Margins are under considerable pressure at retailers who are now dealing with a fundamental swing in supply-demand dynamics

Turnover for show, margins for dough.

I’m borrowing liberally from golf folklore to bring you that catchy intro. If you’ve played golf, you’ll know how tough it is. If you’ve been reading any retail earnings releases in recent months, you’ll also know how tough that is.

A swing in supply and demand

Towards the end of 2022, the world found itself in an environment of high consumer demand and very limited supply. As consumers were flush with cash thanks to the Fed, demand for products in a gradually reopening economy was huge. Supply chains were a nightmare thanks to congestion at ports and ongoing lockdowns in China, creating a recipe for inflation and unsustainably high margins for retailers.

The supply – demand dynamics have swung wildly over the past twelve months, with the latest Black Friday and festive season shopping trends showing that retailers are having to sacrifice margin to achieve turnover growth. Everyone has stock (and usually too much of it), an issue compounded by a fall in consumer demand as stimulus waned and energy costs put pressure on household budgets across the world.

In recent Magic Markets Premium reports, we’ve looked at Lululemon, Levi’s and Nike. These global apparel giants operate in totally different product categories, yet the theme across the board is clear: margins are under significant pressure.

Where did the margins go?

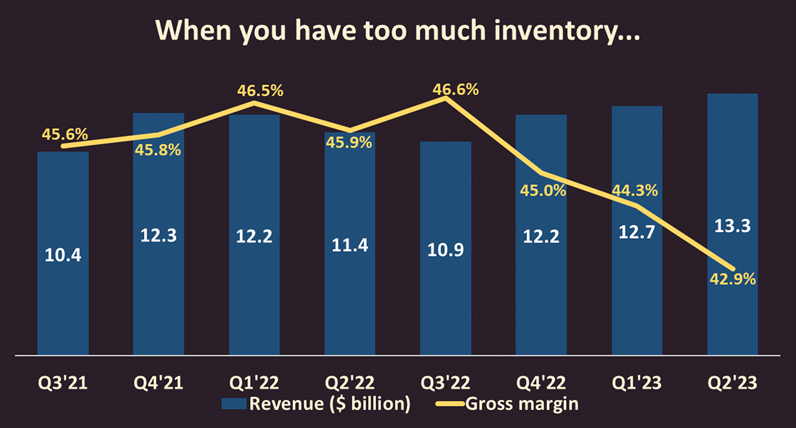

I’ve lifted this chart from our latest Magic Markets Premium report on Nike:

Other than some seasonality in the numbers, you can see that revenue isn’t a huge issue for Nike. The company is posting reasonable top-line growth on a year-on-year basis (the right metric in a seasonal business). Sadly, gross margin appears to have bought a one-way ticket to hell, with a recent trend that you don’t need a finance degree to understand. That yellow worm is headed firmly in the wrong direction.

There is simply too much inventory in the system, which means an environment of markdowns and SALE signs across the front of every shop. Another major contributor is the return of the wholesale channel, which Nike starved of stock (their exact wording) during the pandemic. Wholesale margins will always be lower than direct-to-consumer margins that capture the full value chain, so a swing back towards wholesale creates a mix effect that is negative for margins.

This isn’t just an issue for Nike. Most retailers are experiencing either pressure on gross margin (because of markdowns to compete) or operating margin (because they have lost market share while raising prices to protect gross margins).

Many are taking pain on both levels, which is why share prices have come under pressure in this sector, particularly for companies that have been trading at clearly elevated multiples.

Lululemon is particularly interesting

Lululemon is credited with inventing the athleisure category, taking yoga pants from the studio to the local coffee shop and charging a delicious premium along the way.

It’s been fascinating to see how the recent strategy has differed to the likes of Levi’s, which focused on hiking prices to protect gross margins. One would assume that Lululemon would have more pricing power, yet the company has chosen to chase volumes and give up margins along the way.

The net profit number is all that matters of course, which is a function of revenue and margins. Hot off the pressure is updated guidance from the company on its fourth quarter numbers, which will see revenue increase by 25% – 27% on a year-on-year basis. This is ahead of previous guidance.

Sadly, diluted earnings per share is expected to be similar to previous guidance, which means that margin contraction has offset any benefit of revenue being higher than expected. Indeed, gross margin is expected to decline by 90 – 110 basis points, a huge swing from previous guidance of an increase of 10 – 20 basis points.

Lululemon has done a great job of managing costs, with selling, general and administrative (SG&A) expenses growing below gross profit growth. This has offset some (but not all) of the margin pressure.

Chasing revenue has worked for Lululemon because the company still has incredible growth potential. For a business like Nike that is already a mature business in most key markets, margins are more important than top-line growth.

We are in a tough environment for apparel retailers. Tread carefully.

I enjoy you daily comments.Thank you

Really insightful and see opportunity for smaller brands to grow.