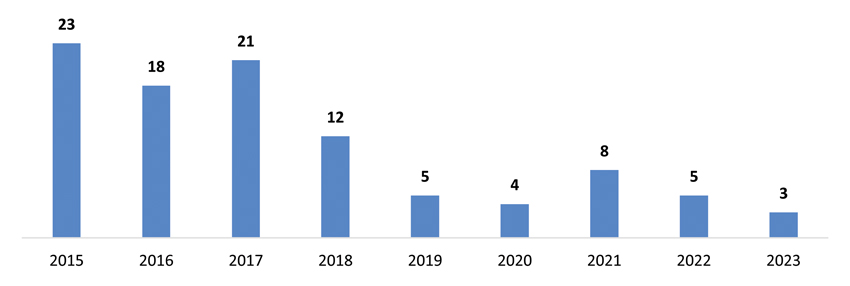

While the Johannesburg Stock Exchange (JSE) remains Africa’s largest and most liquid stock market1, new equity listings and capital raising activity has decreased significantly over recent years (Figure 1). As this has corresponded with a large number of delistings, the pool of listed equity investment opportunities on the JSE has shrunk over this period. Some of this decline may be attributable to global macroeconomic factors, such as the COVID-19 pandemic, a volatile inflation and interest rate environment, and geopolitical tensions such as the Russia-Ukraine war, which have impacted global equity prices. However, as a developing country and relatively new democracy, South Africa (SA) also has some of its own unique and well publicised political, economic and infrastructure challenges, which have, at times, exacerbated the general risk-off approach towards emerging and frontier markets, and the flight of capital to perceived safe-haven assets2.

Source: JSE

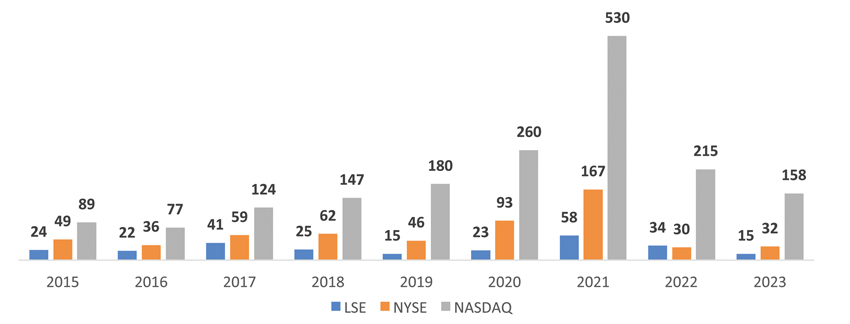

The trends (Figure 1) are not unique to SA, with other international exchanges, such as the London Stock Exchange (LSE), also seeing limited appetite for new equity listings over recent years. However, the picture for the NASDAQ is more positive (Figure 2), with that exchange having benefitted from numerous technology companies coming to market. By contrast, only 5.6% of equity listings on the JSE are in the technology sector3.

Source: S&P Capital IQ Pro

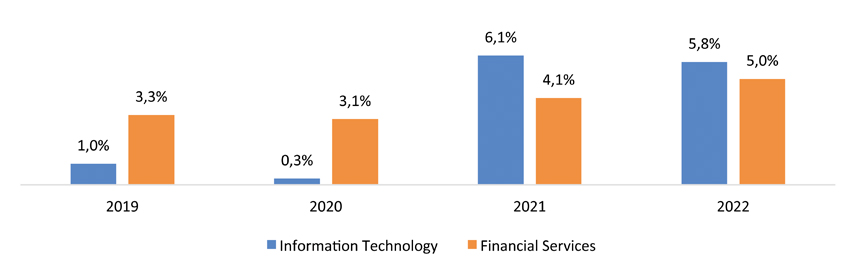

What we did see in SA was an increase in the deployment of private equity (PE) capital into technology-related businesses. The allocation to information technology increased from 1.0% in 2019 to 5.8% in 2022 (Figure 3)4, with a larger share also going to financial services, indicating a potential link with fintech. Is this a result of the early-stage nature of many of these endeavours, or has PE capital emerged as a preferred source of investment to fund growth, rather than the public markets?

Source: South African Venture Capital and Private Equity Association Survey 2023

In 2022, South African technology companies raised US$830m through 95 rounds of PE funding, constituting 17% of the total funding, and 14% of the overall deal count, for PE-related technology transactions in Africa5.

Increased costs, additional regulation and rigorous reporting requirements are regularly cited as reasons for companies to avoid public listings. Critics argue that these restrict the ability to be entrepreneurial and agile, which is especially relevant to early-stage growth companies where heightened scrutiny from the wider investor community and media restricts one’s ability to manoeuvre.

While managing listed companies (and public opinion) comes with its challenges, it brings with it the benefit of deep pools of capital in SA. Many institutional investors hold that regulation and reporting requirements can be advantageous, contending that effective management should possess the discipline and skills to handle these aspects as an integral part of business operations and growth. Retail investors also benefit from the additional regulatory protection in the listed environment.

Interestingly, as ESG becomes increasingly influential in capital allocation, whether for public or private investment, and PE capital expands (partly due to a shrinking listed universe), one might anticipate a convergence in certain regulatory standards and investment criteria between the two markets over time. The cost of sound advice and rigorous systems should be outweighed by the long-term benefits of building a transparent, accountable and sustainable business, able to draw on deeper pools of capital.

Will there be a tipping point where new equity listings return to public markets in SA, with robust systems to allow for transparency and ease of trade? Or will PE develop over time, to the point where it can provide a similar offering to retail investors? While the increased prominence of PE is likely here to stay, we expect that listed markets will, over the long term, continue to provide an effective platform to sufficiently mature companies seeking to raise capital for continued growth. In an environment that offers transparency, deep pools of capital and an enhanced profile, companies can also continue to grow acquisitively through issuing shares that have earned a premium by demonstrating their ability to run a business under wider scrutiny.

Will SA have its own tech listing boom when private capital markets have played their role in funding startup and early-stage businesses that have been developed locally and reached a point of maturity fit for public markets? While the JSE may benefit from SA’s position as one of the largest hubs for innovation in Africa, the NASDAQ can be attractive to SA technology companies as it has, at times, seen substantially higher valuations being achieved for new tech listings. However, it may be sensible for SA technology companies to consider a JSE listing as a first step, allowing them to establish a track record with investors and build their profile, thereby better positioning themselves for a potential future international listing.

1 Riscura and BrightAfrica – Liquidity (https://brightafrica.riscura.com/listed-equity/liquidity/#:~:text=The%20Johannesburg%20Stock%20Exchange%20(JSE,USD%201%20431m%20traded%20daily)

2 Riscura and Bright Africa – Liquidity

3 JSE

4 South African Venture Capital and Private Equity Association Survey 2023 (https://savca.co.za/wp-content/uploads/2023/09/SAVCA-PE-Survey-2023-Electronic.pdf)

5 2022 Partech Africa Report (https://partech-admin.prod.unomena.io/media/documents/2022_Partech_Africa_Tech_VC_Report.pdf)

Terence Kretzmann is a Director and Bhargav Desai a Junior Corporate Financier | PSG Capital.

This article first appeared in DealMakers, SA’s quarterly M&A publication

DealMakers is SA’s M&A publication.

www.dealmakerssouthafrica.com