By Nico Katzke, Satrix

Few need reminding of the volatility of our currency and the devastating impact it has on imported goods prices, and our ability to travel in comfort. The rand has slumped to its second lowest average monthly value to the USD in March, and few will dare make a case for the prospect of significant strengthening in coming quarters. With this in mind, we tackle the question of what to do with the rand in your investment portfolio, given its volatile nature – and the answer might surprise you.

The TL;DR summary of this piece follows:

- Hedging the rand exposure of offshore assets systematically (i.e., as a rule over the long term) reduces returns and increases volatility;

- Empirical evidence clearly shows that currency hedging should be a tactical short-term call on the currency, not a hard rule.

We unpack this somewhat unintuitive conclusion below.

The Volatility Paradox

If you are invested in a balanced fund, chances are your manager increased offshore exposure in the last year given changes in Regulation 28. A key question is how to treat the currency exposure from those offshore assets. Some managers have chosen to partially hedge out the currency exposure systematically – which is typically motivated by trying to reduce overall volatility.

But how does currency hedging work? If you held the MSCI All Country World Index (ACWI) in your balanced fund – the return for this index would be in USD (say 6%). If the rand depreciates, the offshore holding is now worth more in rands, and vice versa. Hedging this exposure would mean you neutralize (in full or in part) the movement of the rand, so that you only earn the USD returns.

With the rand being volatile, it seems perfectly reasonable to reduce currency exposure in order to achieve smoother returns. The data, however, suggests otherwise.

This follows due to a volatility paradox. Simply put, we tend to incorrectly think of volatility in a linear way similar to returns. If I hold two assets, with one returning 10% and the other 20%, holding both in equal proportion leads to an overall return of 15%. Volatility does not work this way, as co-variance needs to be considered too. If we hold two assets (A and B) in a portfolio with annualised volatility of 10%, then adding an asset (C) with a volatility of 20% does not necessarily increase the portfolio’s volatility. This seems unintuitive but can be understood simply. If A and C were strongly negatively correlated, then movements in A (say +10% return) would be offset by movement in C (say -9% return). This way, adding a volatile asset could actually reduce overall portfolio volatility – depending on its co-movement with other assets in the portfolio. Think of waves cancelling each other out, which is exactly what noise cancelling headphones do.

This follows similarly for global holdings and their typical relationship to the volatile rand. We’ve mostly seen a strong negative correlation between offshore USD returns (say for the MSCI ACWI) and the rand. When global equities rally, the rand most likely strengthens (risk-on sentiment), with the opposite holding more likely too. To better visualize this relationship and understand the impact of the rand’s movements, consider a simple 60 / 40 equity and bond portfolio, with a 70% local and 30% global allocation. 1

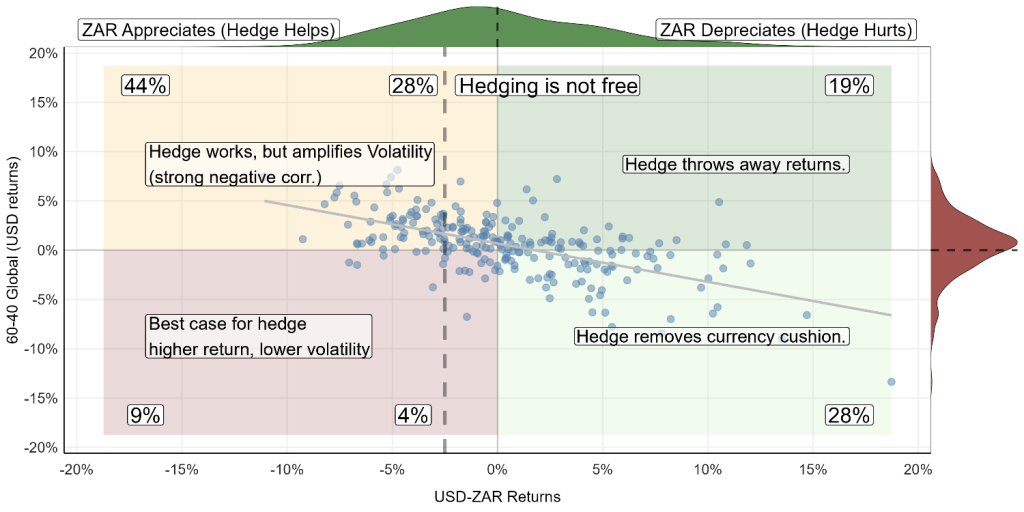

The following scatter plot shows the strong negative relationship between the global allocation and the rand since 2004 – with labels at the top shown to help with interpreting the impact of rand hedging.

The reason for the strong negative correlation (grey line) is simple to understand and persistent. The rand does not move in isolation. The same global factors underpinning global asset returns also influence the rand. Amongst other, positive risk sentiment tends to favour both (and vice versa). Also note the strong right-tail in the scatterplots – meaning the rand experiences far deeper monthly depreciations than appreciations: meaning the cost of getting the hedge wrong (right side) is mostly far greater than the benefit of getting it right (left-side).

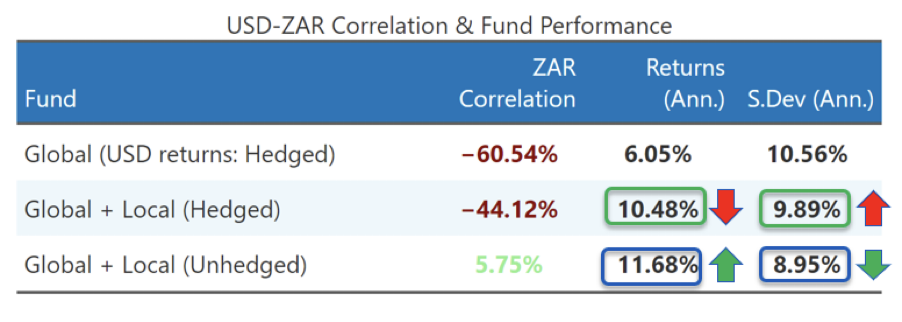

But what about overall portfolio returns and volatility? If we rebalanced our simple 60/40 : 70/30 portfolio quarterly and compared a fully hedged and unhedged alternative – the results are clear. It shows that the strong negative correlation between the rand and USD returns of global equities and bonds serve to reduce portfolio volatility. Also, the rand’s general weakening trend means it generally serves to increase overall returns when left unhedged.

Conclusion

The rand is a volatile currency, and carefully managing currency exposure can be a very important tactical tool for short-term risk-mitigation. The motivation for longer-term strategic hedging is more problematic though. It is mostly put to investors that hedging the volatile currency reduces portfolio risk (few would take comfort from shielding against significant rand strengthening) – which seems perfectly plausible. Yet the data simply does not support this.

Considering the consistent interactions between the rand and offshore asset returns, the rand’s variability actually serves as an important cushion against both losses and volatility. Neutralising this benefit through hedging should be very carefully considered – and only done tactically (applied through strong short-term conviction). The data on this is simply too clear to ignore.

1 This translates to a 42% allocation to FTSE/JSE All Share equities Index, 28% to the FTSE/JSE All Bond Index, 12% to the Bloomberg Global Aggregate Bond Index, 18% to the MSCI ACWI Equities Index.

Disclosure

Satrix Investments (Pty) Ltd is an approved FSP in term of the Financial Advisory and Intermediary Services Act (FAIS). The information does not constitute advice as contemplated in FAIS. Use or rely on this information at your own risk. Consult your Financial Adviser before making an investment decision.

While every effort has been made to ensure the reasonableness and accuracy of the information contained in this document (“the information”), the FSP’s, its shareholders, subsidiaries, clients, agents, officers and employees do not make any representations or warranties regarding the accuracy or suitability of the information and shall not be held responsible and disclaims all liability for any loss, liability and damage whatsoever suffered as a result of or which may be attributable, directly or indirectly, to any use of or reliance upon the information.

THANKS NICO FOR YOUR OPINION ON HEDGING,, WHAT IS YOUR OPINION ON GOING LONG ON THE RAND,, I USE TO GOING LONG AND WAS LUCKY , I WAS LONG WHEN ZUMA APPOINT HIS UNEXPERIANCE FINANCE MIN. GOT OUT AT CLOSE TO THE HEIGHT. IM GETTING OLDER AND ARE MORE CAREFUL,, STILL LONG AT THE MOMENT,, BUT AT A MUCH LOWER LEVEL,, WHAT IS THE TAX IMPLICATIONS ON A PROFIT,, I WAS CHARGED AT NORMAL INCOME TAX.

THANKS AGAIN,

PIETMAN