The fiscal strategies employed during the pandemic are coming back to haunt some of the world’s most powerful economies. As Chris Gilmour explores, the UK is in for a tough time.

When the Sars-CoV-2 virus struck the western world outside of China about 2.5 years ago, most countries reacted by taking on massive amounts of new debt and applying stimulus measures in order to prevent their economies from stalling.

At the time, I cautioned that these measures would have to be paid for in one way or another once the pandemic had ended and whether that was via massive tax increases or other austerity measures didn’t really make much difference. With the arrival of the Omicron variant of the virus last November, the pandemic has all but disappeared in most western countries, even though it is still alive and kicking in China. Most restrictions have now been lifted, particularly those relating to international travel and life is largely getting back to normal in most countries.

Economic payback

But this is where it gets “interesting”…

The UK had its first real taste of coronavirus payback time last week, when the new chancellor of the exchequer, Jeremy Hunt, unveiled his autumn statement, which is akin to South Africa’s medium-term budget policy statement. In many ways, this can be seen as a worst-case scenario template for many other countries that will probably have to indulge in similar, though perhaps not quite as extreme measures in the not too distant future.

In part, Hunt’s mini-budget was designed to provide clarity on government spending in the wake of the disastrous measures announced by his predecessor, Kwasi Kwarteng, in late September. Kwarteng had attempted, in true libertarian fashion, to spend his way out of the problem with unfunded tax cuts. To add insult to injury, Kwarteng completely ignored the Office for Budget Responsibility (OBR) which was designed in 2010 to help prevent treasury officials doing their own thing regardless of the financial outcome.

In this case, the international bond markets brought Kwarteng’s excesses to heel by trashing the value of UK pensions and in so doing, dropping the external value of sterling to near-parity with the US dollar.

Jeremy Hunt is no rocket scientist; unlike Kwarteng, he doesn’t hold a PhD in economics, but he is regarded as being a safe pair of hands. Last week he had the unenviable task of applying austerity measures to an already crippled economy in the hope that some kind of light will emerge before the next general election in late 2024. And at least this time he has the buy-in of the OBR, which assisted greatly with forecasts.

Unfortunately, it makes for dismal reading, as the next few charts from the OBR illustrate.

It’s going to be ugly

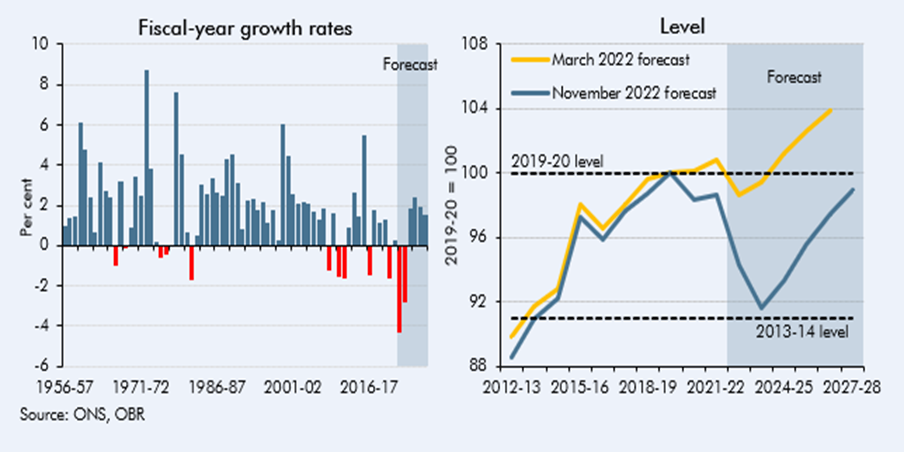

Alone among the major European economies, Britain’s GDP is still trailing its pre-pandemic levels and it looks like it won’t exceed them until 2025 at the earliest. On a per capita basis, the outlook is even more sobering:

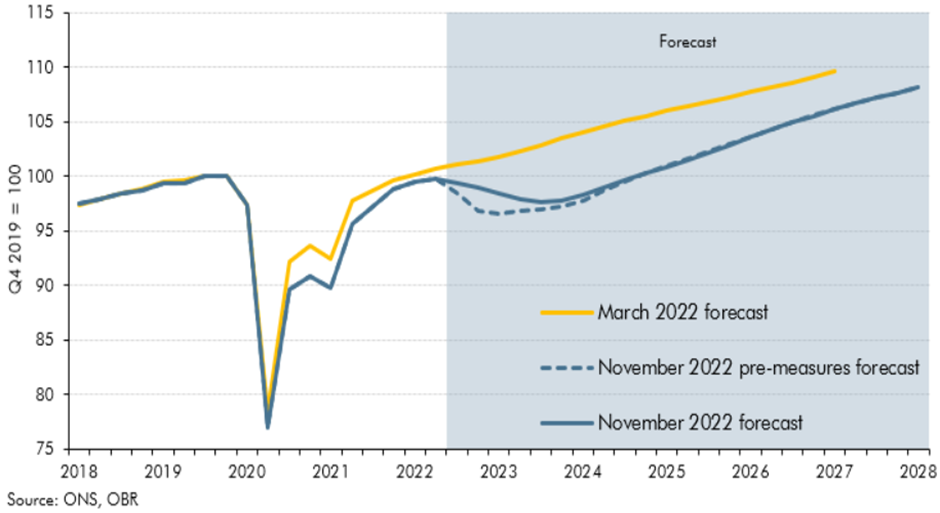

But that’s not all. The Bank of England’s pessimistic GDP outlook of a few months ago, even before the Truss/Kwarteng circus got into full swing, suggested a 5-quarter recession, lasting until well into 2023.

The OBR now forecasts something that is perhaps slightly shallower than that but nevertheless still prolonged:

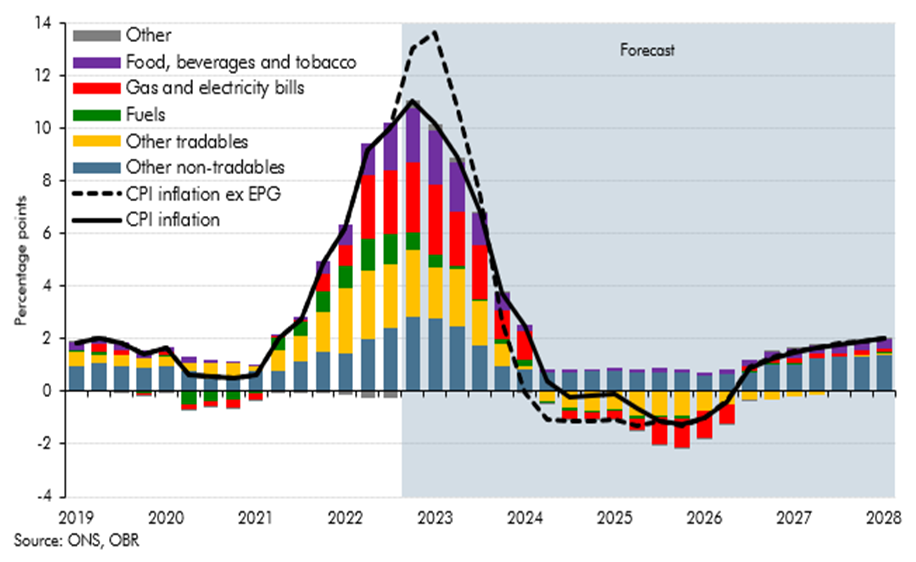

The only metric that looks even remotely optimistic is the one that relates to the root causes of inflation in the UK. Inflation is seen peaking in 2023, coming off sharply in 2024 and actually going negative in 2025/26:

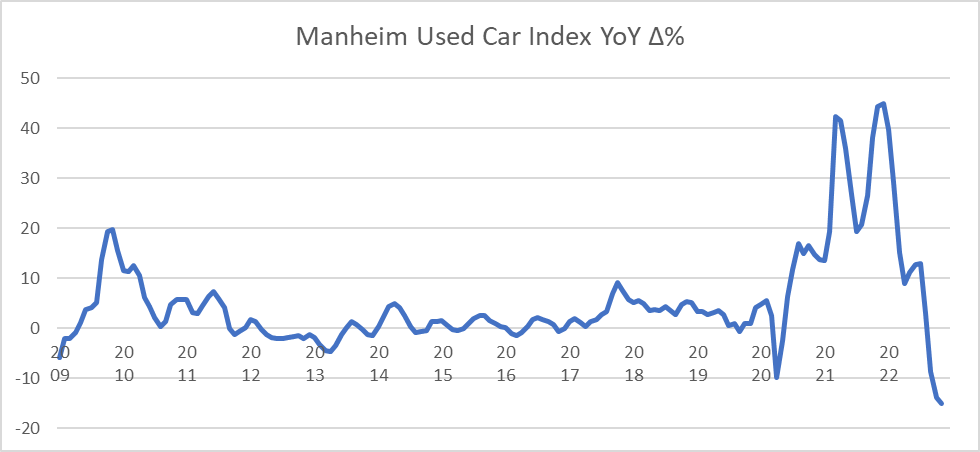

Interestingly, this type of pattern is also reflected in US used-car sales as proxied by the Manheim Used Car Index. The used car market in America was one of the sectors that was right at the forefront of the great inflation a year or so ago. Now it has collapsed, as shown in the graphic below:

One couldn’t help feeling a tinge of sympathy for Hunt as he delivered his statement last week. It must be especially frustrating, nay infuriating to have to effectively “beg” 600 000 people on universal credit to consider coming back to the workplace in order to get some stability back into lower-level employment. These austerity measures may help to concentrate minds in this regard.

He’s done his homework and the Brits are about to endure a real “winter of discontent” and one can only hope that his measures are enough to transform the winter of discontent into a glorious summer, as per Shakespeare’s famous soliloquy.

There will be no second chances.

The global economy is fraught with as many moving parts and potential traps as I have ever seen. To be sure, gas prices should begin crumbling in line with Russia’s progressively strangled economy. But who can possibly read the mind of a dictator such as Vladimir Putin?

In the immortal Afrikaans words: “Vasbyt ou maat, vasbyt.”