If you enjoy Ghost Bites, then make sure you’re on the mailing list for a daily dose of market insights in Ghost Mail. It’s free! SIGN UP >>>

Capital & Counties brings news from the West End

Even in a trendy London area, valuations are down over the past three months

The latest trading update by Capital & Counties covers the period from 30 June to 31 October (though the valuation date for the properties was 30 September).

The macroeconomic environment in the UK has hurt valuations, with a 2% decline from June to September. This is being driven by valuation yields rather than underlying rental income, as Covent Garden is experiencing rental growth. For pre-Covid context, the valuation is 25% below 31 December 2019 levels.

There is no shortage of leasing demand, with 35 new leases and renewals signed since June.

As a reminder, Capital & Counties is in the process of a merger with Shaftesbury Capital to bring two West End property portfolios into one group. In the meantime, the company has a strong balance sheet (loan to value ratio of 21%) and is focusing on its business, as there isn’t much that it can do about the macroeconomic climate.

MTN Ghana adds to the party with a great result

Another tick in the box for the portfolio of African subsidiaries

Hot on the heels of MTN Nigeria, we have MTN Ghana with a solid quarterly result. Revenue is the highest it has been over the past five quarters, with a strong contribution across Voice, Data and MoMo (the mobile money business).

For the nine months to September, service revenue is up 27.9%, well ahead of subscriber growth (13% in mobile, 18.2% in active data and 16.3% in active MoMo).

If you liked the EBITDA margin in Nigeria, just wait until you see Ghana. The margin is 310 basis points higher at 57.5%, driving a 35.1% increase in EBITDA.

The capex requirement in Ghana is high, like in the other African subsidiaries, as MTN is investing heavily. Year-to-date capex is GHS1.4 billion vs. EBITDA of just over GHS4 billion. Unlike Meta, MTN only invests cash flow that it actually generates!

It’s not all rainbows. Inflation in Ghana was 37.2% in September 2022, so that gives context to these growth numbers. The government is tightening monetary policy and is restructuring its debt with the IMF. This is why MTN Group trades at a modest multiple despite the growth in Africa, as investors have been burnt before by African growth stories that aren’t accompanied by dividends.

For now, MTN is rolling out its networks in these countries with self-funded, in-country cash. Over the next 10 years, I’m bullish on what the company can achieve with a huge smartphone user base.

Octodec’s share price jumps 9.3% after releasing results

Income is up and the balance sheet is improving, but reversions are still negative

Octodec owns a portfolio of 246 residential, retail, office, industrial and specialised properties in Tshwane and Johannesburg. The portfolio is valued at R11 billion and the residential income is a differentiator here on the JSE, contributing 31.7% of rental income. Nearly 55% of income is derived from the CBD areas in those cities.

For the year ended August, distributable income after tax has increased from R358.4 million to R466.1 million. On a per share basis, it has come in at 175.1 cents.

The dividend per share is 130 cents, which now puts the fund on a trailing yield of 13.1% after the share price closed at R9.89.

The net asset value (NAV) per share is R23.28, so the discount to NAV is still huge at 57.5%.

The loan-to-value (LTV) ratio has improved from 43.2% to 39.7%.

Looking deeper into the portfolio, negative reversions are still being experienced in every sector except retail shopping centres. In the offices segment, renewal reversion is -3.7% and new lease reversion is -12.4%.

Santova reports another great set of numbers

A jump in HEPS to of 62.4% is more good news for shareholders

Santova has a reputation for being a small cap on a strong growth trajectory. The latest interim results only support that reputation, with revenue up by 13.5%, HEPS up by 62.4% and the net asset value per share increasing by 35.7%.

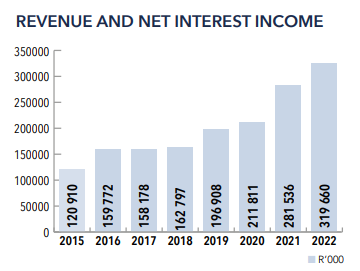

I decided that the revenue and net interest income chart tells the best story of how this business has benefitted from the supply chain crunch during the pandemic:

Cash generated from operations has increased by 45.5% and return on equity has increased by 720 basis points to 28.2%, so Santova is doing all the right things it seems.

As always, the focus is on the company’s outlook. Shipping rates have declined in 2022 and there is a general cooling off in consumer spending because of inflation. Even then, current shipping rates are up on 2019 pre-pandemic rates and by a huge margin ($4,000 vs. $1,300 – $1,600).

Santova notes that a subdued peak season is anticipated because larger customers are sitting with elevated stock levels, having ordered for Black Friday and Christmas earlier in the year. Smaller customers can now take advantage of decreasing shipping rates.

Finally, the acquisition of A-Link Freight in the US closed in September, shortly after the end of this reported period. Those numbers will be in the next result.

Sasol raises $750 million in convertible bonds

A drop of nearly 8% in the share price would’ve upset shareholders

To refinance debt and for general corporate purposes, Sasol offered $750 million in guaranteed senior unsecured convertible bonds due 2027. That’s a mouthful, isn’t it?

In simple terms:

- Debt instruments (“bonds”) that offer protection to investors (“guaranteed senior” tells you that)

- The instruments aren’t secured by a specific, valuable asset (“unsecured”)

- They carry an equity kicker as they can be converted into shares at some point (“convertible”)

- The debt is repayable in 2027 (I think that part is self-explanatory)

When the issuance was announced in the morning, the expected pricing was between 4% and 4.5% per annum. This is because Sasol needed to test investor demand in the market and wasn’t quite sure where the pricing would land.

Whenever you see a convertible instrument, you need to look out for the terms of that conversion. In this case, my understanding is that the conversion is at Sasol’s election (not the investor’s choice) and is convertible into shares or cash. The conversion price was indicated as being at a premium of between 30% to 35% above the volume weighted average price on 1 November. This makes more sense when you remember that the instruments are only due in 2027.

There are also certain events that would allow the holders to trigger a redemption, like a change of control or a delisting of Sasol.

As another important point, shareholders still need to approve the convertibility of the bonds. If that approval isn’t achieved, Sasol can choose to redeem all of the bonds at the greater of 102% of the principal amount or the fair market value.

When it comes to hybrid instruments like these, things get complicated.

By the end of the day, Sasol announced that the bonds were priced at 4.5% per annum and that the conversion price is a a 30% premium. In other words, the market was only interested at the most lucrative end of the range in both cases (the highest yield and lowest conversion price).

The bond issuance gave the market the jitters, with the share price closing almost 8% lower.

Textainer Group banks another good quarter

Despite volatility in shipping, Textainer has achieved steady headline earnings this year

In Textainer, we have another example of a company talking about normalising shipping rates.

Demand for new containers was muted during this quarter as shipping lines have sufficient inventories. Textainer still managed to make money from this by selling old containers.

Income from operations of $123 million was slightly higher quarter-on-quarter and 8% higher year-on-year. Average fleet utilisation was 99.4% in this quarter vs. 99.8% a year ago. Adjusted EBITDA of $192.6 million is 4.6% higher year-on-year.

The shipping game is all about capital management. With less of an opportunity to deploy capital, Textainer is focused on returning capital to shareholders through dividends and share repurchases. The year-to-date repurchases represent 8% of shares outstanding at the beginning of the year.

The balance sheet is strong and 90% of the financing is hedged for rising rates.

A dividend of $0.25 per share has been declared.

The share price is down 3.3% this year and 5% over 12 months.

Little Bites:

- Director dealings:

- An associate of Piet Viljoen and Jan van Niekerk (Calibre International Investment Holdings) has acquired R31.6 million worth of shares in Astoria Investments

- The CEO of AVI exercised share options and immediately sold all the shares for R2.76 million

- Des de Beer has bought more shares in Lighthouse Properties, this time to the value of R2.5 million

- A prescribed officer of Renergen has bought shares worth R246k

- Sibanye-Stillwater has entered into s189 consultations regarding the Beatrix 4 shaft and the Kloof 1 plant, both of which are part of the SA gold operations. The Beatrix shaft is lossmaking and the Kloof 1 plant is experiencing the impact of depleting mineral reserves. This is a significant step, as it could lead to retrenchment of 1,959 employees and could affect 465 contractors. Sibanye hopes to reduce these numbers through measures like natural attrition, retirements, voluntary separation and transfer to vacant positions.

- Naspers and Prosus have responded to the press speculation by Asian Tech Press, specifically an article that claimed that a Chinese state-owned investment company is in talks with the group to buy all of its Tencent shares. The companies call the article “speculative and untrue” – so there we have it. In the meantime, the group is busy with a share buyback programme funded by the sale of a small number of ordinary shares in Tencent.

- Argent Industrial released a trading statement for the six months ended September 2022. Headline earnings per share (HEPS) is expected to be between 11.2% and 31.2% higher than the comparable period. This implies a range of between 164.7 cents and 194.3 cents for the interim period. The share price closed at R12.99.

- Michael Fleming, CFO of Clicks, will be taking early retirement. The announcement is a great reminder of the growth achieved by Clicks, as the market cap increased from R10 billion to R77 billion during his tenure. Gordon Traill has been announced as his replacement, the current chief of support services in Clicks. He has been with Clicks since 2006, when he joined as head of internal audit. This is a great succession planning story.

- Alexander Forbes’ acquisition of Sanlam Life’s standalone retirement fund administration business has become unconditional. This increases the number of active members administered by Alexforbes (the official trading name these days).

- There’s a mass exodus at Rebosis Property Fund, with five independent non-executive directors (including the chairman) tendering their resignations. As a reminder, the company is in business rescue. The board now has four executive directors and one non-executive director. The board and the business rescue practitioners are considering the composition of the board committees and will provide an update in due course.

- Europa Metals has announced its final results for the year ended June 2022. This is an exploration company focused on advancing the Toral project in Spain towards a mining licence application. A $6m farm-in arrangement with Denarius Metals Corp was announced during the year, subject to due diligence and other conditions.

- AH-Vest (owner of AllJoy foods) announced results for the year ended June 2022 that saw a 14.4% increase in revenue and a 72.4% decrease in operating profit. HEPS has collapsed by around 80% and the dividend per share has followed suit. The sharp drop in profitability is attributed to higher production and distribution costs due to e.g. fuel price increases.