The Satrix Balanced Index Fund (with assets under management of R9.5 billion) has just turned ten. Over this decade, the fund’s consistent performance demonstrates why rules-based or indexed balanced funds are dominating their category.

Kingsley Williams, Chief Investment Officer at Satrix*, attributes the fund’s consistent performance to a rigorous and systematic Strategic Asset Allocation process, which focuses on the medium to long term, while ignoring the noise in the short term.

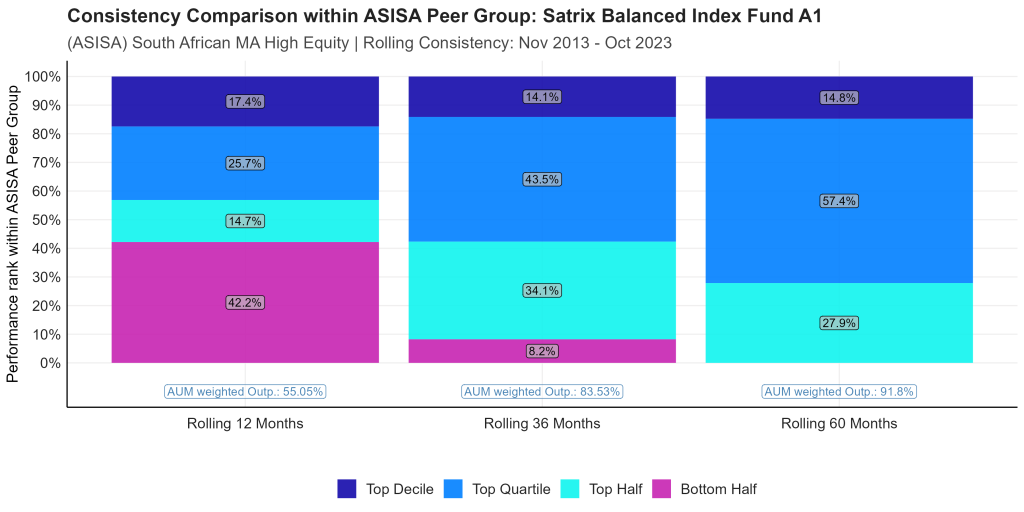

“The proof of our pioneering approach is in the pudding. Since inception, the fund has consistently been in the top quartile of performers more than half the time on a rolling three-year basis, while beating the median active manager 91% of the time over the same period. On a rolling five-year basis, it has never underperformed the median active manager, lending credence to its long-term approach”.

A Revolutionary Approach

In 2013, the Satrix Balanced Index Fund was one of the early adopters of an indexed or rules-based approach to constructing multi-asset funds locally.

Williams says, “In the multi-asset space, from an active management perspective, you can add value at building block level in terms of strategic asset allocation to different asset classes, including equities, bonds, commodities, etc., as well as timing your trades within each asset class. Active managers in this space can tactically change allocation both between and within asset classes – with varying degrees of success.”

Satrix chose to do neither. “Instead of actively managing each asset class, we track indices that provide investors with cost effective and representative performance of each asset class. By focussing on getting our building block balance right, we have succeeded in gaining a long-term edge. The self-enforced discipline of not tactically changing course in the short term keeps costs, both management and trading, lower while allowing our strategic positioning to pay off. We review our position every two years and only make changes if we deem it necessary. Research has shown that acting more often seldom adds value and definitely adds cost. We believe this approach puts the odds firmly in favour of investors to outperform their more active counterparts.”

Next, Williams shares their balanced index funds’ key differentiators:

1. The Evidence Is In The Returns:

Williams says, “Despite the upside potential of tactical asset allocation, the difference between active managers’ and rules-based providers’ returns has been remarkably small. Most rules-based funds have consistently done very well, which raises the question of whether investors are being adequately compensated through more expensive offerings. In fact, often human intervention ends up destroying value rather than adding it – the global research on this is quite clear in that more than 90% of return and volatility variation comes down to setting strategic asset allocations. For this reason, we focus entirely on getting the strategic asset allocation right.”

2. The Fee Differential:

Rules-based funds offer a lower pricing point, which compounds the value proposition of robust returns. Over the medium to longer term, active managers need to be correct quite often in their tactical decisions to justify a higher fee – which has proven exceedingly hard to do consistently, especially as markets are becoming more efficient and complex.

The Secret Sauce: The Differentiators That Set Satrix Apart:

The consistent performance of the Satrix Balanced Index Fund is tied to two critical differentiators:

1. Structural Premiums Captured

A key differentiator for the Satrix Balanced Index funds is that the local equity building blocks make use of Satrix’s multi-factor index portfolio, SmartCore™. Nico Katzke, Head of Portfolio Solutions at Satrix, says that multi-factor strategies offer exposure to risk premiums shown to pay off over the medium to longer term.

“SmartCore™ offers a refined core exposure to the local equity market. Global and local research suggests that certain company features, including measures of value and balance sheet quality, as well as positive price and earnings momentum, make them more likely to outperform at lower drawdowns. The strategy systematically captures these factor premiums while explicitly targeting risk, both on an absolute basis and relative to the local benchmark index. This aligns with our overall philosophy of exposing our clients’ assets to longer-term sources of return.”

2. Construction

The biennial research-intensive process that Satrix employs for its Strategic Asset Allocation review is its other key performance differentiator.

Williams adds, “Being part of the larger Sanlam Investment Group, we can access multiple perspectives to thoroughly review each of our considered asset classes’ expected returns over the medium to long term. That’s one key variable in the optimisation process; the other is cutting-edge optimisation techniques that enable us to understand the risk interplay between the asset classes.

“We do a significant amount of stress testing to arrive at the most efficient portfolio possible, under different assumptions and scenarios. The biennial review also allows us to update the balanced fund according to regulatory changes and newly accessible asset classes. For example, we recently included global listed infrastructure as this provides a source of differentiated equity returns in an otherwise US and technology-dominated global equity universe. Even with significantly reduced expected return forecasts, our optimisation approaches ‘love’ infrastructure because of how it behaves with other asset classes, and further diversifies the portfolio.”

Crucially, the process is systematic; so the asset allocation is not changed according to market swings, and is only reviewed once every two years. In this way, the fund is being actively managed, but not in a traditional, tactical sense.

A key consideration for Satrix is building solutions that are optimally diversified with sufficient upside potential.

Katzke adds, “true diversification is all about putting your eggs in uncorrelated baskets in the most efficient way possible. This involves prioritising risk source diversification so that the fortunes of our funds are not decided by singular events.”

The Market is Starting to Notice

While rules-based funds still account for a comparatively small proportion of assets within the balanced fund categories (according to Morningstar numbers, roughly 8% and 6% for high- and low-equity balanced fund strategies respectively), the market is starting to notice.

According to Williams, “we’ve seen up to half of all flows in the high equity balanced fund segment going to rules-based strategies in the last year. With a few of these index strategies now having reached ten-year milestones on the back of performances superior to most active managers, the case for indexation in balanced funds has never been stronger. We believe a disciplined, indexed approach puts the odds firmly in favour of clients with an eye to long-term wealth creation.”

For more information, visit https://satrix.co.za/products

*Satrix, a division of Sanlam Investment Management

CIS disclosure

Satrix Investments (Pty) Ltd is an approved financial service provider in terms of the Financial Advisory and Intermediary Services Act, No 37 of 2002 (“FAIS”). The information above does not constitute financial advice in terms of FAIS. Consult your financial adviser before making an investment decision. While every effort has been made to ensure the reasonableness and accuracy of the information contained in this document (“the information”), the FSP, its shareholders, subsidiaries, clients, agents, officers and employees do not make any representations or warranties regarding the accuracy or suitability of the information and shall not be held responsible and disclaim all liability for any loss, liability and damage whatsoever suffered as a result of or which may be attributable, directly or indirectly, to any use of or reliance upon the information.

Satrix Managers (RF) (Pty) Ltd (Satrix) is a registered and approved Manager in Collective Investment Schemes in Securities. Collective investment schemes are generally medium- to long-term investments. With Unit Trusts and ETFs the investor essentially owns a “proportionate share” (in proportion to the participatory interest held in the fund) of the underlying investments held by the fund. With Unit Trusts, the investor holds participatory units issued by the fund while in the case of an ETF, the participatory interest, while issued by the fund, comprises a listed security traded on the stock exchange. ETFs are index tracking funds, registered as a Collective Investment and can be traded by any stockbroker on the stock exchange or via Investment Plans and online trading platforms. ETFs may incur additional costs due to being listed on the JSE. Past performance is not necessarily a guide to future performance and the value of investments / units may go up or down. A schedule of fees and charges, and maximum commissions are available on the Minimum Disclosure Document or upon request from the Manager. Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. Should the respective portfolio engage in scrip lending, the utility percentage and related counterparties can be viewed on the ETF Minimum Disclosure Document.