to trade every day. Current affairs to political news can make the markets move and cause volatility, which can be advantageous to a trader. Diversify your portfolio by opening a trading account with IG and explore the possibilities of CFD trading or practice your trading skills on an IG demo account.