Opulence, grandeur, sparkle and the who’s who are all terms associated with luxury and abundance, but it does not get more luxurious than these French conglomerates, LVMH, Hermès, Kering, and Financière Richemont S.A., commonly referred to as Richemont, the Switzerland-based luxury goods holding company founded by the famous South African businessman, Johann Rupert.

Comparing Share Price Performance Across French Luxury Brands

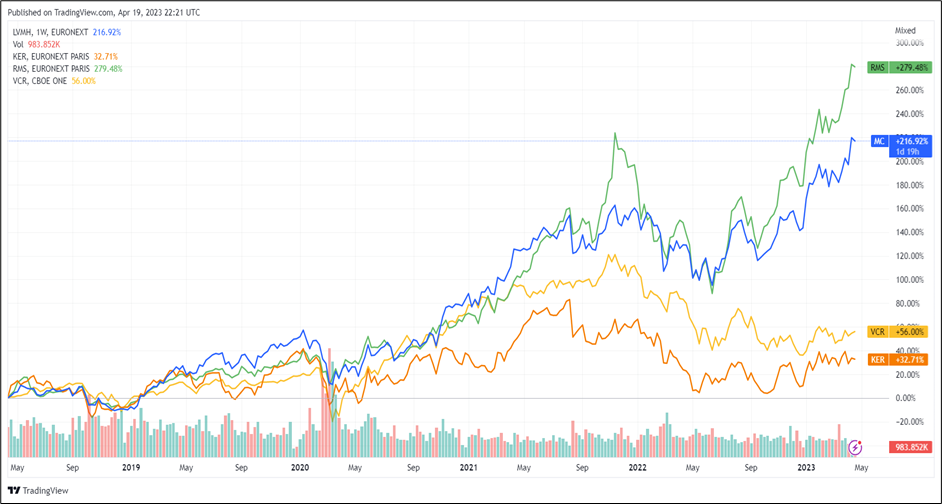

Concerning the price chart below, it is clear that Hermès International SCA (EPA: RMS), commonly known as Hermès, has delivered superior returns to its shareholders, boasting a stellar 280% cumulative return (green line) over the most recent five-year period. Hermès has significantly outperformed its competitors and the Vanguard Consumer Discretionary ETF (yellow line) on a five-year historical performance basis.

LVMH Moët Hennessy Louis Vuitton (EPA: MC), commonly called LVMH, has performed remarkably well over the last five years, returning nearly 220% to its shareholders (blue line). Despite falling short of Hermès’ five-year performance, LVMH shareholders will be pleased to see such impressive share price growth, significantly outperforming the overall investment return of stocks in the consumer discretionary sector, as measured by the Vanguard Consumer Discretionary ETF.

With Hermès (EPA: RMS) and LVMH (EPA: MC) seemingly racing ahead, returning superior percentage growth in their respective share prices, it is important to note that Kering (EPA: KER) has underperformed the Vanguard Consumer Discretionary ETF, returning a measly 32% (orange line) over the most recent five-year period.

China’s Reopening Bodes Well for Luxury Goods

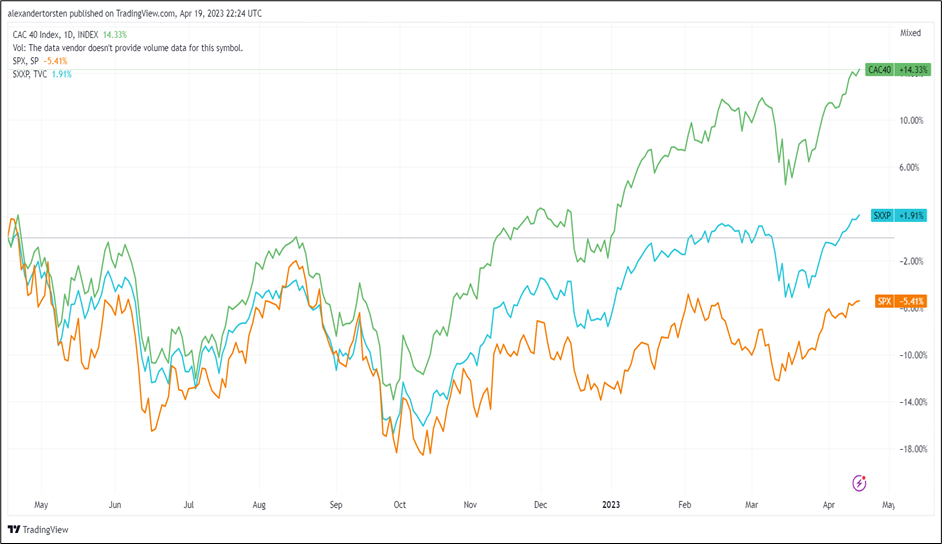

French stocks have soared to record highs as investors pile into luxury goods groups with expectations of a sustained rebound in Chinese demand for these brands. The CAC40, a stock market index that represents the 40 largest publicly traded companies in France, has risen more than 14% over the last one-year period and by more than 30% since a low at the end of September of 2022. Concerning the price chart below, over the most recent one-year period, the CAC40 index (green line) has comfortably outperformed the SXXP (blue line) as well as the S&P 500 index (orange line), returning double-digit growth over the last twelve months.

The SXXP, or the STOXX Europe 600 index, is a broad-based stock market index representing 600 large, mid-sized, and small-cap companies across 18 European nations. This broad-based European index has returned just under 2% over the most recent one-year period. Still, it fares relatively well against the performance of the S&P 500 index (orange line), which has seen negative growth over the most recent twelve months.

The superior relative performance of the CAC40 index can be primarily accredited to macroeconomic trends boding well for luxury goods amidst China’s efficient removal of zero-Covid restrictions, which has accounted for most of the luxury goods sector’s recent success. According to market analysts at Morgan Stanley, Chinese demand for luxury products is among the world’s highest, with China recently emerging as the most important market for European luxury names. Consequently, the country’s economic reopening following extended lockdown periods bodes well for the luxury goods market, especially seeing that prices for luxury goods can reportedly be up to 30% lower in Europe than in China.

While China’s reopening paves the path for surging demand for luxury goods, it is also important to note that demand for luxury products is relatively inelastic, meaning that consumers are less sensitive to changes in price. In other words, the demand for a luxury product remains relatively stable, given a series of price changes. For this reason, luxury products are widely viewed as a hedge against inflation despite generally performing poorly in past recessions. Overall, French stocks have enjoyed a stellar rebound against China’s economic reopening and increased demand for luxury goods.

Hermès International S.A. (EPA: RMS)

Hermès, the world-renowned French brand specialising in crafting luxury items, has seen its share price surge more than 30% this year, giving it a market value of more than €200 billion. The maker of Birkin bags has demonstrated immense resilience to challenging market conditions by utilising its strong brand appeal while predominantly catering to affluent consumers, paving the path to its recent success in navigating turbulent demand trends.

Fundamental Analysis:

On Friday, 14 April, the French luxury design house, Hermès released revenue figures for the first quarter of 2023, starting the year positively by posting a 23% year-over-year growth in consolidated revenue, which came in at €3.38 billion for the quarter, as all geographical areas recorded robust growth. Surging demand for the company’s must-have handbags has incentivised Hermès to strengthen its production capacities by opening a string of artisan factories to ramp up production. Moreover, the French luxury conglomerate recently announced plans to reopen its iconic flagship store in the centre of Beijing, given the brand’s dominant presence in China amidst the country’s decision to dismantle its zero-Covid restrictions. Despite macroeconomic uncertainties, Hermès maintains its ambitious stance on solid revenue growth as the group confidently moves through the 2023 financial year.

Looking at Hermès’ 2022 annual financial statements, the luxury design house posted stellar results amidst a turbulent macroeconomic environment which saw interest rates rise persistently in a heated battle against inflation, cutting into consumers’ disposable income and thus cementing the ideology that luxury items are a hedge against inflation. Revenue came in at €11.60 billion for 2022, representing a 29% year-over-year increase from the 2021 figure of €8.98 billion. Basic earnings per share (EPS) increased by 38% from €23.37 in 2021 to €32.20 per share for the 2022 financial year, while operating cash flows surged by 34% over the same period.

Technical Analysis:

Looking at the 1W price chart on Hermès, it is clear that the first half of 2022 proved exceptionally troublesome for the French luxury design house, with the share price crashing nearly 42% over a mere seven months to find support at the €970.30 level (red line) midway through June of last year. From that point onward, the price action on Hermès has experienced a persistent uptrend, finding higher highs and higher lows.

Should the recent positive market sentiment around luxury goods persist, bullish investors could further see the share price increase and continue its recent rally. If the current bullish rally loses steam amidst a change in market sentiment, the bears could see the price action on Hermès retrace and decline toward €1,673.20 (black dotted line), which could be the first support level for the bears. Suppose the share price reverts and falls toward the significant support level at €1,673.20. In that case, the possibility exists for either a retracement toward higher levels or, if the support level does not hold, the price action can decline to lower support levels.

LVMH Moët Hennessy Louis Vuitton (EPA: MC)

LVMH, the French multinational luxury goods conglomerate, has seen its share price soar close to 28% year-to-date as macroeconomic trends favour the luxury goods sector, paving the path for Bernard Arnault, CEO of LVMH, to become the world’s richest man as of 1 April 2023.

Fundamental Analysis:

An excellent start to the year is the current theme for LVMH, with the European luxury goods behemoth reporting first-quarter revenue of €21 billion, a significant 17% year-over-year increase compared to the same period in 2022. As of 19 April 2023, LVMH is the twelfth-largest company in the world, with a market capitalisation of $483.67 billion, but the recent share price rally lifted the French luxury giant’s market capitalisation to $486 billion on 13 April, briefly ranking it as the world’s tenth-biggest company. Should the recent positive market sentiment around luxury goods persist, potentially leading LVMH to reach a market capitalisation of $500 billion, it would become the first European company to achieve that milestone.

Looking at LVMH’s 2022 annual financial statements, the luxury giant reported an impressive 23% year-over-year increase in revenue from €64.2 billion in 2021 to €79.2 billion in 2022. Moreover, the group’s basic earnings per share (EPS) figure reached €28.05 in 2022, representing a 17% increase from the prior year’s figure of €23.90 per share.

Technical Analysis:

Looking at the 1W price chart on LVMH, the luxury giant has seen its share price rise to record levels, experiencing a trend similar to that of Hermès. LVMH saw its share price decline to test the significant support level at €543.80 (red line) in mid-June of 2022, and it has since rallied amidst bullish sentiment around luxuries, much like Hermès. If current market sentiment turns negative, the bears could see the price action retrace and decline toward lower levels, as indicated on the price action chart. However, LVMH is enjoying strong growth momentum amidst robust demand from local customers and international travellers, which may lead to higher levels.

Kering (EPA: KER)

Kering, the owner of world-renowned brands, namely Balenciaga, Bottega Veneta, Gucci, Alexander McQueen, and Yves Saint Laurent, has not enjoyed the same share price rally as Hermès and LVMH as of late, despite boasting relatively robust results for the 2022 financial year.

Fundamental Analysis:

Kering, in its 2022 annual financial statements, reported a 15% increase in revenue from €17.65 billion in 2021 to €20.35 billion in 2022 while enjoying a healthy 13% increase in basic earnings per share (EPS). Despite robust revenue and earnings growth, the famous luxury brand owner saw its free cash flow from operations decline by approximately 19% from €3.95 billion in 2021 to €3.21 billion in 2022, while net debt surged more than 1200% to €2.31 billion in 2022.

Looking at Kering’s revenue breakdown by segment, Yves Saint Laurent returned a 31% year-over-year increase in revenue from €2.52 billion in 2021 to €3.30 billion in 2022, while Bottega Veneta and Gucci returned 16% and 8% year-over-year increases in revenue, respectively.

Technical Analysis:

Despite experiencing a slight rally in the early weeks of January 2023, Kering’s share price has been consolidating sideways between €527.20 and €600.70 (black dotted lines) for the greater part of the 2023 financial year as market participants await a potential breakout in either direction.

For the bull case, a buying opportunity could exist if the price action pushes above €600.70, which could be the first resistance point in the price for the bulls. If the share price breaches this resistance level, it could reach higher resistance levels at €639.00 or €674.10 (black dotted lines), a share level towards the primary price resistance at €718.80 (green line).

The bears could see the price action continue its long-term downtrend toward the support level of €527.20, which could be the first support level for the bears. Should the price action on Kering trend lower and the €527.20 support level fails to hold, the share price may decline to lower support levels at €480.40 (black dotted line) or €442.05 (red line).

Compagnie Financière Richemont S.A. (JSE: CFR)

The South African-founded luxury goods company Compagnie Financière Richemont S.A., more commonly known as Richemont, is making headlines, gaining significant attention and interest from market participants.

The Switzerland-based luxury goods holding company saw its share price surge as its 10-for-1 share consolidation kicked in on Wednesday, 19 April 2023, as the company moved forward with the secondary listing of its A shares on the JSE. With Richemont recently receiving the go-ahead to terminate its South African Depository Receipt programme, the company now has listed shares in South Africa that will trade in tandem with those in Europe.

Find out more about Trive South Africa by visiting the website here

Sources: Bloomberg, Hermès, LVMH, Kering, Richemont, Financial Times, Moneyweb, Cape Talk, The Fashion Law, The Guardian, Luxury Tribune, Reuters, Trive SA, Koyfin, Trading View