Andre Botha, Senior Dealer at TreasuryONE, shares the latest with us on inflation in the US:

In the last week or so, we have seen the fascinating side of markets, with data and events coming thick and fast from all over the globe. However, the underlying narrative that most of the data and events are telling us is that:

1) inflation is not as transitory as initially thought;

2) Central Banks are talking a big game on their monetary policy with Central Banks looking to hike aggressively; and

3) there is a notion of risk-off in the market, especially from the demand side.

Interest rate hike

Last week, we saw the US Fed hiking their interest rate by 50 basis points, as many in the market expected. The market did a peculiar thing after the announcement: the US dollar lost ground, and risky assets were on the front foot. The reason for this is the Fed eliminated the potential of a 75-basis-point raise, indicating a dovish stance.

But, hang on a minute? The Fed alluded to more 50 basis point hikes going forward, which is hawkish, come to think of it. It took the market a trading session or so to figure that out, and we saw risky assets like the rand give back all of its gains post-Fed back in the following trading session.

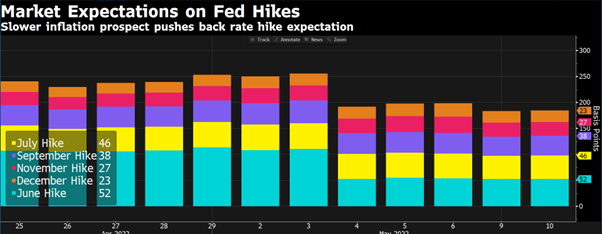

See below the interest rate expectations in the US for the rest of 2022. Despite the fact that it has dropped since the last FOMC, it is still pricing in nearly another 200bps of raises, with 50bps hike expected in June and July.

Interest rate hikes, at what cost?

Speaking of Central Banks, we also saw the Bank of England hiking interest rates by 25 basis points last week. Again, the Central Bank emphasised fighting inflation – and fighting inflation will cause certain hardships along the way for the economy.

This would ring true for most economies in their bid to fight inflation where there will be interest rate hikes, but at what cost? The delicate balancing act is determining where the sweet spot is between raising interest rates to combat inflation, and driving oneself into a recession.

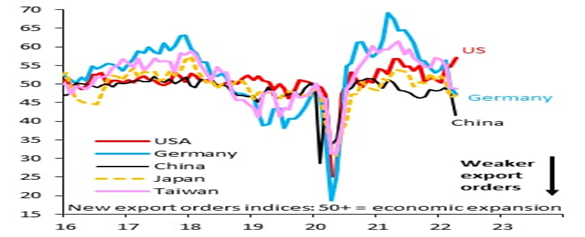

We have already seen economies like China and Germany declining in their new export numbers, which suggests that a recession is on its way. It is also curious to see that the US is the only country at the moment showing growth in its export numbers.

And the last point leads to the final issue of global demand weakening. The slowdown in demand was a given, as China went into lockdown over renewed fears of COVID. We have seen commodity prices falling by the wayside as demand from China slows. If inflation continues to rise, demand will be reduced even further as purchasing power declines around the world, which is negative for the global economy. The global picture in the short term is not a rosy one.

US inflation rate out this week

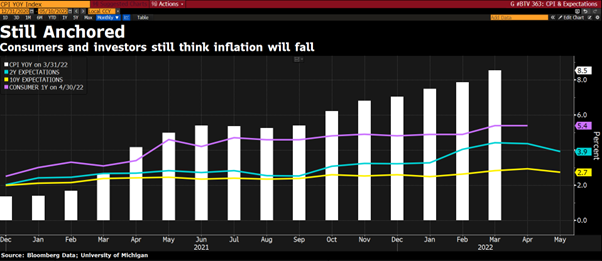

Looking at this week in data terms, we have the US inflation rate coming out tomorrow, and the market will be eager to see if inflation is still running hard or if there is some respite in the number. Expect markets to be quite volatile around the release of the number as this will significantly impact the forward view of interest rates and the view of the market regarding them.

The expectation is for an 8.1% rise in inflation for April 2022. See below the inflation expectations in the US continue to fall. The 2-year (green) and 10-year (yellow) is pointing to lower inflation in the coming months.

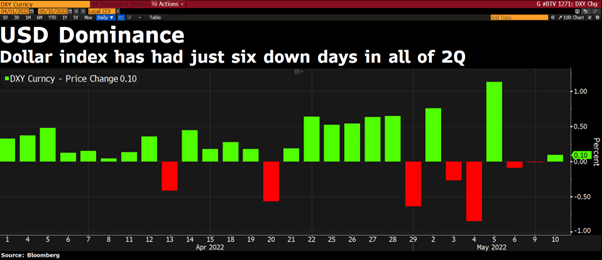

We have seen the rand push past the R16.20 level on the local front but have since retraced back to R16.10. The dollar has been a wrecking ball so far in Q2 of 2022, with the dollar index only having 6 down days so far for the quarter. This has been the telling story of the weakness in the rand and the rest of the currency market.

We expect the rand to be under pressure with the global sentiment skewing more to the “risk-off” side than taking any risk. We have seen the US dollar being the “safe haven” of choice, and any move in the US dollar will feed through to the rand.

We do believe that some correction is warranted, but that depends on the inflation number out on Wednesday from the US. For now, we still believe the rand is testing the upper end of our R15.00 to R16.00 for the rest of 2022.

See below the support line for the rand around R15.00.

For more information and to speak to the team at TreasuryONE, visit their website here.

What are the chances of a further steeper drop in the JSE based on the expected further hikes in the US treasury rate?

The JSE dropped sharply last week and the beginning of this week and hen in rose slightly.

Previous patterns appeared to indicate that that might be a precursor to another steep drop soon

Valentin Volker